- Bonk bounced from $0.000013 to $0.00001480 as buyers surged back into the market.

- Derivatives data shows a bullish tilt, with Open Interest and volume rising sharply.

- Momentum is strong, but overbought signals hint at either breakout or reversal ahead.

Bonk (BONK) surprised a few folks by climbing off its recent floor around $0.000013 and tagging $0.00001480 before easing off slightly to $0.00001446. Nothing wild on its own—but paired with the surge in volume (up a whopping 98.33% to $160.5 million), it’s hard not to raise an eyebrow.

So, is this just a technical hiccup? Or maybe… something bigger brewing underneath?

Buyers Step Back Into the Ring

After getting knocked around by heavy selling, Bonk’s buyers weren’t down for long. Data from Coinalyze showed a strong return of demand—309 billion in buy volume compared to 182 billion sold on June 29. That left a healthy Buy-Sell Delta of +127 billion. Not subtle. That kind of imbalance screams renewed interest, maybe even FOMO from dip-buyers.

Meanwhile, Netflow turned negative, clocking in at -765K. That means more BONK was leaving exchanges than entering—classic sign of accumulation. It doesn’t guarantee a rally, but it sure doesn’t hurt.

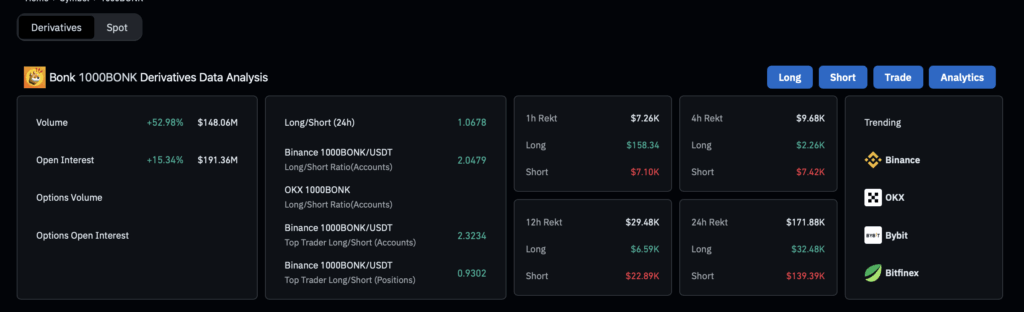

Derivatives Are Heating Up, Too

The futures market wasn’t asleep either. BONK’s Open Interest spiked 6.68% to $11.65 million, with trading volume in derivatives jumping 59.45% to $32.34 million. That kind of increase means one thing—traders are showing up. And based on the Long/Short Ratio of 1.124, they’re mostly betting on upside.

When you pair rising Open Interest with a tilt toward longs, it usually signals rising confidence. Not always a breakout… but definitely people taking positions expecting action.

Momentum Builds—But So Do the Risks

On the technical side, indicators are lighting up. The Stochastic RSI just rocketed to 89, which is deep in overbought territory. That’s not inherently bad—strong trends tend to stay overbought—but it also raises the possibility of a quick pullback.

And with the Relative Vigor Index at -0.0332 but pointing up, it shows that bullish energy is there, but not screamingly strong yet. If bulls push just a bit harder, reclaiming the $0.000015 level isn’t out of reach. But… hesitation or fatigue might mean a fallback to $0.000013. Traders will need to stay alert.