- BlackRock transferred large amounts of BTC and ETH to Coinbase Prime

- The move comes as Bitcoin and Ethereum extend sharp 2026 losses

- ETF outflows and liquidations highlight ongoing market stress

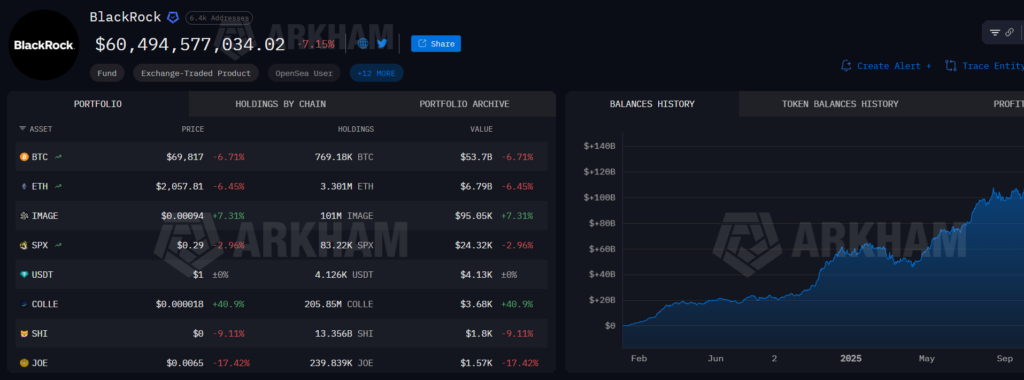

BlackRock, the world’s largest asset manager, deposited roughly 5,080 Bitcoin, worth about $358 million, along with 27,196 Ethereum valued near $57 million, into Coinbase Prime earlier today. The data, flagged by on-chain tracking, immediately caught market attention given the timing. These transfers arrived just as crypto markets were already under pressure and sentiment was fragile.

Bitcoin had broken below the $71,000 level the day before and slid further to around $69,200 at the time of reporting. That puts BTC down roughly 22% over the past seven days, a sharp move that has rattled both spot and derivatives markets.

Large Transfers Don’t Always Mean Selling

Movements of this size often trigger speculation, but they don’t automatically signal liquidations. Coinbase Prime is commonly used for custody, execution, and internal fund operations, especially by large institutions. Similar transfer patterns earlier this week were followed by sizable inflows and outflows without clear directional intent.

Still, in volatile conditions, every large move gets scrutinized. When prices are already falling, even routine operational transfers can amplify fear and short-term reactions across the market.

ETF Outflows Add to the Pressure

The timing also coincides with notable ETF activity. IBIT, BlackRock’s spot Bitcoin ETF launched in January 2024, recorded roughly $373 million in net outflows on Wednesday. Across the broader US market, spot Bitcoin ETFs saw about $545 million leave in a single day.

Those outflows reflect investors reducing exposure as prices slide, not necessarily a collapse in long-term conviction, but the speed of withdrawals has added to downside momentum. The pressure has spilled into derivatives as well.

Liquidations and Year-to-Date Losses Mount

Crypto markets saw more than $1 billion in leveraged liquidations over the past 24 hours, with long positions accounting for roughly $897 million of that total. The unwind highlights how quickly leverage builds during rebounds, and how violently it can reverse when prices break key levels.

Bitcoin is now down more than 20% year-to-date in 2026, while Ethereum has suffered even deeper losses, falling roughly 30% since January. In that context, institutional moves, even neutral ones, are being interpreted through a much more cautious lens.