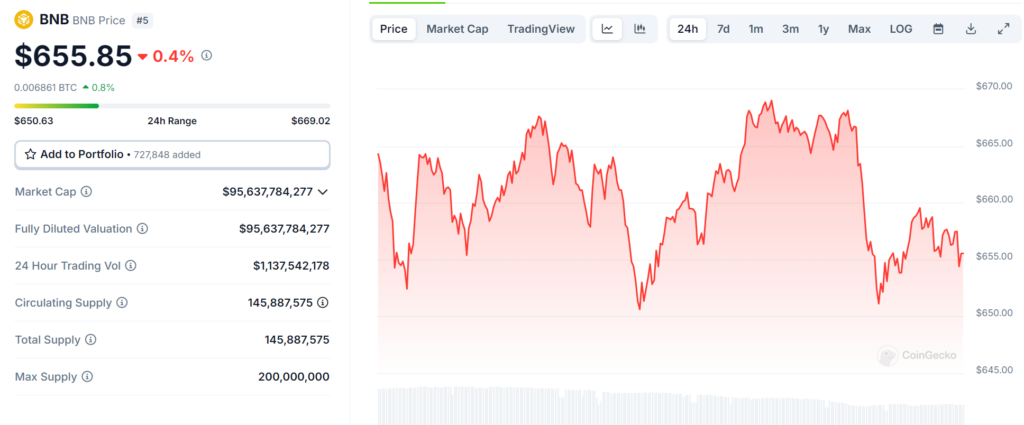

- BNB trades at $655.85 with a minor 0.4 percent decrease in value.

- Market cap stands at $95.64 billion, supported by a circulating supply of 145.89 million.

- Trading volume exceeds $1.13 billion in the past 24 hours.

BNB, the native cryptocurrency of the Binance ecosystem, has shown resilience with only a slight dip in value, trading at $655.85 as of the latest session. This marks a small decline, aligning with broader market corrections observed in recent days. Despite these minor fluctuations, BNB remains a cornerstone of Binance’s expansive blockchain platform and services.

According to CoinGecko, the cryptocurrency’s market cap of $95.64 billion highlights its strong position among leading digital assets. BNB’s circulating supply stands at 145.89 million, with a total supply of 200 million tokens. The past 24 hours have seen a trading volume of $1.13 billion, underscoring active investor participation. Price movements over the same period ranged between $650.63 and $669.02, reflecting a period of steady consolidation.

Ecosystem Growth Drives Market Resilience

BNB’s consistent performance is tied to the growth of the Binance ecosystem, which includes a decentralized exchange, token launchpads, and blockchain-based applications. The utility of BNB across these platforms drives its adoption and maintains its relevance in the competitive crypto space.

The Binance Smart Chain (BSC), a key driver for BNB, continues to attract developers and users due to its low transaction fees and high throughput. The integration of decentralized finance protocols and gaming applications has further strengthened BSC’s ecosystem. Additionally, BNB’s role in transaction fee discounts on Binance’s centralized exchange remains a strong value proposition for traders.

External factors such as regulatory developments and market sentiment have also influenced BNB’s price trajectory. While regulatory scrutiny around centralized exchanges has created temporary uncertainties, Binance’s global expansion and partnerships indicate a forward-looking strategy.

Short-Term Trends and Long-Term Potential

Technical analysis suggests that BNB may find strong support at the $650 level, while resistance near $670 could determine its immediate upward movement. Market watchers believe that breaking through this resistance could pave the way for further gains, particularly if broader market conditions stabilize.

Long-term, BNB’s potential is tied to the sustained growth of Binance’s ecosystem. As blockchain applications diversify and more use cases emerge, BNB’s utility and adoption are expected to increase. The integration of new technologies and focus on compliance could bolster its standing as a key player in the cryptocurrency market.