- BNB rose 4.25% to $891 despite a major drop in network activity.

- Whales may be quietly repositioning as price consolidates below $900.

- Roadmap upgrades, ETF review, and ongoing burns support long-term confidence.

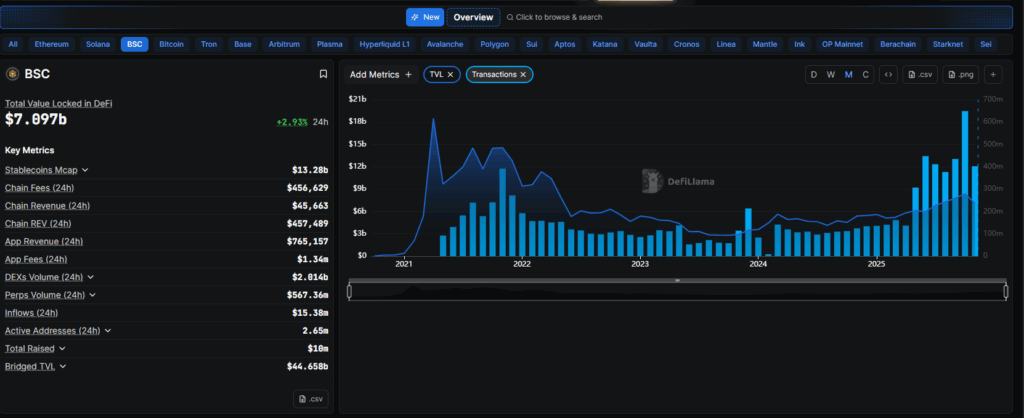

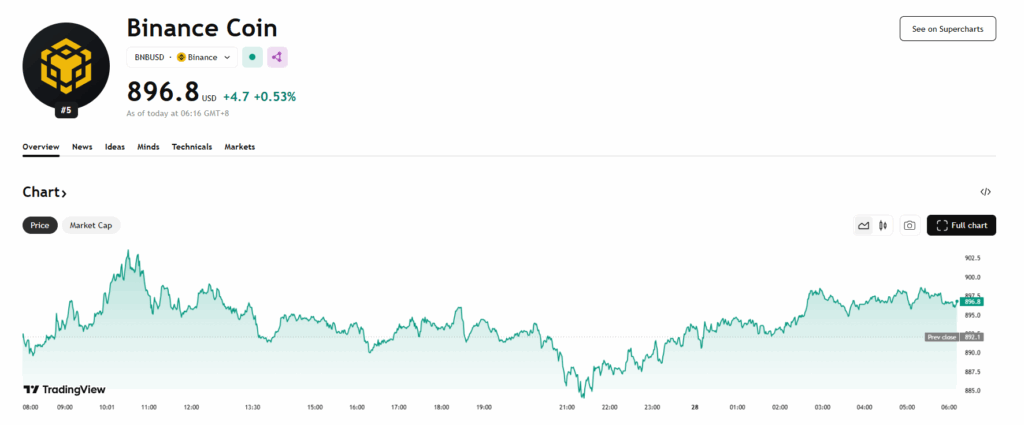

BNB managed to rise 4.25% in the past 24 hours, climbing to around $891—even as its underlying blockchain is showing one of its weakest usage periods of the year. According to new data from DeFiLlama, BNB Chain daily transactions have fallen nearly 50% this month to just 15.1 million. Network utilization has dipped to 19%, and decentralized exchange volumes have dropped by over $5 billion. This slowdown reflects the fading memecoin trading frenzy and the broader crypto pullback that saw Bitcoin briefly dip toward the $82,000 level.

Market Shows Stability as Large Holders Reposition

Despite weaker fundamentals, BNB’s price has held surprisingly firm. The token is consolidating right below the $900 zone, with tight trading ranges and gradually declining volume suggesting whales may be quietly repositioning. Earlier in November, BNB slipped under $1,000 during the wider market downturn, but strong hands appear to be defending current levels. The CoinDesk Research technical model flags this stability as a sign that traders expect catalysts on the horizon—even if short-term activity remains in decline.

Roadmap Upgrades and ETF Review Support Longer-Term Outlook

BNB’s 2025–2026 roadmap continues to place heavy focus on scaling upgrades designed for institutional-grade DeFi, high-throughput trading systems, and emerging AI-driven applications. These commitments are part of why some traders are looking past the temporary slump in usage. Adding to this narrative, the U.S. SEC is still reviewing VanEck’s proposed spot BNB ETF—an approval that could open a new wave of regulated demand for the asset, similar to what Bitcoin and Ethereum ETFs experienced.

Burns Continue, but Activity Drop May Slow Future Reductions

BNB’s long-standing burn mechanism remains one of its strongest value pillars. In Q3 2025 alone, roughly $1.2 billion worth of BNB was permanently removed from circulation. However, with on-chain activity shrinking, future burn totals may soften since the mechanism is partially tied to usage levels. Even so, reduced supply over time keeps BNB in a favorable structural position—provided the network can regain momentum as the market recovers.