- BlackRock has added its Bitcoin ETF to a $150 billion model-portfolio, potentially driving new institutional demand.

- The firm will allocate 1-2% of its portfolio models to Bitcoin, aligning with the crypto market’s recent surge.

- Despite Bitcoin’s price drop, BlackRock sees long-term growth potential and is doubling down on its crypto strategy.

In what could be a seismic shift for the digital asset space, BlackRock has officially integrated its widely popular Bitcoin ETF into its massive $150 billion model-portfolio ecosystem. With the $11 trillion asset manager bringing its iShares Bitcoin Trust (IBIT) into the fold, Bloomberg reports suggest that this move could unlock a fresh wave of demand for Bitcoin exposure.

BlackRock is set to allocate between 1% and 2% of its portfolio models to the Bitcoin ETF, a decision that could amplify investor interest. As part of a broader asset redistribution strategy, this adjustment aligns with the explosive growth in crypto markets over the past six months, fueling speculation about institutional appetite for Bitcoin.

BlackRock Expands Bitcoin ETF Reach, Demand Surge May Follow

Crypto’s trajectory since late 2024 has been nothing short of remarkable. With the U.S. government making significant strides in regulatory clarity, the market has witnessed massive valuation surges. A major driver? BlackRock’s role in pushing through Spot Bitcoin ETF approvals, a development that fundamentally altered the investment landscape.

Institutional investors now have a more structured, compliant avenue to gain Bitcoin exposure. And IBIT? It might just be one of the most successful ETF launches in financial history. Now, with its inclusion in BlackRock’s $150 billion model-portfolio strategy, the fund’s growth prospects seem even stronger.

BlackRock’s Strategy Amidst Market Volatility

“We believe Bitcoin has long-term investment merit and can potentially provide unique and additive sources of diversification to portfolios,” stated Michael Gates, BlackRock’s head portfolio manager for its Target Allocation ETF model portfolios.

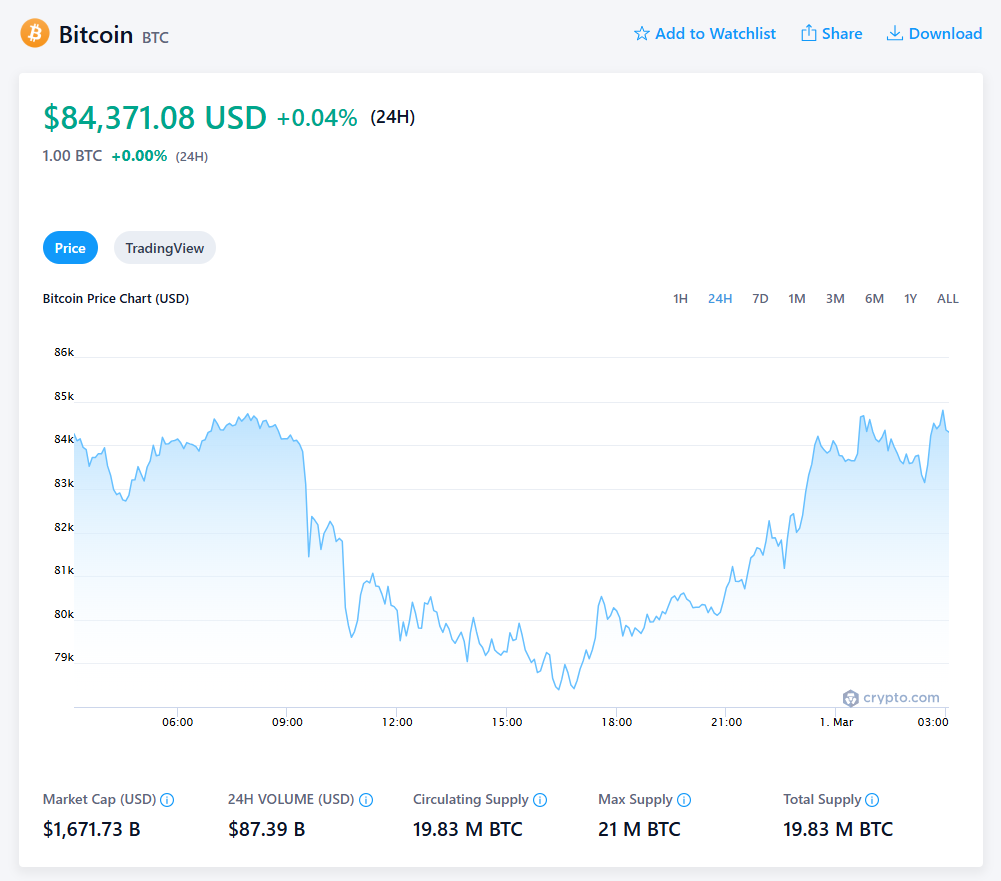

The decision comes at an interesting time. Bitcoin, after hitting an all-time high above $110,000 in early 2024, has pulled back, currently sitting below $84,000. Some skeptics see this as a short-term setback, while others interpret BlackRock’s move as a long-haul play, reinforcing the belief that Bitcoin’s potential remains robust.

Whether this integration will push Bitcoin’s demand to new heights remains to be seen. But one thing is certain—BlackRock is doubling down on its crypto play, and the financial world is taking notice.