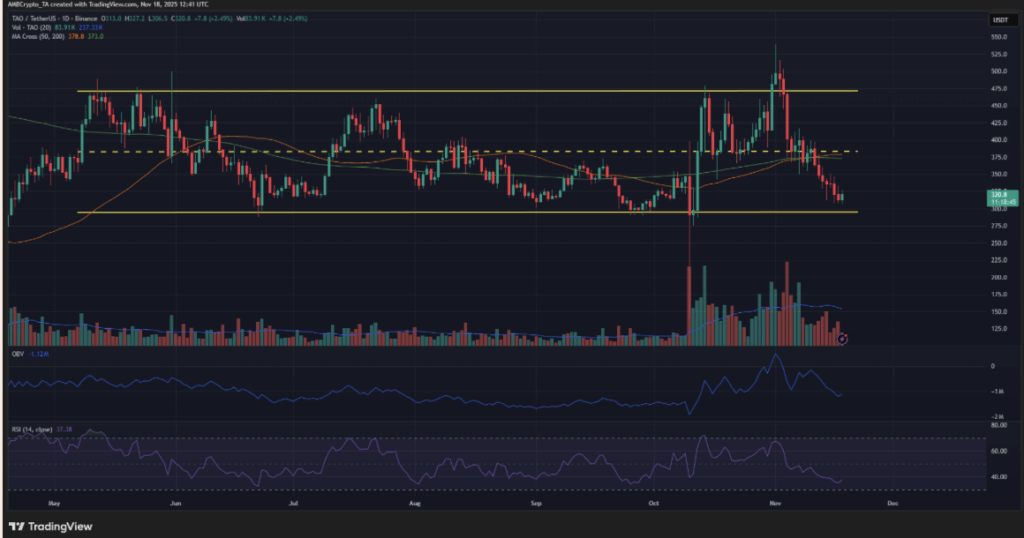

- TAO drops near 60% from ATH but lands on its multi-month support at $300.

- Liquidity clusters show a likely bounce zone at $291–$302 with invalidation at $275.

- Upside targets remain $383 and $471 if bulls defend the range lows.

Bittensor has been bleeding out pretty aggressively, with TAO falling another 14.8% this week — slightly worse than Bitcoin’s own drop. The volatility around this project has been wild; since June, TAO has been bouncing inside a wide range between $294 and $470. Early November even saw a breakout toward $539… only for the price to collapse 41% in just three weeks. The drawdown from the all-time high has now pushed close to 60%, again, putting TAO right back at the same multi-month support area around $300. It’s a psychological level, a technical level, and honestly one of the only places bulls have consistently defended all year.

Developer Activity Has Slowed — A Red Flag for Long-Term Investors

Another thing weighing on sentiment is developer activity. Bittensor’s core dev count dropped sharply in July and August and hasn’t picked up since. For long-term holders, that’s uncomfortable — price can always recover, but shrinking development momentum is harder to explain away. Combine that with the latest crash, and it’s not surprising many investors are nervous. Still, short-term traders aren’t looking at the fundamentals right now; they’re watching the chart.

TAO Sits Directly in a Demand Zone Traders Have Protected Since June

From a technical standpoint, TAO is now sitting in what some would call a “low-risk, high-reward” region. The $300 zone has been defended for months, and price has slid back into it while trading volume keeps falling. Declining volume on a retrace usually means sellers are pushing, yes, but without conviction. It sets the stage for bulls and bears to find a temporary balance — and often that’s where reversals begin. A few days of sideways action here could be all it takes for buyers to attempt a new leg upward. Of course, demand actually has to show up, and a Bitcoin bounce would probably help spark that shift across altcoins.

Liquidation Heatmap Shows Where the Bounce Could Trigger

CoinGlass data shows a thick liquidity pocket between $291 and $302 — basically the exact range TAO is testing right now. Importantly, there’s barely any liquidity building up beneath the range. That signals something simple: the price is less likely to violently wick far below this support before a bounce attempt. For traders, that defines clear invalidation. A bullish swing setup becomes invalid around $275. The real demand zone sits between $288 and $302, and if TAO holds that region, the logical upside targets are $383 (mid-range resistance) and $471 (range high). Whether the bounce materializes depends entirely on buyers stepping in — but TAO has held this zone before, and the market is watching to see if it can do it again.