- ProShares has launched a 2x leveraged Cardano ETF, signaling deeper institutional interest in ADA

- ADA is still working through a wave (2) correction, with $0.438 acting as a key trigger level

- Tight EMA convergence and neutral RSI suggest consolidation ahead of a potential breakout

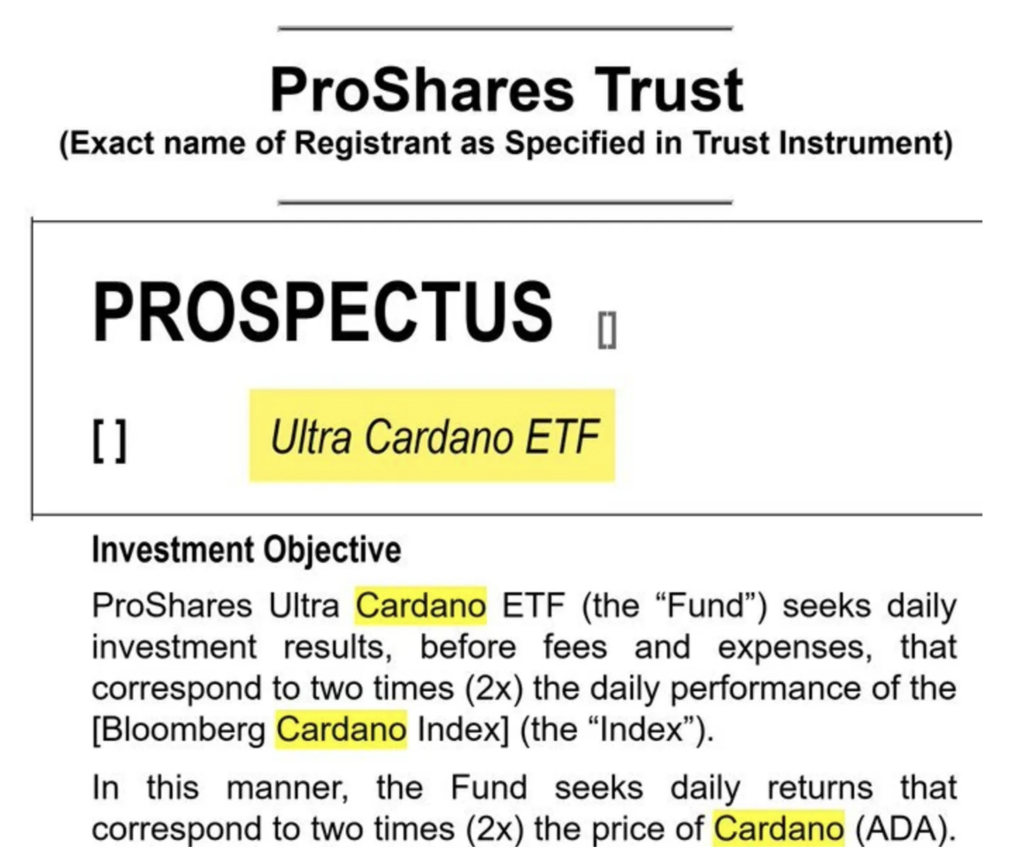

Cardano just picked up a new, and fairly serious, piece of market infrastructure. ProShares has launched a 2x leveraged Cardano (ADA) ETF, marking another step toward deeper institutional involvement in the altcoin space. It’s not a small signal. Leveraged products tend to show up only once there’s enough demand, liquidity, and confidence to support them.

A Leveraged ETF Puts ADA Back on Institutional Radar

The new ProShares ETF allows traders to gain amplified exposure to ADA’s price moves, effectively doubling gains during strong uptrends, and losses too, of course. This kind of instrument is usually aimed at more sophisticated players, hedge funds, active desks, and institutions running short-term or tactical strategies.

Its launch suggests Cardano is being taken more seriously as a tradable asset, not just a long-term tech bet. Leveraged ETFs often increase visibility as well. Even investors who don’t use them directly tend to pay attention once they exist, and that can pull ADA back into broader market conversations.

ADA Navigates a Textbook Correction Phase

From a technical angle, the timing is interesting. Crypto analyst Man of Bitcoin pointed out that ADA is currently testing the 50% Fibonacci retracement level as part of a wave (2) correction. In Elliott Wave terms, this is pretty normal behavior. Wave (2) corrections are rarely clean or quick, and they often include multiple swings before finally resolving.

The expectation, at least for now, is that ADA could make one more low before the correction is complete. That might not sound bullish on the surface, but it fits the pattern. What matters more is what comes next. A move above the $0.438 level would be a meaningful signal, potentially marking the start of wave (3), which is typically the strongest and most aggressive phase of an Elliott Wave cycle.

That’s the level many traders are watching closely. If ADA can push through it with conviction, the tone changes fast.

Price Stabilizes as Indicators Cool Off

At the time of writing, Cardano is trading around $0.397, showing early signs of stabilization after slipping below short-term exponential moving averages. What stands out is how tightly clustered the EMAs have become. The 20, 50, 100, and 200 EMAs are all converging near $0.396, which usually signals consolidation rather than panic.

ADA briefly pushed above $0.420 earlier, but couldn’t hold that ground. Since then, price action has looked more like quiet accumulation than aggressive selling. RSI sits right around 50, almost perfectly neutral. That tells the same story. Neither buyers nor sellers are in control yet, but that balance can break quickly once momentum returns.

For now, support sits near $0.393, while resistance remains around the prior high at $0.420. A break either way will likely decide the next short-term move. With a leveraged ETF now in play and technicals tightening, ADA may not stay this quiet for long.