- Bitwise predicts Ethereum will experience a revival in 2025 driven by institutional interest and growth in tokenizing real-world assets (RWAs)

- Ethereum’s dominance in the RWA market, estimated to be valued at around $100 trillion globally, could generate over $100 billion in annual fees for the network

- Regulatory clarity from the U.S. Securities and Exchange Commission (SEC) may accelerate institutional adoption of Ethereum and tokenized assets

In a recent development, Bitwise, a prominent investment strategist, has projected a significant resurgence of Ethereum by 2025. The prediction is grounded in the increasing interest from institutional investors and the growth of Real-World Assets (RWAs). This revival could potentially generate over $100 billion annually from RWA-related activities on Ethereum.

Ethereum’s Underperformance and the Promise of a Revival

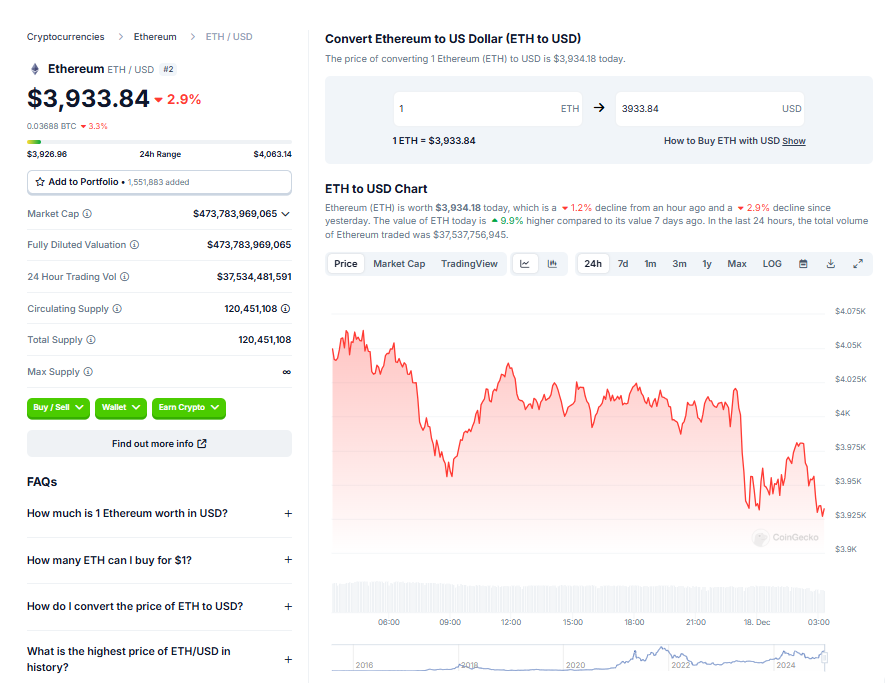

While Bitcoin and Solana have witnessed substantial gains over the past year, Ethereum’s return of 66% year-to-date seems lackluster in comparison. However, recent trends suggest a reversal of fortunes. Over the past ten days, Ethereum ETFs have attracted $2 billion in net inflows, indicating a renewed interest from both institutional and retail investors.

Ethereum and the Real-World Asset (RWA) Market

The potential resurgence of Ethereum is closely tied to the tokenization of real-world assets. This process involves digitizing traditional assets like Treasury bills, real estate, and commodities into blockchain-based tokens, leading to faster, cheaper, and more efficient trading. Major players such as BlackRock, Franklin Templeton, and UBS have already adopted blockchain technology for RWA tokenization. With the global valuation of real-world assets estimated at $100 trillion, the opportunities for Ethereum are enormous.

Ethereum’s Dominance and Regulatory Tailwinds

Ethereum’s dominance in the RWA market is attributed to its status as the most reliable and decentralized smart contract platform. With a vast network of distributed validators, Ethereum has a proven track record of supporting decentralized applications. The possibility of regulatory clarity from an increasingly pro-crypto US Securities and Exchange Commission could further boost Ethereum’s growth prospects.

Conclusion

In conclusion, the forecast for Ethereum’s revival by 2025 is rooted in the increasing institutional interest and the growth of the RWA market. With promising signs of a shift in sentiment and the potential for regulatory tailwinds, Ethereum is poised for significant growth in the coming years.