- BNB recovered 1.88% to trade near $863 after dropping to $833 earlier.

- The rebound reclaimed multiple resistance zones but occurred on low volume.

- Key levels now include $870 on the upside and $832–$836 as critical support.

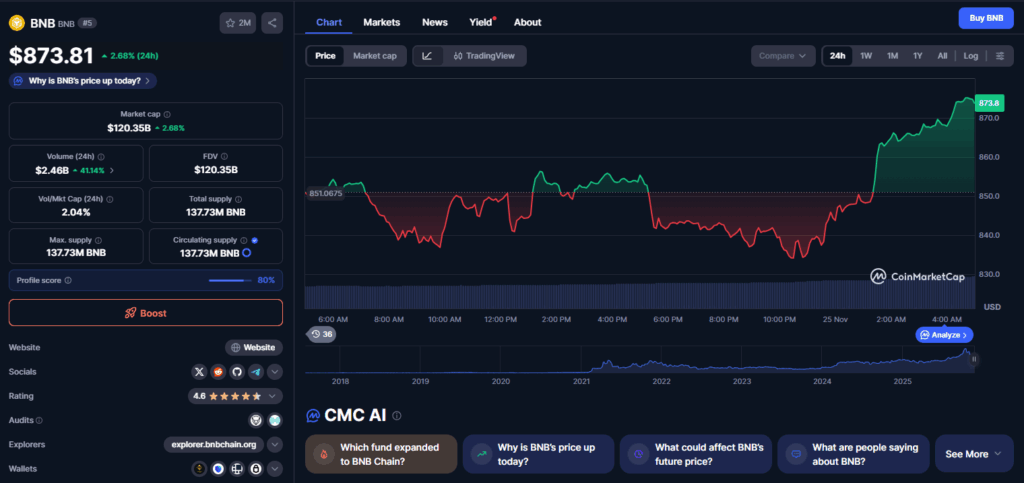

BNB has bounced 1.88% over the last 24 hours, rising to $863 after briefly slipping to $833 earlier in the session. The recovery comes after the token broke through its crucial $800 support range earlier this month, triggering a wave of selling pressure before buyers stepped back in below that level. Over the past day, BNB even pushed above $866, carving out a broad intraday range before retracing slightly.

Short-Term Stability Returns, but Volume Signals Caution

According to CoinDesk Research’s technical data, the rebound pushed BNB above several resistance zones that previously led to repeated rejections near the $855 mark. While this move hints at short-term stabilization, traders remain cautious. Volume during the rebound was moderate—far below levels seen during the major sell-off earlier in the month—suggesting limited conviction behind the move.

Key Levels to Watch as BNB Reenters Resistance Zone

BNB’s push back above $860 places it within a critical zone that flipped from support to resistance during last week’s decline. If the token can maintain this area, $870 becomes the next upside level to watch. However, if selling pressure returns, the $832–$836 range remains the structural floor that bulls must defend to avoid another breakdown.

BNB Still Lagging Behind the Market

Despite its rebound, BNB continues to underperform the broader crypto market. The CoinDesk 20 index climbed 4% in the same period—more than double BNB’s move—highlighting weaker relative strength as traders weigh the token’s next direction.