- ADA is facing a strong supply wall near $0.40 reinforced by the 50-day EMA

- Momentum indicators and on-chain data continue to favor sellers

- A failure to reclaim $0.40 could trigger a deeper move toward $0.32

Cardano’s ADA is under pressure again, and the chart isn’t being subtle about it. Price keeps running into a thick supply wall near the $0.40 level, where sellers have shown up repeatedly and shut down every serious attempt at upside. For now, that ceiling is holding, and it’s testing the patience of bulls.

ADA Struggles Below a Heavy $0.40 Supply Zone

ADA slipped nearly 4% on Friday, trading around $0.38 and briefly dipping to a daily low near $0.379. The move may not look dramatic on its own, but it reinforces a broader short-term downtrend that has been weighing on most large-cap altcoins lately.

The $0.40 area has become more than just a psychological level. It’s a dense supply zone, reinforced by the 50-day exponential moving average, which currently sits around $0.41. Each time price drifts toward that region, sellers step in, and momentum fades quickly. The result has been a series of clean rejections that continue to cap any recovery attempts.

Indicators Point to Growing Downside Risk

Momentum indicators aren’t offering much comfort either. The daily RSI remains below the neutral level, signaling a weak setup with room to slide further toward oversold conditions. At the same time, the Average Directional Index is hovering near 19.5, a reading that suggests bearish control is still present, even if trend strength isn’t extreme.

MACD is also leaning negative, sitting below the zero line and showing bearish divergence. Bollinger Bands have started to contract and tilt toward the lower band, a combination that often precedes heightened volatility. Taken together, these signals paint a picture of a market leaning lower, not one preparing for a breakout.

Broader Market Pressure Isn’t Helping Cardano

Zooming out, Cardano’s weakness isn’t happening in isolation. The broader crypto market ended last year on a soft note, with macro headwinds keeping risk appetite in check. Bitcoin struggled to hold key levels, briefly dipping toward $80,000 before rebounding, only to stall again below the $97,500 zone. That hesitation has spilled over into altcoins.

Analysts at QCP have pointed out that while macro conditions could eventually support bullish narratives, volatility remains elevated. Without stronger spot demand, both Bitcoin and Ethereum continue to reflect a risk-off tone. In that environment, smaller and mid-cap tokens like ADA tend to feel the pressure more quickly.

On-Chain Signals and Funding Rates Add to the Caution

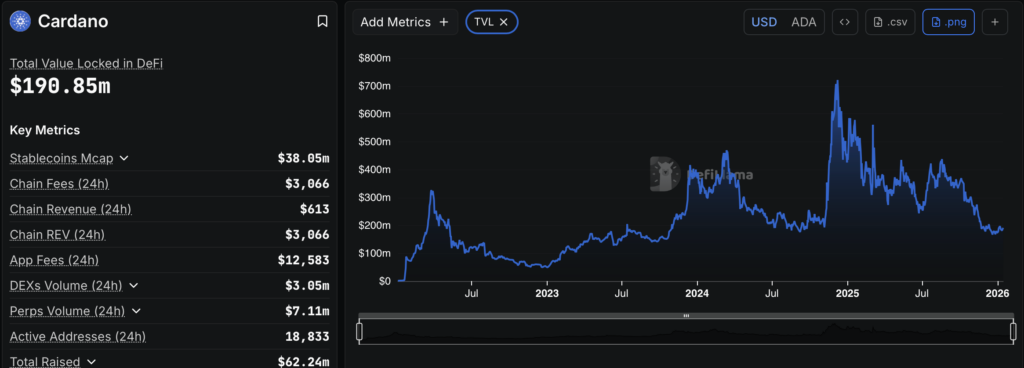

Cardano’s on-chain data isn’t offering much relief either. Metrics such as dormant supply activation suggest renewed selling interest, echoing what’s already visible on the chart. The repeated rejections near the 50-day EMA follow a steep drop from above $0.82 back in October 2025, a move that reset expectations sharply.

Now, with ADA hovering near fragile support around $0.38 and funding rates turning negative, short positions appear to have the upper hand. That shift often signals fading retail optimism. Still, there’s a twist. Daily trading volume is down roughly 26%, which hints at weak conviction on both sides. That lack of commitment could allow price to test the $0.40 supply zone once more, even if the odds remain stacked against a clean breakout.

What Happens If $0.40 Fails Again

The path forward is fairly clear. If ADA can reclaim $0.40 with a meaningful surge in volume, it would relieve immediate downside pressure and challenge the bearish structure. If not, the risk tilts lower. A failure to break that level could open the door to a roughly 10% drop, dragging price back toward multi-month support near $0.32.

For now, ADA remains trapped beneath a stubborn ceiling, with sellers firmly in control and bulls running out of room to maneuver.