- SUI fell 9% to $3.34, with shorts adding nearly $31M in leverage, signaling strong bearish momentum.

- Despite price weakness, the network hit a record 1,632 TPS and $143B in DEX trading volume.

- If support holds at $3.29, SUI could rebound 27% toward $4.33, but a breakdown risks falling to $2.80.

SUI just took a heavy hit, dropping 9% in the past day to around $3.34. The token even retested support at $3.29, a level it has bounced from before. Meanwhile, short positions have piled up with nearly $31 million in leverage, pushing bearish sentiment higher. The timing wasn’t great either—Bitcoin slid almost 3% and Ethereum lost nearly 7%, so the broader market pullback added fuel to the drop.

Still, while the short-term looks shaky, some long-term signals for SUI paint a much brighter picture.

Key Support and Price Action

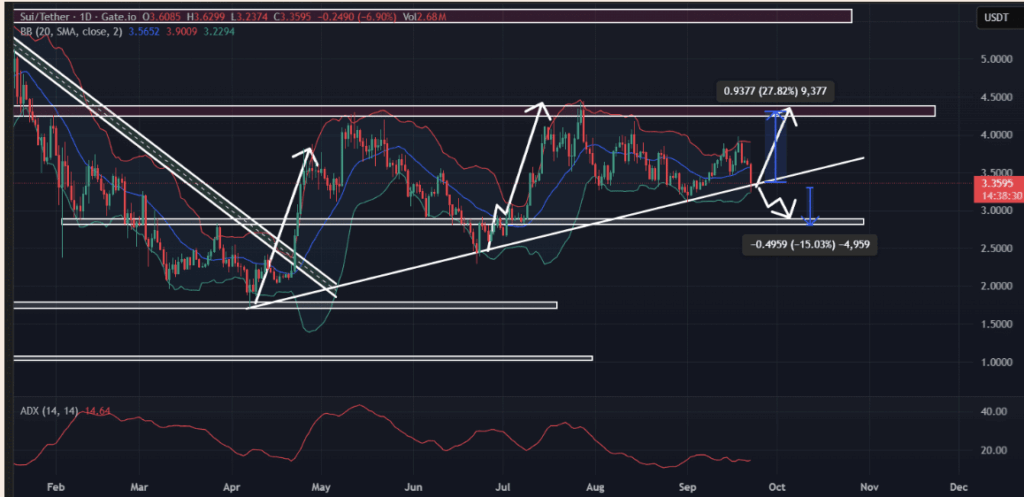

Looking at the charts, SUI has tested its rising trendline from April 2025 for the third time now. The last couple of times this level held, the token bounced hard afterward. If the pattern repeats, bulls might see a rally of about 27%, which could take SUI back near $4.33. But if the line gives way, downside could stretch to $2.80—a drop of roughly 16%.

On the daily time frame, SUI also tagged the lower band of its Bollinger Bands. Historically, every time this has happened since June, a reversal followed not long after. The Average Directional Index (ADX), however, sits at just 14.65, which suggests the trend is weak and still searching for direction.

Network Growth Still Impressive

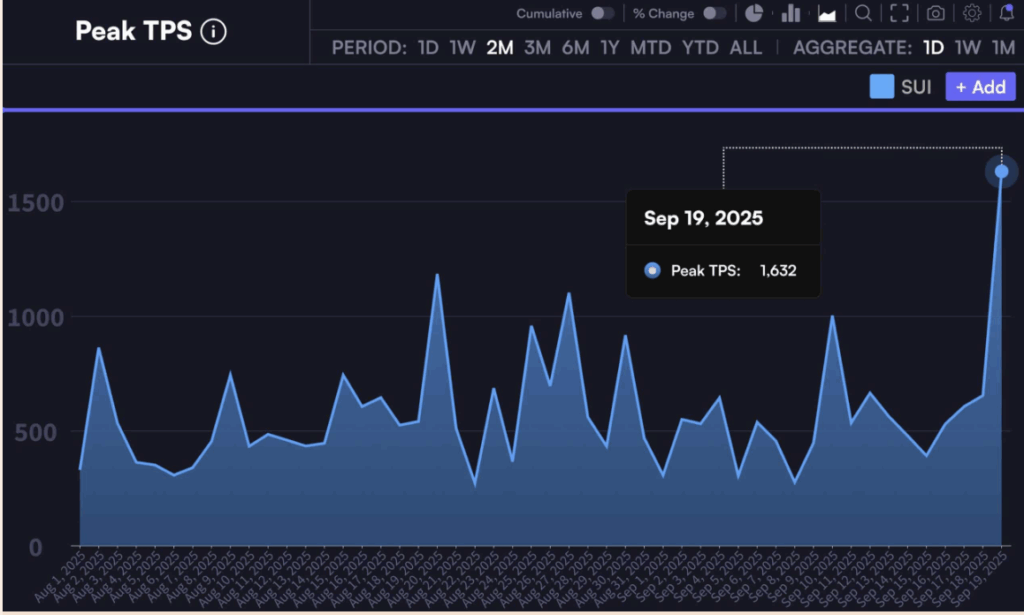

Price might be shaky, but fundamentals tell a different story. Just last week, SUI reached a record 1,632 transactions per second (TPS), showing the network can handle serious throughput. On top of that, cumulative DEX trading volume on SUI hit $143 billion—another all-time high.

Spot Netflows also added a bit of optimism. CoinGlass data showed nearly $25 million flowing out of exchanges on Sept. 22. Outflows like these usually signal accumulation, hinting that larger players could be scooping up tokens instead of dumping them.

Traders Stay Bearish in the Short Term

Despite the strong network stats, traders are leaning bearish for now. Liquidation data shows that long positions worth about $3.66 million were wiped out, while shorts completely dominated with nearly $31 million. Most of the key liquidation levels cluster between $3.29 and $3.70, keeping sentiment fragile in the near-term.

So for now, SUI finds itself stuck at a crossroads—fundamentals are screaming growth, but traders are pressing down on the bearish side of the trade. If support holds, though, this might just be another setup for a big rebound.