- ADA holds strong amid trade tensions: Despite renewed pressure from Trump’s 50% EU tariff announcement, Cardano’s price has remained stable around $0.67–$0.85, suggesting market resilience and potential buildup toward a $1 breakout.

- Analysts see bullish signs forming: Technical analysis points to a healthy consolidation pattern with repeated “pump and pause” cycles. Analyst Dan Gambardello believes this “coiling” behavior could lead to a strong move if Ethereum also breaks out.

- Messari Q1 report shows mixed results: While ADA’s price and treasury dollar value declined, governance milestones like the Plomin Hard Fork and a 30% jump in stablecoin market cap reflect steady development and strong community commitment.

Over the past 48 hours, Cardano’s (ADA) price has bumped up against the upper edge of its falling channel—only to be nudged back down thanks to renewed market jitters. A big part of that? Donald Trump’s surprise call for a 50% tariff on the EU, starting June 1. Naturally, that spooked some investors.

But here’s the thing—ADA’s price didn’t flinch much. That calm suggests the market might be getting used to geopolitical noise. Some traders are even thinking this slow, steady consolidation might actually be a good thing—maybe even the calm before a breakout toward that shiny $1 mark.

Technicals and Analysts Lean Bullish

Cardano’s been grinding through a drawn-out consolidation phase inside a falling channel, largely weighed down by global trade uncertainties. ADA dipped to around $0.50 back in April, but managed a pretty decent recovery by mid-May—tapping the $0.85 zone. That bounce was sparked, in part, by a new UK trade deal that helped chill out some of the tension.

Now, with fresh EU tariff talk back in play, investor nerves are creeping up again. But technically speaking, ADA hasn’t broken beneath any key exponential moving averages. So as long as those supports hold, bulls might still have some fight left in them.

Crypto analyst Dan Gambardello thinks Cardano’s price structure is showing a more refined setup compared to the last bull run. Back then, it was more like: big breakout, quick rally. This time? It’s more of a step-by-step, grind-it-out kind of vibe—with “pump and pause” patterns shaping up. Gambardello calls it a “coiling effect,” and says if ADA keeps ticking the right boxes, $1 is totally within reach.

He also believes Ethereum’s chart is worth watching. If ETH breaks above its long-term trendline, that could be the spark altcoins like ADA need to finally move.

Messari’s Q1 Report: Tough Quarter, But Fundamentals Steady

Messari’s Q1 2025 Cardano report was, well, a bit of a mixed bag. It pointed out the tough environment ADA faced—price pressure led to a dip in market cap and general sentiment. Still, there were some bright spots.

For one, governance took a step forward with the activation of the Plomin Hard Fork—a major milestone. On top of that, ADA staking held strong. Despite the choppy waters, the total amount of ADA staked only dropped by 1%, landing at a healthy 21.6 billion tokens.

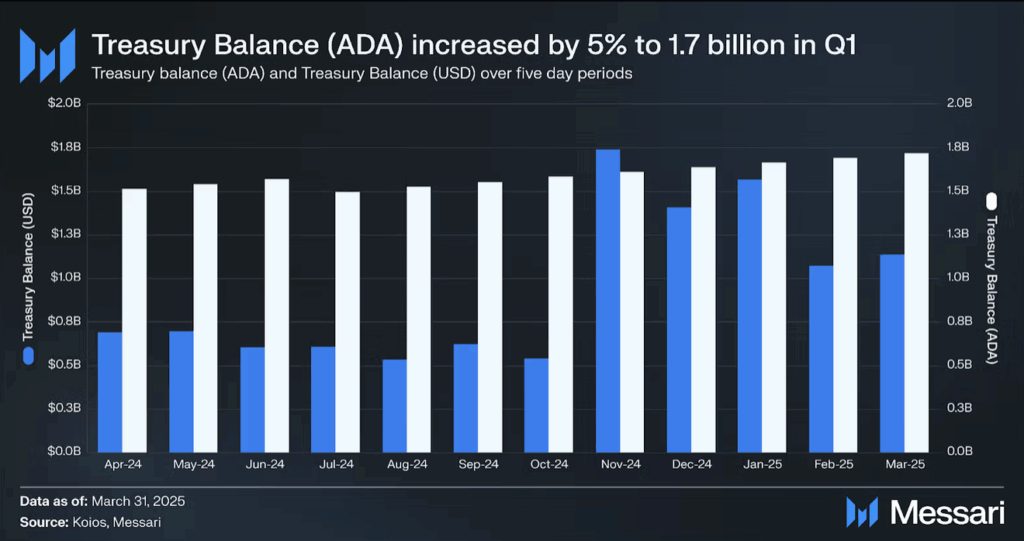

And while the ADA treasury’s dollar value slid 19% to $1.1 billion (thanks to price volatility), the actual token balance rose 5% to 1.7 billion ADA. Not bad.

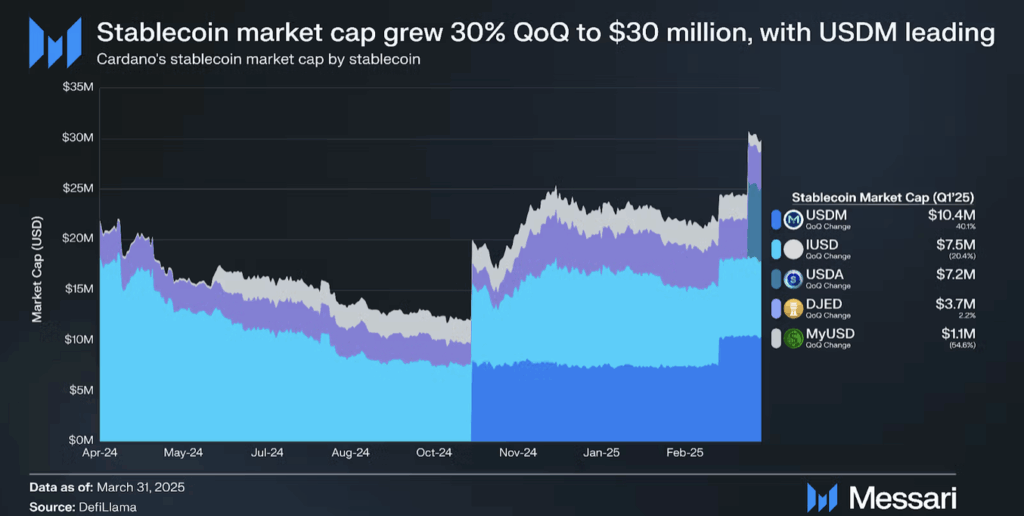

Another standout? The Cardano stablecoin ecosystem. Stablecoin market cap jumped 30% to hit $30.1 million, largely fueled by growing adoption of fiat-backed coins like USDM and IUSD.

Final Take

Despite political noise, ADA’s price is hanging in there—and might be setting the stage for a stronger breakout. With bullish structure forming, solid community support, and governance upgrades ticking along, Cardano could be in for a bigger move if conditions stay favorable.

All eyes now are on the $1 level. Will it crack through? Or will the market keep playing it safe a little while longer?