- Cardano is holding near $0.64, with traders looking for confirmation of a short-term bottom after a 20% monthly drop.

- The network surpassed 115 million transactions, marking eight years of consistent uptime and steady ecosystem growth.

- Institutional inclusion via the ProShares Trust ETF and resilient on-chain activity suggest underlying strength despite price weakness.

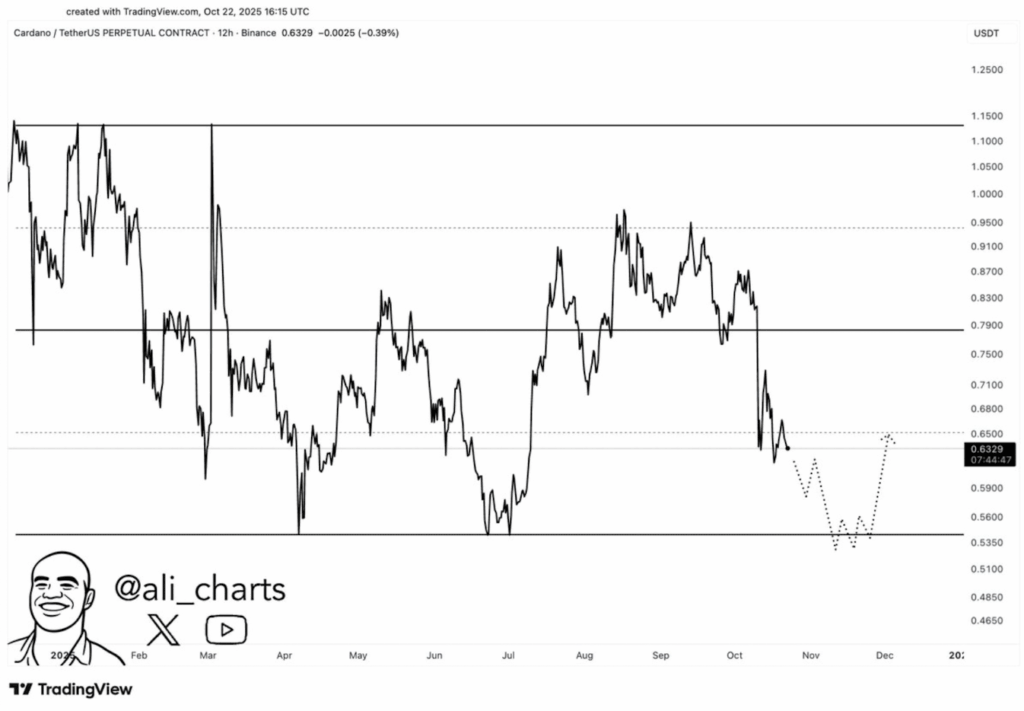

Cardano’s price is sitting around $0.64, trying to find its footing after dropping over 20% in the past month. Despite the decline, ADA managed a small 2.6% daily gain and a 1.2% uptick for the week — a modest sign that traders might be testing the waters again.

The move comes as investors weigh new catalysts like network growth, long-term milestones, and increasing institutional exposure.

Traders Focus on the $0.64 Support Zone

Right now, all eyes are on the $0.64 level, where buyers seem to be quietly stepping back in after weeks of pressure. Intraday trading has been choppy, but volume spikes near that range suggest some accumulation.

Analysts are keeping a close watch on 12-hour ADA/USDT charts, using them to smooth out short-term volatility and spot structural shifts. A few things they’re looking for — higher lows, firmer closes above short-term resistance, and volume confirmation.

If ADA can hold steady here, this could mark the start of a consolidation phase before its next directional push. On the other hand, a clean break below this level might reset the chart entirely.

Round numbers like $0.64 often act as magnets for liquidity, and Cardano seems to be no exception. The more times it tests this area without breaking down, the stronger that base becomes.

Cardano’s Network Growth: Eight Years and 115 Million Transactions

Cardano recently crossed a massive milestone — 115 million transactions on its mainnet. The network has now been operational for more than eight years, a rare feat in crypto longevity.

Community members on X (formerly Twitter) were quick to highlight the achievement, pointing to Cardano’s consistent uptime and slow-but-steady development cycle. Since its launch, Cardano has evolved through several eras — from Byron and its Ouroboros proof-of-stake model, to expanding utility with smart contracts and DeFi integrations.

Wallets like Daedalus and Yoroi have supported users from day one, providing secure ways to store ADA and interact with decentralized apps.

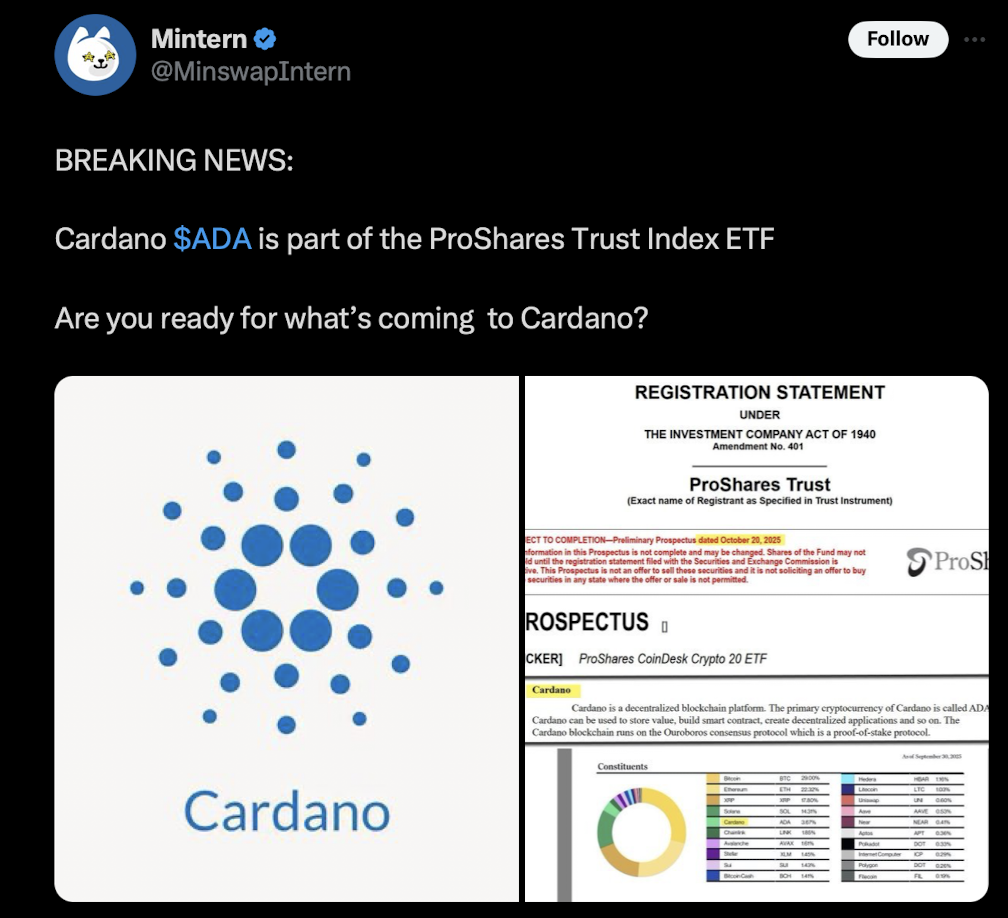

Institutional participation is also starting to pick up. The ProShares Trust Index ETF recently added ADA to its portfolio, a move that improves visibility and opens access to investors through traditional brokerage platforms. For many, this marks another small but important step toward mainstream recognition.

November Outlook: Watching for a Pattern Shift

Heading into November, traders are once again zooming in on short-term structure. The $0.64 area remains the key battleground — if ADA can form a clear pattern of higher lows on the 12-hour chart, it might signal that sellers are finally losing strength.

Market watchers are also paying attention to transaction volume after the 115 million milestone. Sustained on-chain activity usually translates to stronger liquidity — and smoother price discovery.

Meanwhile, institutional investors are keeping an eye on the ETF listing, monitoring whether ADA maintains its position within the fund. Any increase in exposure could help reinforce long-term stability.

For now, the setup remains simple: if ADA holds above $0.64, consolidation could give way to recovery. A decisive drop below it, though, might lead to another round of selling before buyers regroup.