- Bitcoin slipped 5% below $110K, but US spot ETFs still pulled in $241M of inflows led by BlackRock.

- DCC Enterprises added 50 BTC, lifting its holdings to 1,058 as it targets 10,000 by year-end.

- Technicals point to further downside with $101.5K and $91K as key supports unless bulls reclaim $114K.

Bitcoin slid beneath $110,000 for the first time in weeks, logging a 5% drop on Thursday as global markets stumbled. Even with the pullback, institutions kept stepping in—US spot ETFs alone absorbed $241 million in fresh inflows, softening the sting from earlier outflows. Corporate treasuries like DCC Enterprises also added to their stacks, with the firm’s latest 50 BTC purchase bringing its holdings past 1,000.

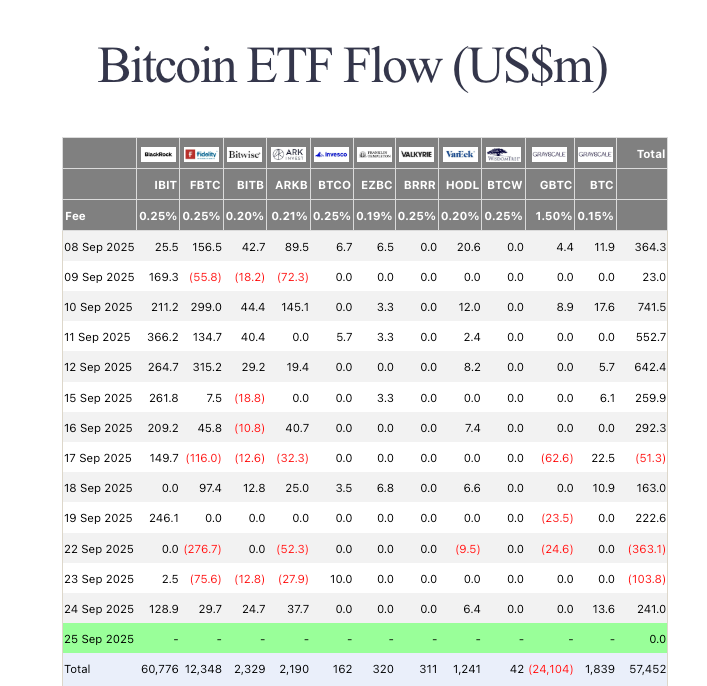

ETFs Bounce Back After Heavy Outflows

The midweek ETF flows highlighted strong demand in the face of volatility. BlackRock’s IBIT led the charge with nearly $129 million in inflows, followed by Ark Invest’s ARKB at $37.7 million and Fidelity’s FBTC at $29.7 million. This came after $466 million in redemptions earlier in the week, a sign that big money traders are taking advantage of dips rather than fleeing. Analysts say this steady pipeline of institutional demand is cushioning Bitcoin’s downside, even if it can’t fully counteract macro headwinds.

Corporate Buying Push Continues

DCC Enterprises is one of those firms aggressively stacking sats. On Thursday, it added another 50 BTC, worth around $5.5 million at current prices, lifting its treasury to 1,058 BTC. CEO Norma Chu doubled down on their 2025 target of 10,000 BTC, emphasizing Bitcoin as a long-term strategic reserve. Since launching its program in May, DCC claims a staggering +1,556% yield on its positions. Moves like this are increasingly shaping market structure, with companies acting as stabilizers when volatility spikes.

Technicals Point Toward $100K

From a charting perspective, the picture isn’t as rosy. BTCUSD broke under the $110,000 support, with RSI down to 37 and Elliott Wave analysis hinting at more pain. The current setup completes a five-wave cycle and points toward an (a)-(b)-(c) correction, targeting $101,500 as the next major support. If that fails, bears could push price toward $91,352. On the upside, bulls need to reclaim $114,100 to flip momentum and aim for $118,600. For now, the trend tilts bearish, but institutional inflows may keep the market from spiraling deeper.