- Cardano treasury hits nearly $1B with over 1.6B ADA accumulated.

- ADA trades around $0.67, showing short-term weakness but strong fundamentals.

- Project Catalyst governance continues to drive community-funded innovation.

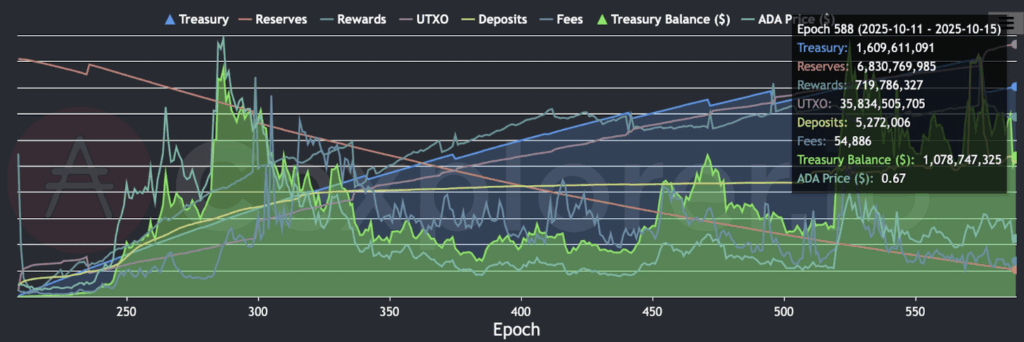

Cardano’s community treasury just crossed 1.6 billion ADA, putting its total value close to $1 billion — a major milestone that highlights how the network funds itself without relying on venture capital. Despite this, ADA’s price action hasn’t been as cheerful lately. The token trades around $0.67, down about 3.5% in the last day, with weekly and monthly losses of 18% and 22%, respectively.

The treasury’s growth comes directly from block rewards and transaction fees, distributed automatically between stake pools, delegators, and the treasury itself. This setup means Cardano runs on organic network revenue, not external fundraising. As on-chain activity grows, so does the treasury — a sign of sustainability that few blockchains can match.

What makes it even more interesting is that community governance fully controls how the funds are used. Through Project Catalyst, ADA holders propose, debate, and vote on which initiatives get funding. It’s a system designed to give smaller builders and researchers a fair shot while keeping spending transparent through public on-chain records.

How Cardano’s Treasury Model Works

Funds accumulate naturally through protocol operations. Every transaction fee and staking reward helps grow the treasury over time, avoiding any inflationary fundraising pressure. This helps keep ADA’s circulating supply more stable, even during volatile markets.

Each proposal funded by the treasury undergoes review and community voting. Successful projects often include research, infrastructure, education, or DeFi tooling, fueling gradual ecosystem expansion. The system also encourages innovation at a grassroots level — anyone with a wallet and an idea can take part.

Interestingly, the Unspent Transaction Output (UTXO) data shows growing network activity, meaning more ADA is moving or being held across addresses. Even with modest individual fees, the sheer scale of Cardano’s usage compounds revenue — so the busier the chain, the faster the treasury grows.

Technical View: ADA’s Struggle for Support

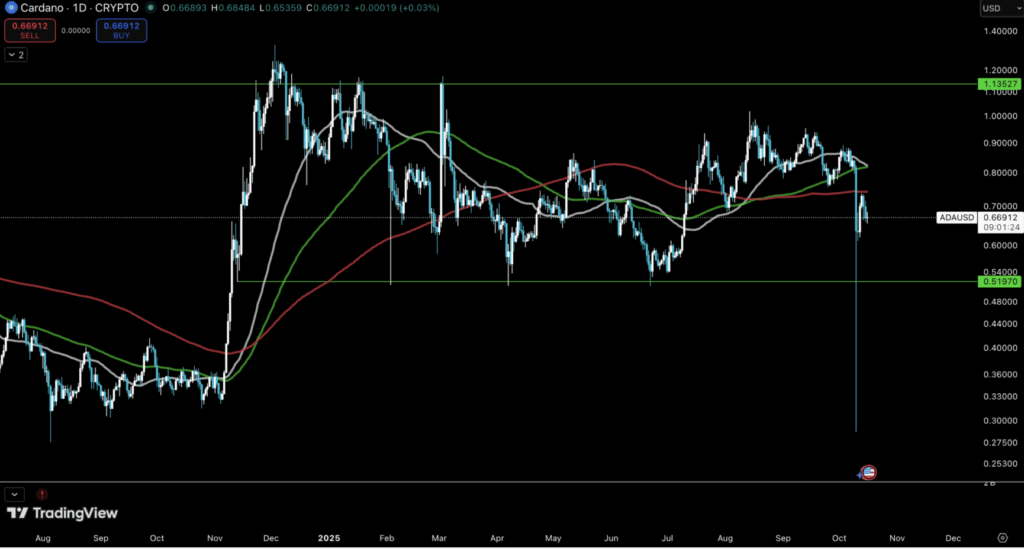

From a technical angle, ADA’s monthly chart still holds above its 50-period moving average, though momentum has weakened. Resistance sits near $1.13, a level that once served as strong support. The long-term chart shows that ADA has been stuck below $1 for about a year now.

On the 4-hour timeframe, ADA is forming a tentative support around $0.63 after a steep drop that took it below all major moving averages. If that level breaks, the next critical zone lies near $0.52, last week’s flash-crash low. Conversely, a strong bounce could send ADA back to the $0.75–$0.80 range, where bulls will likely face new resistance.

Against Bitcoin, the ADA/BTC pair is hovering near historical range lows but shows hints of a potential upside move, similar to the patterns seen in 2018 and 2021.

Cardano’s Fundamentals Stay Strong

Even with market pressure, Cardano’s fundamentals remain solid. The proof-of-stake model keeps staking rewards flowing, while delegators continue supporting the network. Its fully diluted valuation stands near $30 billion, with about 36 billion ADA already circulating out of a total 45 billion supply.

Cardano’s approach — building self-sustainability through governance and protocol-based funding — positions it as one of the few projects that can survive and grow without outside capital. The market might be shaky, but the network’s internal economy looks more robust than ever.