- Ether broke above a six-month downtrend, targeting $3,000 amid rising RSI and strong technicals.

- Ethereum’s TVL climbed to $52.8 billion, but low transaction fees and ETF outflows pose challenges.

- Analysts predict ETH could hit $2,500 to $3,500, driven by Pectra upgrade momentum and network recovery.

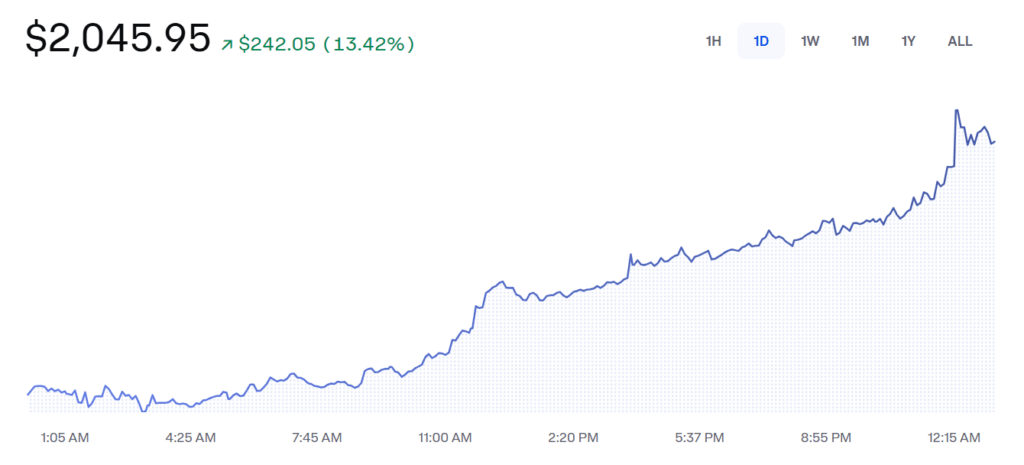

Ether’s looking to shake off its downtrend and make a run for the $3,000 mark, backed by improving network activity, rising TVL, and promising technical signals. Since dipping from its 10-month high of $4,100 in mid-December, ETH has finally broken above a six-month descending trendline, reclaiming the $2,000 level and now setting sights on $2,250.

Crypto analyst Mikybull Crypto highlighted the breakout, noting, “ETH breaking out,” as the relative strength index (RSI) surged from 56 to 66 in the past 24 hours, signaling bullish momentum. Meanwhile, the 50-day SMA at $1,775 has flipped to support, while the next key levels to watch are the 100-day SMA at $2,100 and the congestion zone between $2,500 and $2,800, where the 200-day SMA lies.

Onchain Metrics Show Mixed Signals

Ethereum’s onchain data paints a mixed picture. The total value locked (TVL) has climbed from $44.5 billion to $52.8 billion in the past month, driven by notable gains in projects like BlackRock BUIDL, Spark, and Ether.fi. Daily transactions are also up 22% to 1.34 million, showing renewed network activity.

But there’s a catch — Ethereum fees have plunged 95% year-to-date, reducing the ETH burn rate and making the network slightly inflationary. Adding to the concern, US-listed Ether ETFs saw $39.7 million in net outflows from May 5 to May 7, while Bitcoin ETFs raked in $482 million over the same period.

Analysts Eye $3K as Short-Term Target

Analysts are cautiously optimistic. Crypto Claws said ETH is “primed for a bullish reversal,” setting targets between $2,500 and $3,500. Meanwhile, Crypto Salamanca sees the Pectra upgrade as a catalyst, predicting ETH could reach $2,150 to $2,700 in the coming weeks.

But with weak fee burns and outflows from Ether ETFs, the road to $3,000 might be bumpier than it seems.