- ADA fell roughly 6% in 24 hours, extending weekly losses to nearly 17%.

- Technical indicators continue to show weak momentum and persistent selling pressure.

- Cardano’s ₳70M integration budget highlights progress, but market confidence remains fragile.

Cardano’s native token, ADA, is still under heavy pressure, and the numbers make that clear. Over the past 24 hours, the price slipped around 6%, extending weekly losses to nearly 17%. It’s another tough stretch in a cycle where several major altcoins have already managed strong rebounds or pushed toward fresh highs.

For ADA, the broader trend remains firmly intact. The token is now trading close to 90% below its 2021 peak near $3.10, a gap that continues to test the patience of long-term holders who expected this cycle to look very different.

Technical Indicators Show Little Relief For Buyers

From a technical standpoint, the picture remains fragile. The RSI is hovering near oversold territory, but not in a way that suggests a clear bottom is forming. Instead, it reflects ongoing selling pressure that hasn’t really let up.

The MACD stays stuck in negative territory, reinforcing the idea that momentum is still working against the bulls. Even though trading volume has picked up slightly, price action shows buyers stepping in cautiously, if at all. So far, every small bounce has struggled to gain traction.

Governance Progress Fails To Shift Sentiment

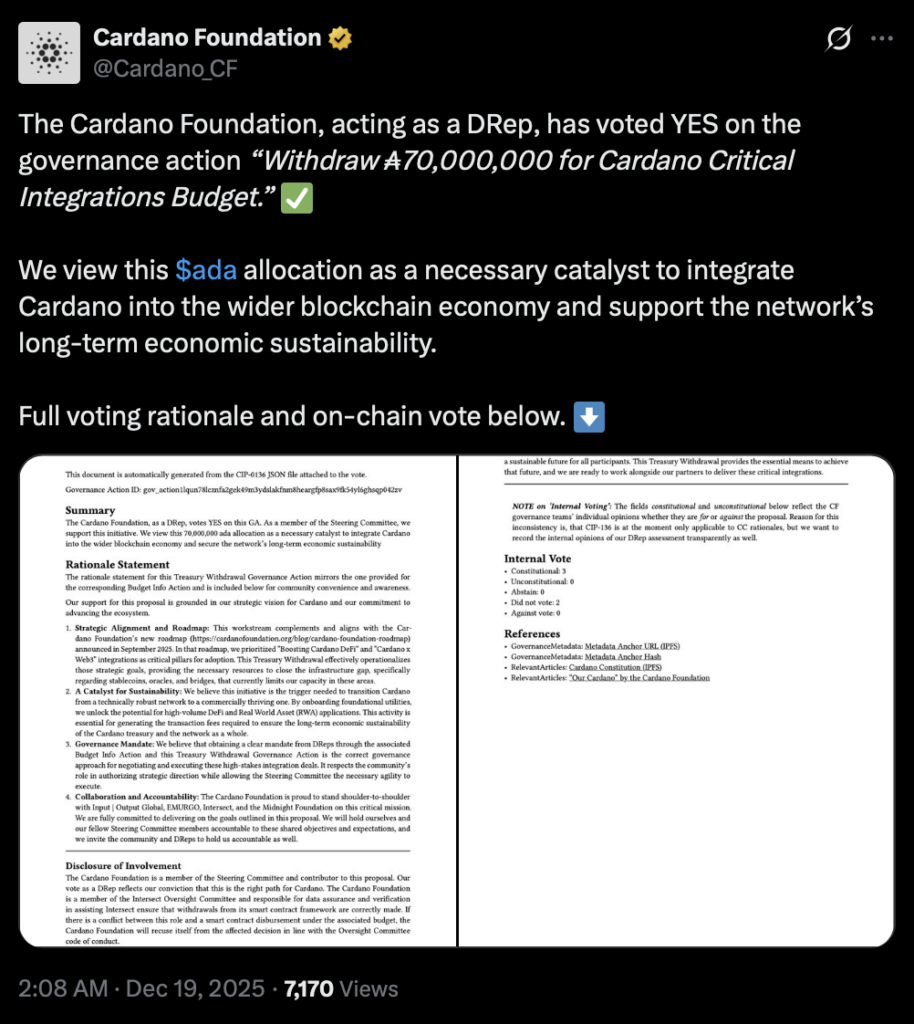

Against this weak market backdrop, the Cardano Foundation confirmed it voted to approve a ₳70 million withdrawal for Cardano’s Critical Integrations Budget. Acting as a delegated representative, the Foundation framed the move as necessary to deepen integrations, improve interoperability, and support long-term network sustainability.

From a development perspective, it’s a meaningful step forward. From a market perspective, though, the response has been flat. Price action barely reacted, and sentiment remained unchanged, highlighting the growing gap between governance progress and investor confidence.

A Growing Gap Between Development And Price Performance

That disconnect is becoming harder to ignore. Cardano continues to move ahead on governance and long-term planning, yet ADA’s price keeps lagging behind peers. In a market where capital is chasing momentum and visible adoption, this underperformance stands out.

As losses stack up, some long-term holders are starting to question whether ADA can realistically return to previous highs without a clear surge in on-chain activity. What was once seen as a patient, long-term bet is slowly turning into a test of endurance.

Why The ₳70M Vote Suddenly Carries More Weight

In a stronger market, a ₳70 million integration budget might have gone largely unnoticed. In today’s environment, it matters more. With confidence fading and capital rotating toward faster-moving ecosystems, Cardano needs to show that development spending can translate into real growth.

If these integrations lead to visible adoption, they could help narrow the gap between Cardano’s long-term vision and its current market standing. If not, ADA risks remaining sidelined in a cycle that has been increasingly unforgiving to projects that struggle to convert fundamentals into momentum.