- TAO has traded in a $295–$471 range since June but is now approaching a key breakout level.

- RSI and CMF readings confirm strong momentum and buyer dominance.

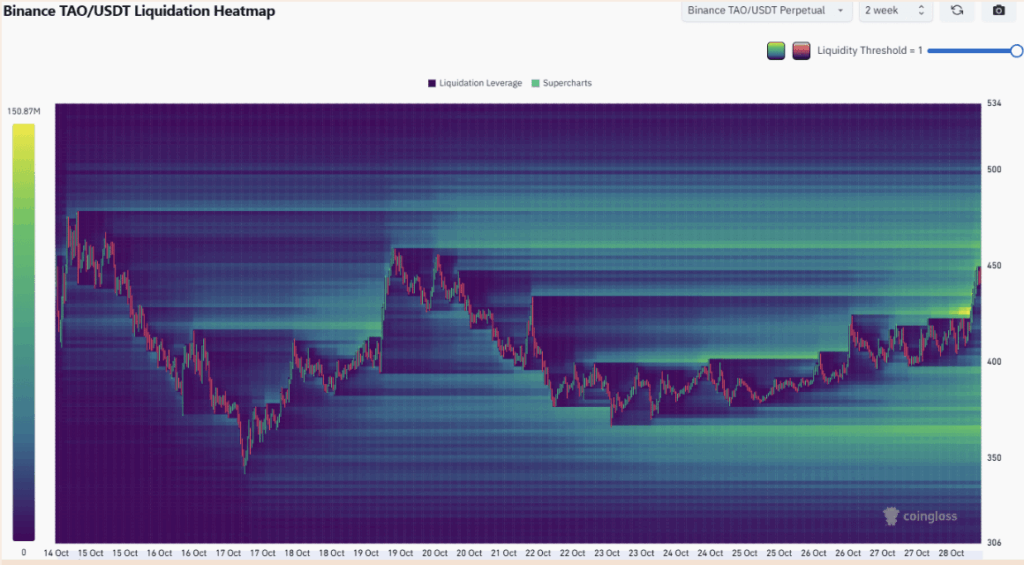

- Liquidity near $480–$500 could trigger volatility before a decisive breakout or pullback.

Bittensor’s token, TAO, has been on an absolute tear lately, climbing close to the top of its six-month range. Traders are starting to wonder — is this the last leg before a correction, or can the AI-focused coin finally break out past $500?

So far, momentum seems to favor the bulls. TAO has shown strong resilience after October’s market-wide dip, holding its range lows and bouncing hard, a sign of genuine demand building up behind the scenes.

TAO Holds the Range, Eyes Breakout

Since June, TAO has been trapped in a sideways range between $295 and $471, with a key mid-level support sitting around $383. When the market crashed on October 10, many altcoins saw massive wicks on Binance — TAO included — dropping briefly to $140 before quickly snapping back to close the session near $290. That recovery was no small feat and suggested that strong hands were waiting at the bottom.

Since then, TAO hasn’t looked back. It’s rallied over 10% in the past 24 hours with trading volume spiking nearly 40%, signaling fresh participation from both retail and institutional players. On the 1-day chart, indicators lean bullish: the RSI sits around 62, showing firm momentum, and the Chaikin Money Flow (CMF) is above +0.05, confirming steady buy pressure.

From a technical perspective, the next logical targets lie at the mid-range resistance ($383) and the range high near $470–$480. If TAO can close convincingly above that zone, the chart opens up room for a leg higher — maybe even toward $500 or beyond.

Liquidity Clusters Point to a Push Higher

Looking at CoinGlass’s liquidation heatmap, there’s a noticeable cluster of liquidations and open interest sitting in the $450–$480 range. This area acts as a magnet for price, meaning TAO could very likely wick above those levels to trigger stop orders before consolidating.

Below that, the next dense liquidity pocket appears around $395, which should serve as a strong support if any pullback occurs. The setup suggests a brief push beyond the range highs is the most probable short-term scenario, though bulls will still need heavy volume to sustain a true breakout.

TAO’s Strength vs. Bitcoin Hints at More Upside

TAO’s strength becomes even clearer when compared to Bitcoin. After the broader market correction, most altcoins took a hit, but TAO/BTC actually broke higher, showing a bullish structure break on October 12.

While Bitcoin slid back to the $108k area, TAO traders were buying aggressively, pushing the pair upward. The next major resistance on the TAO/BTC chart is still far away, meaning there’s room for TAO to continue outperforming Bitcoin — a rare sign of confidence in a market that’s been shaky lately.

Final Thoughts: Rally Still Has Legs, But Watch $500 Closely

All signs point toward continued momentum — strong spot volume, bullish RSI, and clear liquidity targets above the current range. Still, the $470–$500 zone is where things could get tricky. That area has repeatedly rejected price since summer, and it’ll take significant buying volume to flip it into new support.

If TAO breaks out cleanly, it could enter a new price discovery phase and potentially aim for $550+. But if rejection hits again, expect a retest of $395–$400 before any second attempt. Either way, the token’s structure looks solid, and bulls are firmly in control — for now.