- Capital is rotating from memecoins into AI, DeFi, and infrastructure tokens.

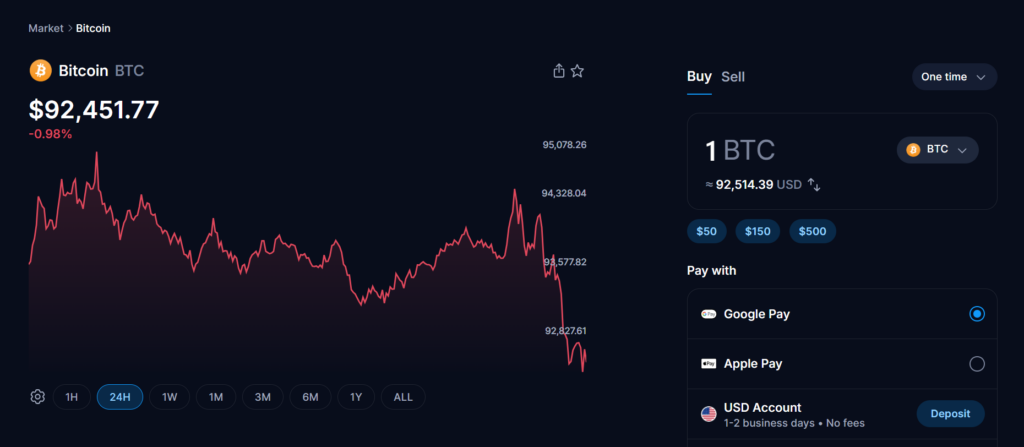

- Bitcoin holding above $93K provides a stable base for higher-risk rotations.

- This behavior aligns more with early-cycle positioning than late-cycle excess.

As Bitcoin holds comfortably above the $93,000 level, the most meaningful shifts aren’t happening at the top of the chart. They’re happening underneath. Data highlighted by CoinDesk shows capital gradually rotating away from memecoins and toward utility-driven sectors like AI, DeFi, and infrastructure-focused tokens. That distinction matters. Memecoins tend to lead when speculation is loose and fast. When capital starts favoring function over jokes, the tone of the market changes in a quieter, more durable way.

AI Tokens Are Behaving Like High-Beta Tech

AI-linked crypto assets have been among the strongest performers during this rotation. Tokens like Render have posted outsized gains in short timeframes, echoing behavior seen in traditional markets where investors are rotating back into growth and technology exposure. Crypto doesn’t move in a vacuum. When Wall Street re-engages with AI narratives, digital assets tied to that theme tend to respond first and with more force.

Bitcoin’s Stability Is Doing the Heavy Lifting

Bitcoin isn’t trying to sprint right now, and that’s precisely the point. By holding its ground above key levels, it gives the rest of the market room to breathe. Traders can rotate into higher-risk segments without worrying that the entire structure will collapse underneath them. When you layer in renewed spot ETF inflows, the picture becomes clearer — the base is being supported while capital explores further out on the risk curve.

Why a Memecoin Cool-Off Isn’t Bearish

A slowdown in memecoins shouldn’t be mistaken for weakness. It’s digestion. Rotations like this usually happen when participants start asking which sectors still have room to run, rather than piling into assets that already doubled. That kind of thinking tends to show up early in a cycle, not at the end of one.

What This Rotation Really Suggests

This market isn’t chasing laughs right now. It’s reallocating toward compute, finance, and infrastructure narratives. Bitcoin holding steady while capital shifts into AI and utility tokens isn’t random. It’s often how sustainable trends begin — quietly, before broader participation catches on.