- Cardano is trading near $0.57, down 1% daily, but Open Interest in ADA futures climbed to $680 million, hinting at cautious optimism.

- Analyst Ali Martinez predicts a possible retest of $0.50 before a rebound to $0.70, depending on whether that support holds.

- Whales and sharks added 348 million ADA (worth $204 million) this week, signaling growing accumulation and long-term confidence in the asset.

Cardano’s price action has been anything but calm lately. With crypto markets swinging back and forth, ADA has struggled to hold key support, leaving traders split on whether the next move will be up or down.

ADA slips, but futures hint at quiet optimism

At the moment, Cardano (ADA) is trading around $0.574, down roughly 1% on the day, as volume slid about 11% to $744 million. It’s been a choppy ride — over the past month, ADA’s seen a nearly 19% pullback despite gaining 7% over the last week. The range has been wide too, hitting a 30-day high of $0.735 before dropping to as low as $0.493, a swing that says a lot about just how tense the market has been.

But not everything looks bearish. Derivatives data tells a slightly different story. Open Interest in ADA futures climbed over 2% to $680 million, suggesting that traders are still positioning themselves for potential upside. That bump in futures activity could be an early sign that sentiment is starting to lean bullish again, even if the spot price doesn’t show it yet.

Experts eye a retest before a rebound

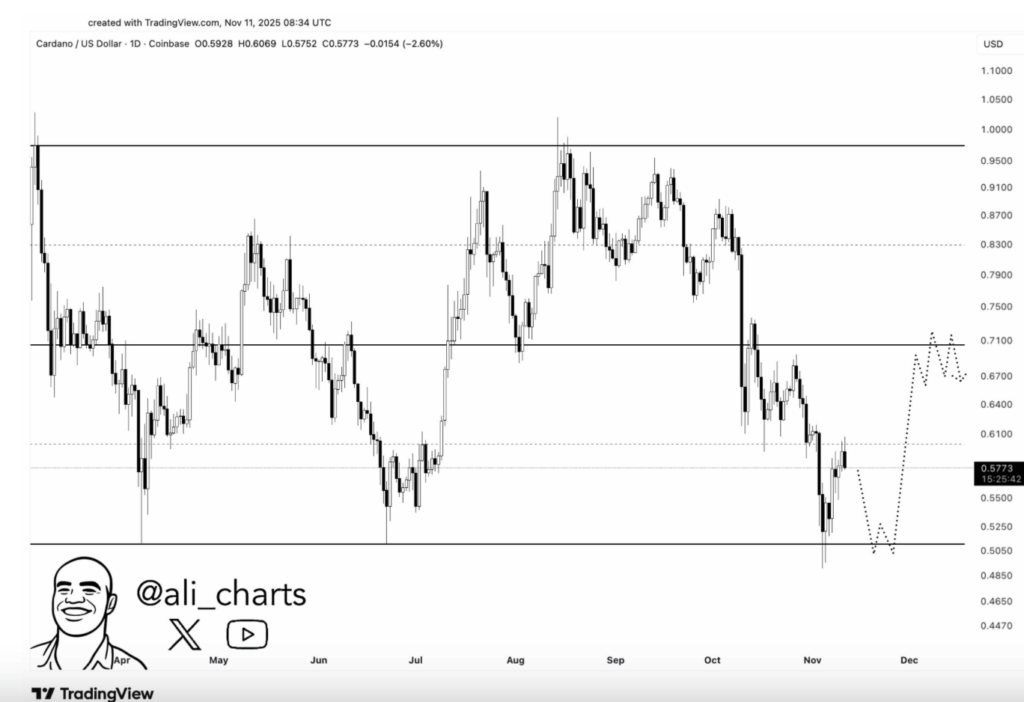

Market analysts seem divided, but one well-known voice, Ali Martinez, sees the recent dip as part of a setup for a possible rebound. In a recent post on X, Martinez predicted ADA could first fall back to $0.50 — a key support area — before bouncing toward $0.70 if that level holds.

He explained that $0.50 has acted like a “make-or-break” zone for ADA lately. If bulls defend it, the momentum could shift upward quickly. But if that floor gives way, things could turn ugly fast, opening the door to another leg down. Essentially, Cardano’s next big move hinges on how traders react around that zone — hold the line, and optimism returns; lose it, and short-term sentiment might crumble again.

Whales and sharks are buying the dip

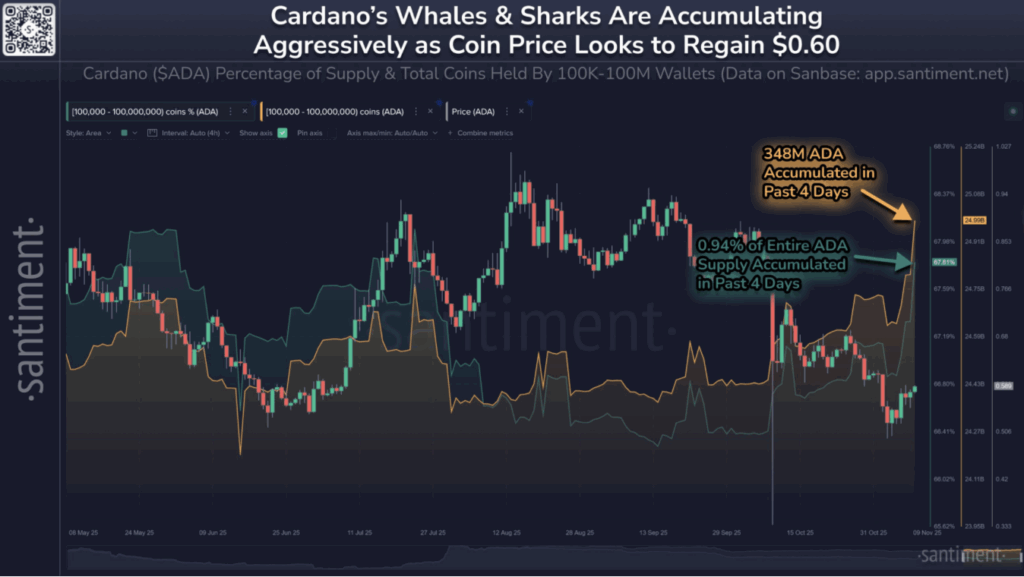

While retail traders debate direction, the big wallets are already making moves. Data from Santiment shows that Cardano’s largest holders — the whales and sharks — have been quietly stacking up ADA over the past week. Together, they’ve added about 348 million ADA, worth roughly $204 million, to their portfolios.

That’s nearly 0.94% of the entire ADA supply, which isn’t small by any means. It signals that major investors still believe in Cardano’s long-term potential, even if short-term volatility remains rough. Historically, heavy accumulation by whales has often preceded market recoveries, as these players tend to buy when fear dominates and sell once sentiment shifts.

What’s next for ADA?

The coming days will likely decide whether ADA’s latest dip turns into a bounce or a deeper correction. If it can hold the $0.50–$0.52 range, traders might finally get that move toward $0.70 that analysts have been talking about. But if it breaks below support again, another slide toward the mid-$0.40s wouldn’t be off the table.

Either way, with derivatives heating up, whales buying aggressively, and retail sentiment shaky, Cardano’s setup feels like a coiled spring — tense, unpredictable, and just waiting for its next catalyst.