• Solana price has formed a falling wedge chart pattern and a break and retest, pointing to more gains in the near term

• Solana has strong fundamentals including a large user base, high fees generated, dominance in the meme coin industry, and potential for a spot Solana ETF approval

• The initial target for a Solana price rebound is $263, with further gains possible towards $300 if it breaks above that level

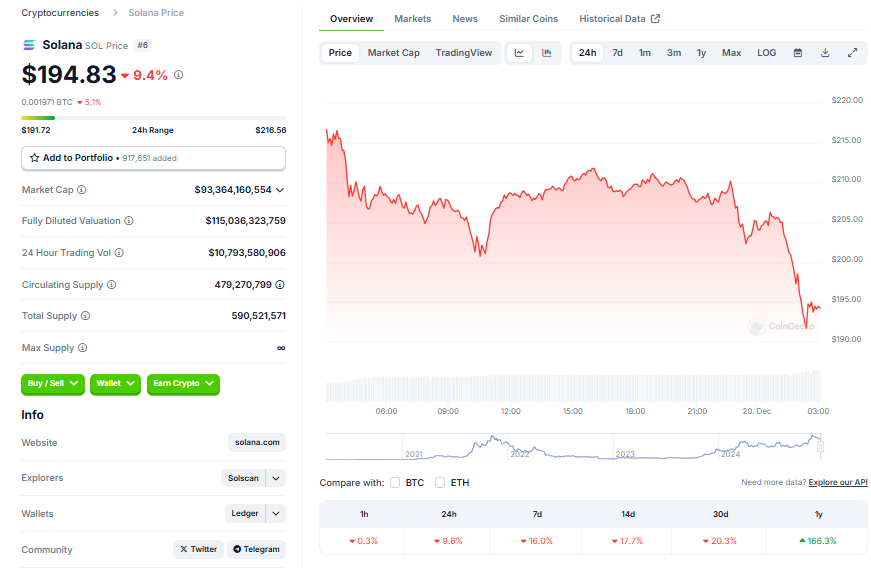

Unveiling a distinct pattern in the Solana price, its recent performance prompts speculation of a potential surge. Traders are keenly observing the movement of this fifth-largest cryptocurrency, especially after a technical bear market following the hawkish Federal Reserve decision.

Technical Indicators Foretell a Solana Price Uplift

The Solana price has exhibited several bullish chart patterns, creating anticipation of a forthcoming rebound. These patterns are primarily a falling wedge chart pattern and a break and retest pattern. Moreover, the Solana price remains above the 100-day and 200-day Exponential Moving Averages, which further supports the possibility of a bounce-back.

Solana’s Strong Fundamentals

Beyond its price, Solana has strong fundamentals that make it a formidable contender in the crypto world. It is threatening Ethereum‘s dominance by attracting a substantial number of developers and users. Moreover, Solana proves its position with over 51 million users in the last 24 hours, significantly outperforming Ethereum’s 441,000 and Tron’s 2.4 million.

Solana’s Impact on the Meme Coin Industry and DApps

Solana has also established a significant presence in the meme coin industry and Decentralized Public Infrastructure industry. With its ecosystem tokens amassing a market cap of over 20 billion and platforms like Helium and Hivemapper under its belt, Solana is undeniably a force to be reckoned with.

Conclusion

There is a growing consensus that the Securities and Exchange Commission may approve a spot Solana ETF, which would bolster its position further. As Solana continues to demonstrate its potential through robust fundamentals and technical patterns, many anticipate that it may soon enter “beast mode.”