- XRP has had a huge year after the SEC settlement and a new all-time high, but it still trails Ethereum by a wide market-cap margin.

- Ethereum’s dominance comes from its massive app ecosystem and role as a base layer for DeFi, NFTs, and tokenization, while XRP is focused on payments and remittances.

- XRP could keep growing with stronger adoption and ETFs, but overtaking ETH would likely require a fundamental shift in how value is distributed across the entire crypto market.

Ripple’s XRP has been on a tear in 2025. After the SEC vs. Ripple lawsuit finally reached a settlement, the token went on to print a fresh all-time high for the first time in nearly seven years. With new ETFs, heavy adoption in payments, and renewed hype around the XRP Ledger, a big question keeps popping up: can XRP ever overtake Ethereum and claim the number two spot in crypto by market cap?

Where XRP And Ethereum Stand Right Now

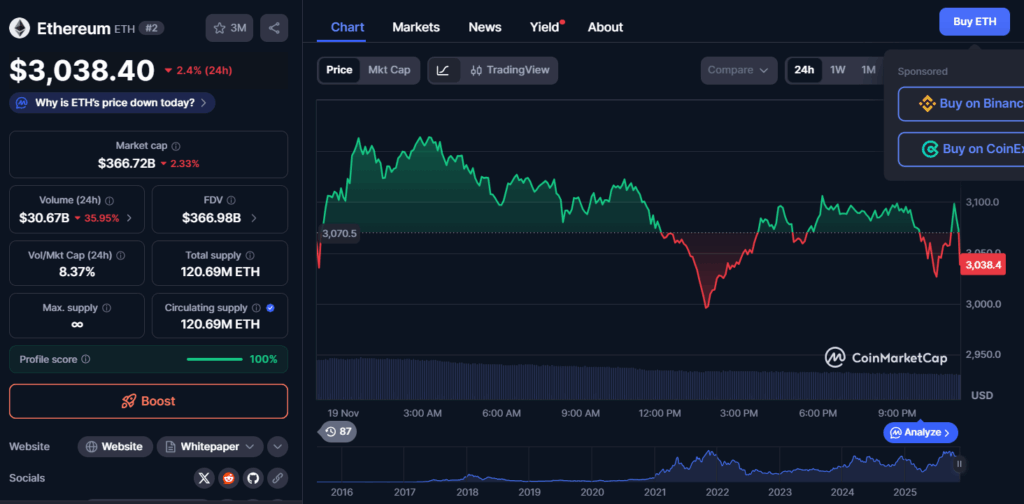

According to recent market data, Ethereum still sits comfortably in second place with a market cap around $370 billion. XRP, meanwhile, holds the fourth spot with roughly $131 billion in market value. That’s a serious gap, not a tiny margin.

For XRP to flip Ethereum, it wouldn’t just need a big rally. It would need either:

- Massive upside in its own valuation,

- A brutal loss of dominance from ETH,

- Or some messy mix of both over a long stretch of time.

In other words, this isn’t a “one more green candle and we’re there” situation. It’s a structural question, not just a short-term price chart thing.

Ethereum’s Biggest Advantage: The App Layer

One reason Ethereum has held the number two slot for so long is simple: it’s where a huge chunk of crypto actually lives. Thousands of tokens, DeFi protocols, NFT platforms, rollups, and experiments are built directly on Ethereum or its broader ecosystem. That app layer keeps liquidity, builders, and users cycling through the same core infrastructure.

XRP plays a different game. The XRP Ledger isn’t designed as a general-purpose smart contract superhub. It’s optimized for speed, settlement, and cross-border value transfer. Banks and financial institutions, especially in places like Japan, have leaned into this, using the network for remittances and payments. That’s powerful utility, but it’s narrower in scope than the “build everything here” model that Ethereum offers.

Can Adoption Alone Carry XRP Past ETH?

XRP’s adoption curve in banking and payments is real, and similar momentum could spread further into the U.S. and other major markets over the next few years. More banks, more corridors, more volume — all of that can absolutely drive value into the token and lift its market cap dramatically over time.

But overtaking Ethereum is a different beast. ETH has both a deep app ecosystem and a powerful “economic base layer” narrative: it’s the settlement chain for a huge chunk of Web3 activity. XRP, at least for now, is not set up to compete on that exact front. Unless the XRP Ledger evolves into a broader application platform or the financial rails narrative becomes even more valuable than the app layer itself, ETH likely stays ahead.

ETFs, Institutions, And The Narrative Gap

Both Ethereum and XRP now have ETF vehicles that open the door for institutional flows. Ethereum has already shown what happens when those flows really catch: earlier this year, ETH ripped higher off the back of strong ETF demand.

XRP is still in the early innings of that story. Its ETFs haven’t yet triggered the same kind of sustained bid that ETH saw. That might change over time, but right now, Ethereum still owns the stronger institutional narrative: it’s the backbone for DeFi, tokenization, and a huge number of experiments in real-world assets. XRP’s story is more focused and more specialized.

So, Could XRP Ever Flip Ethereum?

Is it impossible? No. The crypto market is famous for making “impossible” things happen after people stop expecting them. A massive wave of global adoption for XRP in payments, combined with regulatory clarity and aggressive ETF inflows, could push the project into a much higher orbit.

But here is the honest read for now: flipping Ethereum isn’t likely in the near term, and it may never happen unless the structure of the market changes in a big way. What does look realistic is XRP steadily growing its market cap as its real-world usage deepens. If that keeps happening for long enough, the conversation about rankings will naturally resurface — just on a much bigger stage.