- BlackRock’s iShares Ethereum Trust ETF recorded $60.3 million in daily inflows, a 94-day high.

- Ether neared $3,300, marking its highest level since August, fueling investor interest.

- Ethereum’s recent gains suggest growing strength, with analysts eyeing a potential trend reversal.

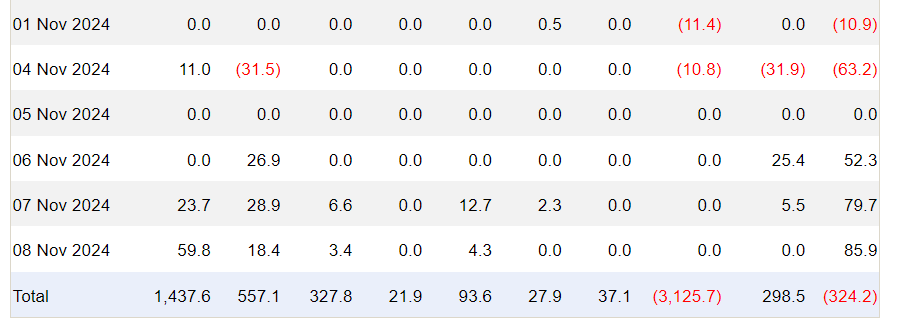

BlackRock’s iShares Ethereum Trust ETF (ETHA) witnessed its highest daily inflows in over three months, attracting $60.3 million on Nov. 8, per Farside data. This surge comes as Ether’s price hovers near $3,300, a level last approached in August. BlackRock’s spike in inflows occurred just after Donald Trump was confirmed as the next U.S. president, a factor analysts link to increased investor optimism.

Other Ethereum ETFs also experienced notable inflows on the same day: Fidelity’s Ethereum Fund added $18.4 million, VanEck’s Ethereum Fund gained $4.3 million, and Bitwise’s Ethereum ETF attracted $3.4 million. BlackRock’s spike in inflows follows a strong performance for its Bitcoin ETF, which recently hit $1 billion in daily inflows for the first time since launching in January.

Source: Farside

Ether Sees Strong Weekly Gains, Analysts Predict Trend Shift

Ether also posted its largest weekly gains since May 2024, drawing attention from traders and investors alike. The ETH/BTC pair rose by 6% in recent days, as Bitcoin’s price momentum slowed. This shift has analysts speculating about a potential trend reversal, with Into The Cryptoverse founder Benjamin Cowen suggesting that Ethereum may have bottomed against Bitcoin.

Broader Market Implications for Ether

With Ethereum showing signs of increased strength, market observers believe Ether could further solidify its position. Ethereum’s recent gains signal strong interest from investors, underscoring its potential for further growth as it briefly leads Bitcoin in performance, adding to the optimism surrounding Ether’s next milestones.