- Cardano whales are quietly accumulating ADA while retail wallets continue to sell into weakness.

- ADA price remains under pressure near $0.40, with momentum weak but sellers showing signs of fatigue.

- This divergence has historically appeared near late-stage downtrends, often before broader trend reversals.

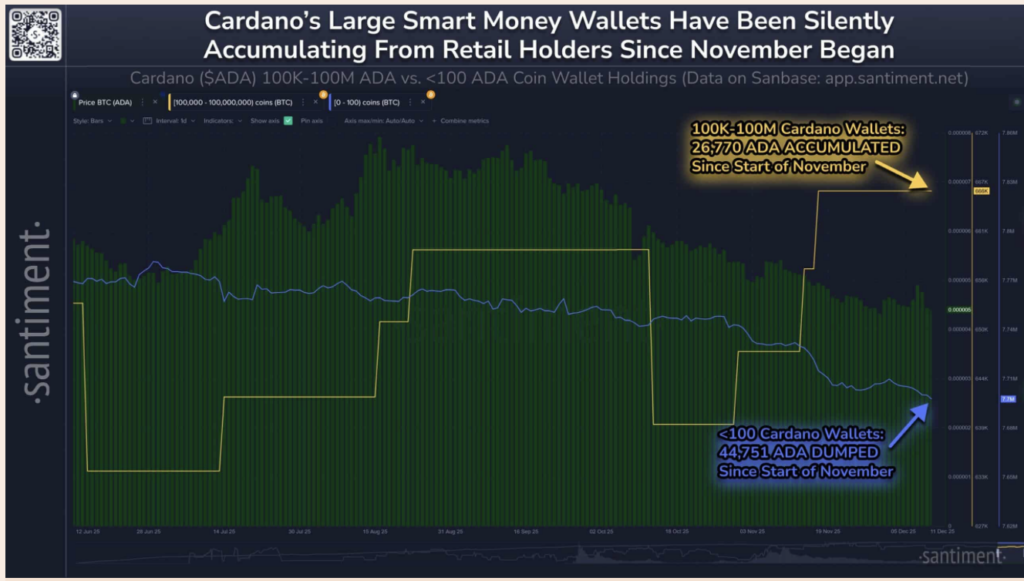

Fresh on-chain data is hinting that Cardano’s recent price weakness might be hiding something bigger beneath the surface. On the chart, ADA doesn’t look great — it’s been sliding lower for nearly two months now. But under that quiet downtrend, behavior is starting to split in an interesting way.

While retail traders appear to be losing patience, Cardano’s largest holders are doing the opposite. They’re buying. Slowly, quietly, and without much noise.

Whales Accumulate as Retail Gives Up

According to Santiment, the divide between large holders and smaller wallets has become pretty clear. Wallets holding between 100,000 and 100 million ADA have added roughly 26,770 ADA since November 1. At the same time, retail wallets holding less than 100 ADA have dumped about 44,751 ADA.

That pattern shows up again and again near the later stages of bearish cycles. Big players step in when fear peaks, while smaller traders exit after months of frustration. It’s not flashy, but historically, this type of absorption has mattered for ADA over longer timeframes.

Price Still Struggles, Even as Accumulation Builds

Despite that accumulation, ADA’s price hasn’t reacted yet. The token trades near $0.40, still stuck in a structure of lower highs and lower lows. Momentum remains weak, and buyers haven’t reclaimed control.

The RSI sits around 40, which reflects bearish pressure — but also hints that sellers may be running out of steam. Importantly, ADA hasn’t lost its key mid-term support zones. It’s just… stalled. For now, price action and on-chain fundamentals are moving in opposite directions, which can feel uncomfortable if you’re watching only the chart.

Why This Divergence Matters

Historically, Cardano has tended to rally when three things line up:

Smart money increases exposure,

Retail sentiment turns fearful, and

Bitcoin stabilizes after volatility.

Santiment notes that whale accumulation in ADA usually becomes more meaningful once Bitcoin calms down. Right now, BTC is still reacting to macro uncertainty and post-FOMC noise, which may be keeping altcoins like ADA in a holding pattern.

Large holders buying into weakness suggests confidence in ADA’s longer-term outlook — whether that’s driven by staking rewards, future upgrades, or simple valuation resets after a prolonged decline. Retail selling, on the other hand, often reflects late-stage capitulation rather than informed positioning.

What Comes Next for ADA?

If Bitcoin finds stability and liquidity improves across the market, ADA’s quiet accumulation phase could turn out to be the groundwork for a trend shift. Until then, price may continue to drift, even as smart money keeps building under the surface.

Nothing explosive yet. Just a slow divergence — and those are often the setups people only recognize after the move is already underway.