- BONK has dropped 8.67% in 24 hours, deepening its weekly losses, though it’s still up 41% for the month.

- The token is approaching a key demand zone between $0.00001546 and $0.00001405, which could trigger a bounce — but if it fails, lower support levels may come into play.

- Despite bearish momentum and high long liquidations, spot buyers are still active, purchasing $18.63M worth of BONK in the past week, offering a slim chance for a bullish turnaround.

Bonk (BONK), the Solana-based memecoin, just took a bit of a beating—dropping 8.67% in the last 24 hours. That dip piled onto its rough week, pushing the losses deeper. Oddly enough, this recent stumble contrasts with its overall monthly growth of 41%, which had folks feeling a bit more optimistic not long ago.

But hang tight—it’s not all doom and gloom just yet. While the broader outlook leans bearish, there’s a tiny spark left that might flip things around. Might.

BONK Drifting Toward Demand—Could That Save It?

Right now, BONK’s price is inching toward a critical demand zone. These zones? They’re where buyers usually hang out, waiting to scoop up assets at what they see as a discount. For BONK, that zone lives between $0.00001546 and $0.00001405.

If buyers step in with enough volume, we could see a bounce from this region. But—and it’s a big one—if that zone fails to hold? BONK might be heading even lower. And quickly.

Analysts flagged support levels down at $0.00001178, $0.00001043, and $0.00000888. Those are the next pits it could fall into if this slide keeps up.

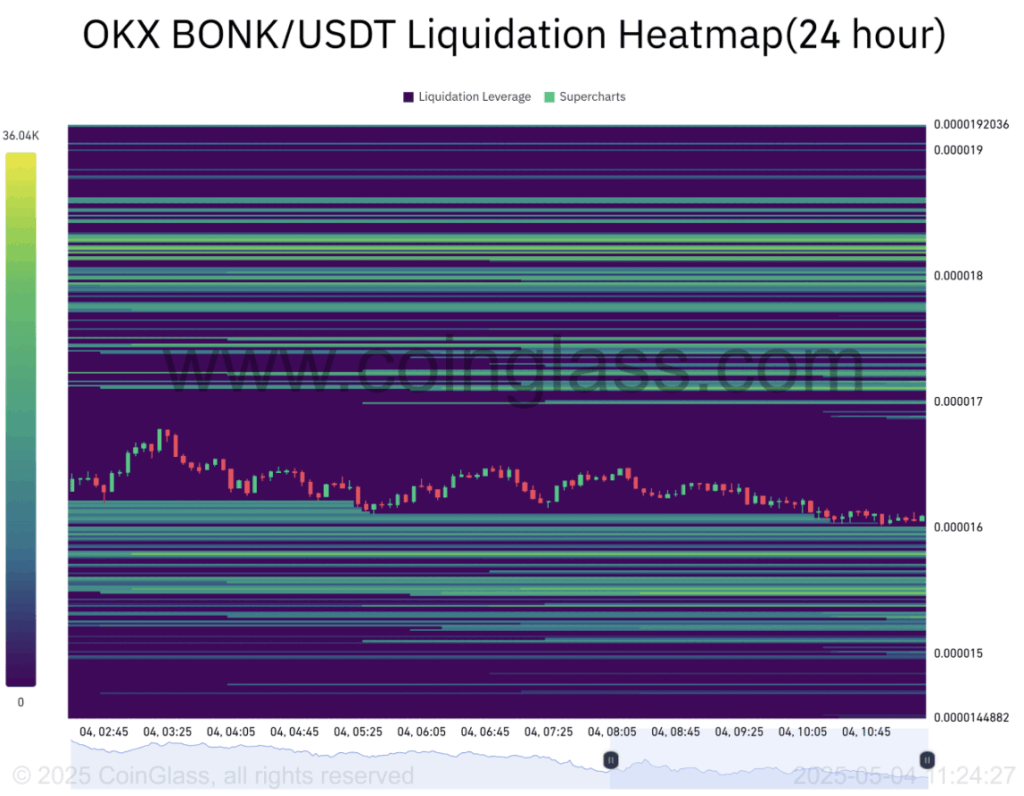

Liquidity Clusters Hint at a Tipping Point

Looking at the Liquidation Heatmap, BONK’s floating near some dense liquidity zones—particularly between $0.000016 and $0.00001448. That lines up neatly with the demand area mentioned earlier.

But just because BONK’s bumping into that liquidity doesn’t guarantee a reversal. Sometimes, it’s just… well, noise before another leg down.

Bears Still Running the Show

One of the more telling signs right now is BONK’s market momentum. It’s firmly in bearish territory. The Taker Buy/Sell Ratio—a metric that shows who’s controlling the volume—says it all: just 45.82% of traders are long, while 54.18% are short. That’s a solid lean toward sellers.

And then there’s the liquidation data. Longs are getting hammered. About $205K in long positions were wiped out, compared to just $1,990 in shorts. That’s a brutal imbalance—suggesting bulls are getting flushed out while bears dig in deeper.

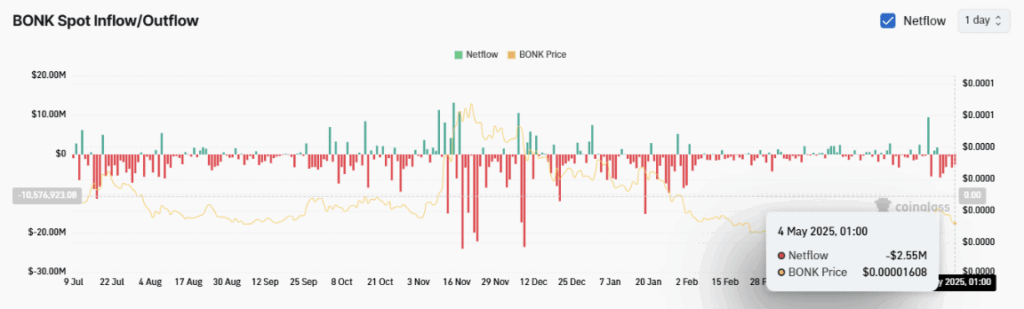

But Wait—Spot Buyers Are Still Around

Even with all the selling pressure, spot traders are quietly making moves. BONK saw $2.55 million in spot purchases just today. Over the last week? Nearly $18.63 million worth was scooped up—the biggest weekly grab since late January.

So what’s that mean? If this buying trend keeps up and BONK holds that demand zone, it might spark a bit of a bounce. No guarantees, of course. But it’s the one factor bulls can still cling to.