- Cardano surged 16% to $0.98 as Grayscale’s creation of ADA trusts fueled speculation about a potential spot ETF.

- Technicals show ADA nearing key $0.94 resistance, with a breakout potentially targeting $1.20–$1.50.

- On-chain data, positive sentiment, and short liquidations over $832k support sustained bullish momentum.

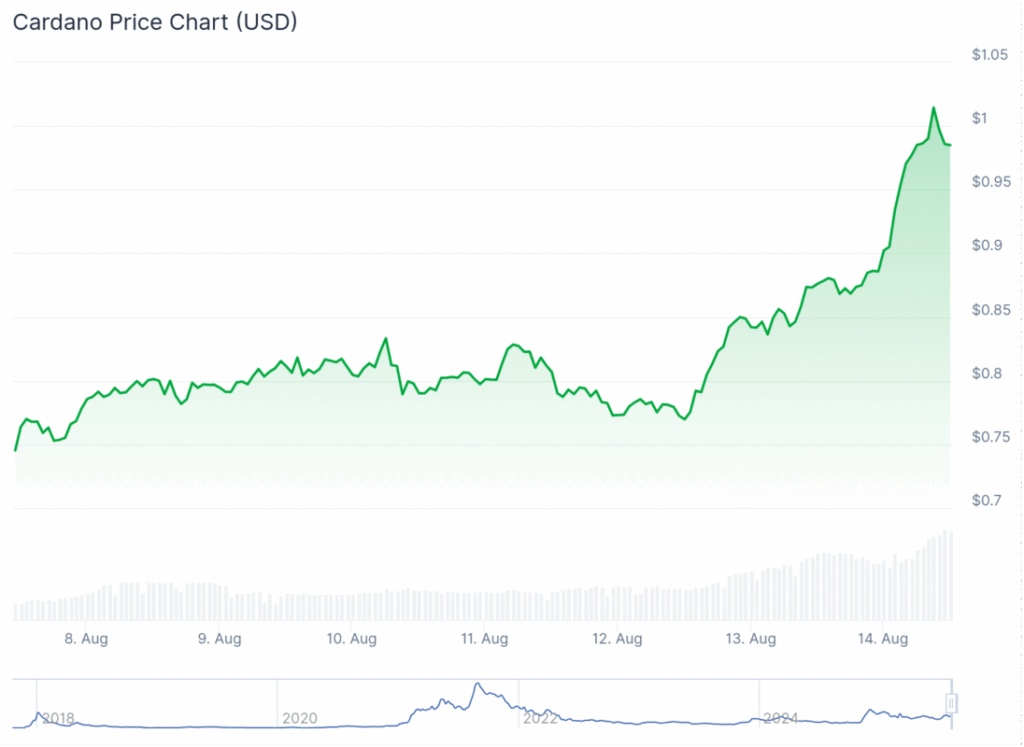

Cardano is back in the spotlight, surging 16% in a single session to trade at $0.98 — its strongest daily performance in weeks and edging dangerously close to the psychological $1 barrier. The move has lit up the ADA community, with traders eyeing even loftier targets as a mix of technical strength and institutional whispers fuel the rally.

ETF Buzz Meets Technical Breakout Potential

The latest spark? Grayscale’s quiet creation of Delaware trusts for ADA, igniting speculation that a spot Cardano ETF might be in the cards. This isn’t their first rodeo — Grayscale has a history of building such investment vehicles ahead of major regulatory green lights. The move has caught the attention of big-money players, potentially opening the gates for deeper institutional adoption.

From a chart perspective, ADA is pressing against a long-watched resistance zone at $0.94. A clean break above could unlock momentum toward $1.20, and if buying pressure holds, the $1.50 target flagged by analysts like Ali might not be far behind. Since mid-July, price action has been carving out higher lows, a classic signal of sustained accumulation.

Shorts Squeezed as Bears Retreat

The rally hasn’t just been about buyers — it’s been about forcing sellers out. Data shows short liquidations topping $832k in the last 24 hours, dwarfing the $439k in long position losses. Binance, Bybit, and OKX saw the heaviest short wipes, with the covering adding extra fuel to ADA’s upward push.

On-Chain Signals Back the Bullish Case

Under the hood, Cardano’s on-chain health is leaning bullish. The MVRV Z-score sits at 0.445, meaning holders are in profit but not yet at levels that usually trigger a wave of selling. The Stock-to-Flow ratio has also climbed, hinting at tighter supply dynamics, while weighted sentiment has flipped firmly positive at 1.495 — a sign traders are increasingly optimistic.

With technicals lining up, institutional chatter growing, and on-chain metrics pointing toward limited selling pressure, ADA’s setup is looking as solid as it’s been all year. If $0.94 falls convincingly, the market could be looking at a swift run to $1.20… and maybe even that $1.50 zone before long.