- ADA dropped over 5% in 24 hours, sliding toward key $0.59–$0.60 support.

- Whales sold 100 million tokens in three days, triggering liquidations and panic selling.

- Long-term sentiment could improve if Cardano ETF proposals gain SEC approval.

Cardano has been bleeding out lately, dropping more than 5% in just the past day and sliding to around $0.60. The fall has triggered a clear technical breakdown, leaving traders eyeing $0.55 as the next possible stop if the $0.60 support fails to hold. From its local high of roughly $0.89 in early October, ADA’s downtrend has been relentless, with each recovery attempt fading out almost as soon as it began.

Whales Start Dumping as Liquidations Spike

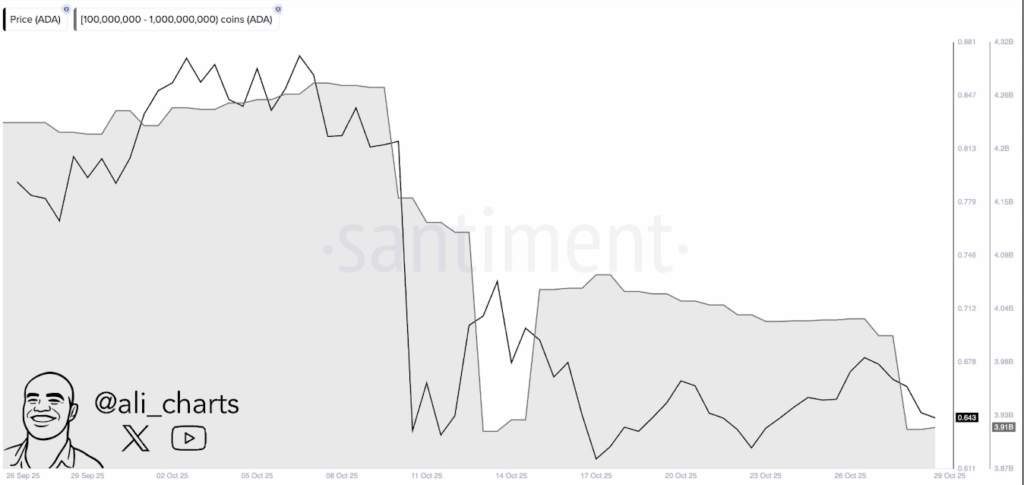

Right now, ADA is hovering just above $0.59—a level that’s become a bit of a battleground. According to crypto analyst Ali Martinez, whales holding between 100 million and 1 billion ADA offloaded around 100 million tokens in only three days. That’s a huge amount of sell pressure for any market to absorb, and as usual, it came right before prices cracked lower. Martinez spotted this pattern when ADA was around $0.64, saying it hinted at waning momentum, which, well, seems spot-on now.

CoinGlass data also backs this bearish mood. In the past 24 hours, traders saw $4.36 million in total liquidations, with the overwhelming majority—more than $4 million—coming from long positions. That imbalance shows how overleveraged bullish traders got caught off guard by the sudden drop. The result: ADA plunged to the $0.59–$0.60 zone, while risk appetite across the altcoin market cooled off sharply. Some traders might already be eyeing re-entries though, waiting for sentiment to stabilize.

Technical Picture: ADA Still Under Pressure

Technical signals don’t look great either. Analyst Jesse Olson noted that “a downward sloping 200-week moving average is not bullish,” and his chart shows ADA still trading below it. Historically, that line acts like a wall until it flattens or starts curving upward. The Relative Strength Index (RSI) sits near 35, meaning ADA is close to oversold territory—so a small rebound might be on the table if sellers take a breather.

If the $0.59 support gives way, ADA could tumble to $0.55, maybe even $0.51, which would mark new lows for 2025. On the flip side, resistance lies at $0.65 and $0.70, while a clean breakout above $0.80 could flip the script entirely and trigger a push toward $1.70. For now, though, that support zone around $0.59 will probably decide whether this slide keeps going or a short-term bounce finally takes shape in early November.

ETF Filings Offer a Glimmer of Long-Term Hope

Even with all the short-term pain, there’s a hint of optimism on the horizon. ETF issuers REX Shares and Osprey Funds have filed with the SEC to include ADA in their Top 10 Crypto Index ETF. What’s interesting is that this product wouldn’t just track price—it would also feature staking, meaning investors could earn rewards alongside their exposure.

While those filings haven’t yet been approved, they show that institutional interest in altcoins is growing beyond Bitcoin and Ethereum. If a Cardano ETF does go live, it could sit alongside other recent altcoin products for Solana, Litecoin, and Hedera. Analysts believe such approval could boost inflows and maybe even double ADA’s price over time. For now, though, Cardano’s next few weeks hinge on whether buyers can defend that fragile $0.59 level—or if another leg down is still ahead.