- Bitcoin flipped positive year-to-date after reclaiming $94,000.

- Institutional-style liquidity clusters suggest accumulation rather than exit flows.

- A sustained hold above $94,000 could open a path toward the $100,000 zone.

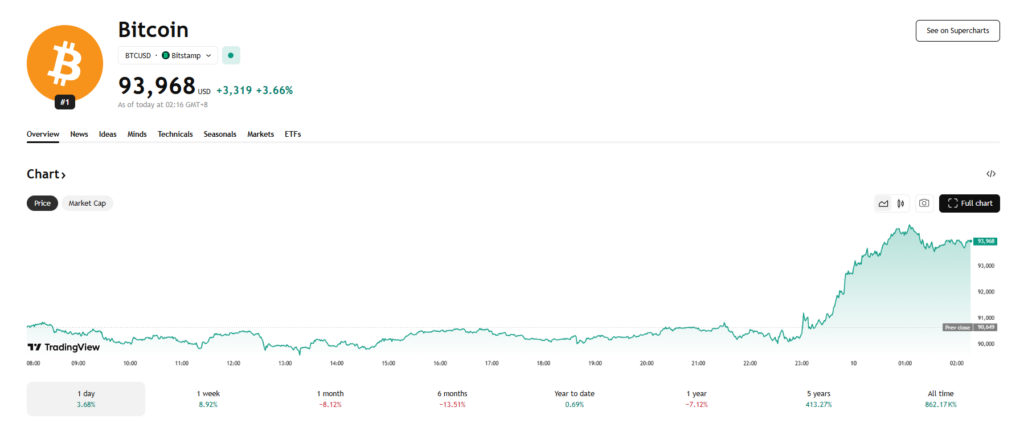

Bitcoin powering through the $94,000 mark has officially pushed it back into positive territory year-to-date, a move that seemed to flip sentiment almost instantly. The jump arrived right as traders were eyeing a cluster of macro catalysts, and the reaction felt… well, fast. Short-covering kicked things off, but a notable shift in tone among larger buyers added fuel, helping BTC reclaim a level many assumed would take longer to revisit.

Institutional Liquidity Is Quietly Returning

Quietly but unmistakably, big-ticket flows are showing up again. On-chain data and order-book patterns point to heavy liquidity clustering around the $93,000 to $95,000 region — usually a sign that institutions aren’t running for the exits. If anything, this looks like accumulation behavior, not panic rotation. That’s pushed some analysts to argue that this range is morphing into a support shelf rather than a cap, which would give Bitcoin a much stronger base for the next leg up.

Technical Structure Points Toward a Bigger Move

From a purely structural standpoint, reclaiming $94,000 is meaningful. BTC is starting to build the kind of trend formation that typically precedes another impulse move. If momentum holds, several models point toward a push toward the $100,000 area — and in some cases beyond — especially if the macro backdrop strengthens. Rate-cut expectations, rising liquidity, and improving risk appetite all sit squarely in Bitcoin’s favor for the moment.

Why This Move Might Be the Start of Something Larger

This wasn’t just a bounce; it felt more like a pivot. Bitcoin taking back the $94,000 level and flipping green for the year suggests the broader market is finding its legs again. If buyers continue to defend this zone — and if macro winds don’t suddenly reverse — this could be the early stage of a more extended rally rather than a one-off spike. The next few days will tell us whether this breakout sticks or becomes the launchpad for the next phase upward.