- On-chain data shows roughly $36 million in ADA accumulation between $0.36 and $0.38

- Supply is tightening as large buyers absorb liquidity while sentiment stays cautious

- Upcoming upgrades and institutional interest add to Cardano’s long-term setup

Cardano is starting to drift back onto the radar, but not because it’s trending on social feeds or dominating headlines. The signal this time is coming from the chain itself, and it’s fairly clear if you’re paying attention. On-chain data is beginning to tell a story that doesn’t line up with the still-muted mood around ADA.

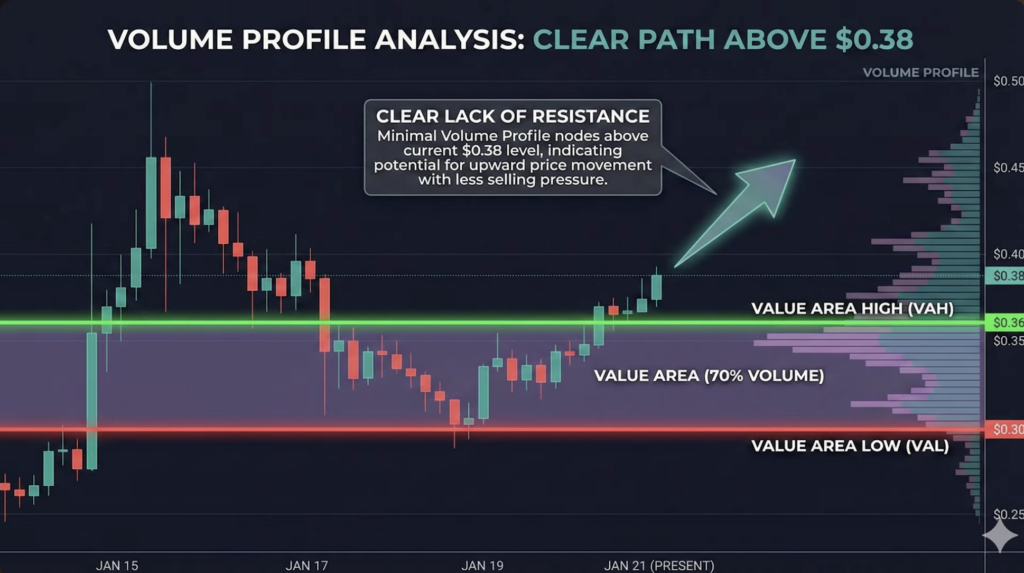

Recent activity points to a cluster of notable transactions totaling roughly $36 million, executed in the $0.36 to $0.38 range. That kind of size usually doesn’t come from short-term traders chasing momentum. More often than not, it’s capital positioning early, quietly, and with patience.

Large Buyers Step In While Sentiment Stays Quiet

What makes this activity stand out is the timing. These buys are happening while broader sentiment around Cardano remains lukewarm at best. That’s typically when long-term accumulation happens, before narratives shift and before prices start moving in a way that grabs attention.

Instead of chasing upside, larger holders appear to be building positions while the rest of the market looks elsewhere. It’s not loud, and it’s not obvious, but it’s often how meaningful moves begin.

Supply Tightens as Accumulation Builds

One of the side effects of steady accumulation is what it does to available liquidity. As larger buyers continue absorbing ADA in a relatively tight price range, exchange supply gradually starts to thin out. That doesn’t trigger an instant rally, but it does subtly change the market’s structure.

When supply tightens like this, future demand doesn’t need to be explosive to move price. Right now, every wave of selling seems to be met with a similar wave of buying, keeping ADA pinned in place even as uncertainty lingers. That balance can last longer than most expect, until it suddenly doesn’t.

A Major Upgrade Is Taking Shape Behind the Scenes

Price action isn’t the only thing worth watching. Cardano is also moving toward a meaningful technical milestone, with the Ouroboros Leios upgrade expected to roll out in early 2026. On paper, the goal is straightforward, increase throughput and efficiency without sacrificing decentralization.

That balance has always mattered to Cardano. The network has consistently favored a slower, more deliberate approach over rushing features to market. If Leios delivers as planned, it could shift how developers and institutions view the chain, especially those looking for something that feels both scalable and structurally sound.

Institutions Begin to Lean In

The institutional angle is also becoming harder to dismiss. Grayscale allocating nearly 19% of certain products toward Cardano-related exposure sends a clear signal that ADA is being taken seriously in diversified crypto portfolios.

Beyond that, new ETF filings tied to Cardano, including those from Cyber Hornet and ProShares, suggest ADA is moving beyond its “just another altcoin” label. The planned launch of Cardano futures on the CME Group only reinforces this trend, giving larger players tools to manage long-term exposure with more precision.

What the Chart Is Quietly Suggesting

On the technical side, Cardano is showing some subtle but notable changes. The 3-day chart is printing a bullish divergence, hinting that selling pressure may be easing even though price hasn’t pushed through major resistance yet.

The MACD is also trending higher, but slowly, not in the kind of way that signals an imminent breakout. That kind of movement tends to align more with accumulation than with sudden expansion. Many traders are watching the $1.20 area as the level that would confirm a broader trend shift, if price ever reaches it.

Whether this evolves into a full rally or stretches into a longer accumulation phase remains uncertain. What does stand out is that Cardano is once again attracting serious interest from large players, quietly, while attention stays elsewhere. Historically, those moments have a habit of becoming important later on.