- BONK dropped 13.25% in the past 24 hours, landing near a key support level that could trigger either a 25% further dip or a 71% bounce, depending on how the market reacts next.

- Bullish sentiment remains strong, with $1.77M in spot accumulation, open interest hitting $22M, and stable funding rates — all suggesting traders are positioning for upside.

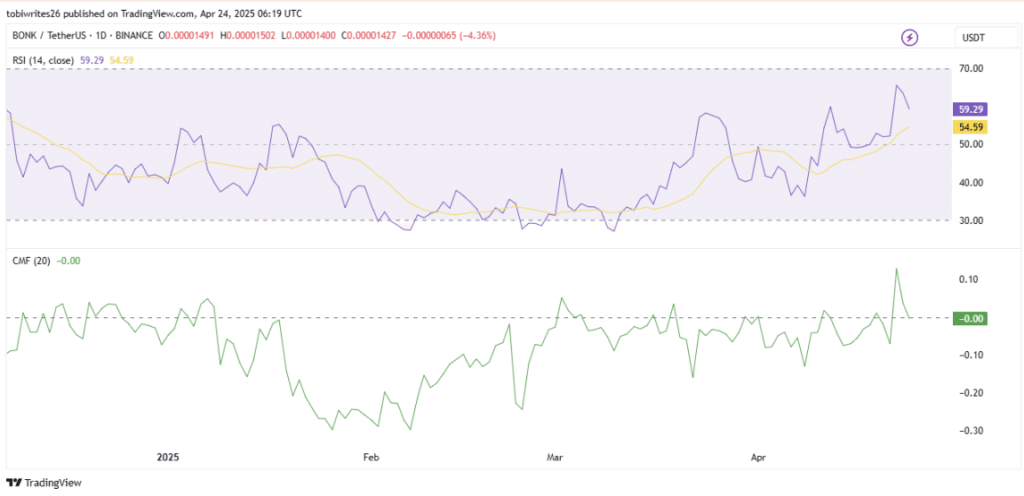

- Technical indicators like RSI (59.29) and CMF (neutral at 0.00) show temporary cooling, but if CMF trends upward and support holds, BONK could rally toward $0.00002655 in the near term.

BONK took a hit—down 13.25% in the last 24 hours, as broader selling pressure dragged it into a key support zone. But here’s the thing: despite the red candle, the market’s mood? It’s still leaning bullish.

If this zone holds, a rebound could be right around the corner. That’s what the charts — and the wallets — are hinting at.

Holding This Level Is Critical

Let’s rewind for a sec. BONK’s slide kicked off after it smacked into a resistance zone earlier this week. Classic rejection. Since then, it’s been dripping lower… and now it’s sitting on a major support level.

Break that floor? We could be looking at another 25.8% drop, with price targeting $0.00001043.

But if bulls defend this zone (and there are signs they might), BONK could bounce up to $0.00002076 — and possibly run all the way to $0.00002655, which would be a 71% rally from here.

There’s also a third option — sideways action. If BONK consolidates here, that might suggest accumulation is happening under the surface.

Traders Are Still Buying the Dip

The vibes on-chain? Surprisingly bullish.

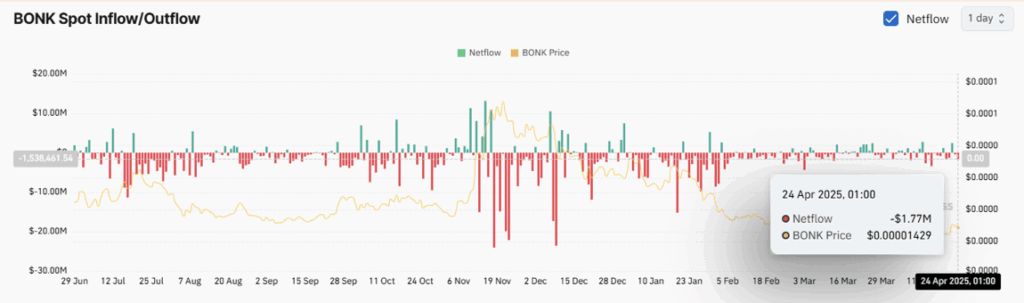

Coinglass Netflow data shows $1.77 million in BONK bought and moved to private wallets. That usually points to accumulation — not panic selling.

It’s not just spot buyers either. Open Interest in BONK futures has surged to $22 million, the highest it’s been since December 2024. That, plus stable funding rates, paints a picture of confidence, not fear.

Why Did BONK Dip Anyway?

Technical stuff mostly. RSI dropped to 59.29, sliding out of its recent comfort zone. Not bearish yet, just a breather. It’s still well above 50, which means momentum is intact — just cooling off a little.

Meanwhile, CMF (Chaikin Money Flow) sat flat at 0.00. That’s neutral — not bullish, not bearish. But it’s worth watching. If CMF starts trending upward, it could confirm that buying pressure is returning.