- Grayscale has filed an S-1 with the SEC for a spot Binance Coin ETF under the ticker GBNB

- The proposed fund would offer direct BNB exposure, with staking and in-kind creation included

- BNB price remained flat near $900 as markets await regulatory clarity

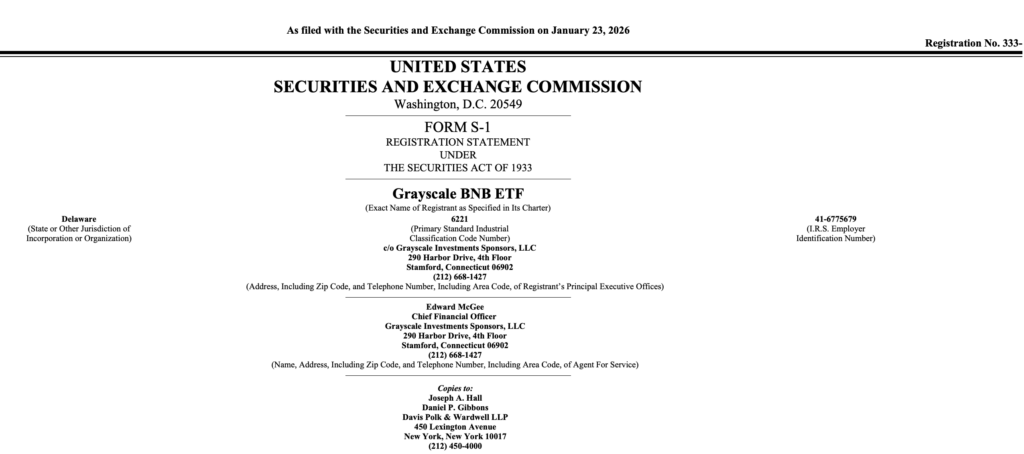

Grayscale has taken another step in its push to bring more crypto assets into traditional markets. The asset manager has filed an S-1 registration statement with the U.S. Securities and Exchange Commission for a spot Binance Coin exchange-traded fund, signaling fresh ambition to expand institutional access to BNB.

The move didn’t come out of nowhere. Earlier, Grayscale registered a BNB-focused trust in Delaware, a procedural step that often hints at bigger plans. By submitting the S-1, the firm has now formally placed its proposal into the SEC’s review process, joining a small but growing list of issuers looking to wrap Binance Coin in an ETF structure.

How Grayscale’s BNB ETF Would Work

According to the filing, the proposed fund would trade on Nasdaq under the ticker GBNB. Its goal is straightforward, give investors direct price exposure to Binance Coin without requiring them to hold or manage the token themselves. For institutions especially, that simplicity tends to matter.

Operationally, the setup looks familiar. Coinbase is listed as the prime broker, while Coinbase Custody would be responsible for holding the underlying BNB. This mirrors the infrastructure Grayscale already uses across several of its existing crypto products, suggesting the firm isn’t reinventing the wheel here.

The filing also includes in-kind creation and redemption, a feature that has become increasingly standard for spot crypto ETFs. On top of that, Grayscale has flagged plans to integrate staking into the fund’s structure. If implemented, that could allow the ETF to generate yield rather than simply track BNB’s spot price, though details on how staking rewards would be handled remain vague for now.

Fees, Timing, and What’s Still Missing

While the S-1 confirms intent, it leaves plenty unanswered. Grayscale has not disclosed the management fee, seed capital, or any expected launch timeline. That uncertainty is typical at this stage, but it does limit how much investors can assess the product’s eventual competitiveness.

As with other crypto ETFs, the approval timeline will hinge on regulatory feedback and the broader policy stance of U.S. regulators. Until there’s more clarity from the SEC, much of this remains a waiting game.

A Crowded Race for a BNB ETF

Grayscale isn’t alone in chasing a Binance Coin ETF. VanEck has already filed for a similar product and submitted amendments, potentially putting it further along in the approval queue. Elsewhere, REX Shares and Osprey Funds have taken a different approach, proposing BNB exposure under the Investment Company Act of 1940 rather than through a traditional spot ETF structure.

If approved, the BNB fund would become Grayscale’s seventh single-asset crypto ETF. It would join a lineup that already includes Bitcoin, Ethereum, XRP, Solana, Dogecoin, and Chainlink. The growing list reflects a broader strategy, turning as many major digital assets as possible into exchange-traded products that fit neatly into traditional portfolios.

Market Reaction Stays Muted

Despite the regulatory significance of the filing, Binance Coin’s price barely flinched. BNB traded near the $900 level following the news, showing little movement across short-term timeframes. That muted response suggests traders see the ETF filing as a long-term development rather than an immediate catalyst.

With approval far from guaranteed and timelines uncertain, the market appears content to wait. For now, Grayscale’s filing adds another layer to the evolving ETF landscape, but its real impact may not be felt until regulators make their next move.