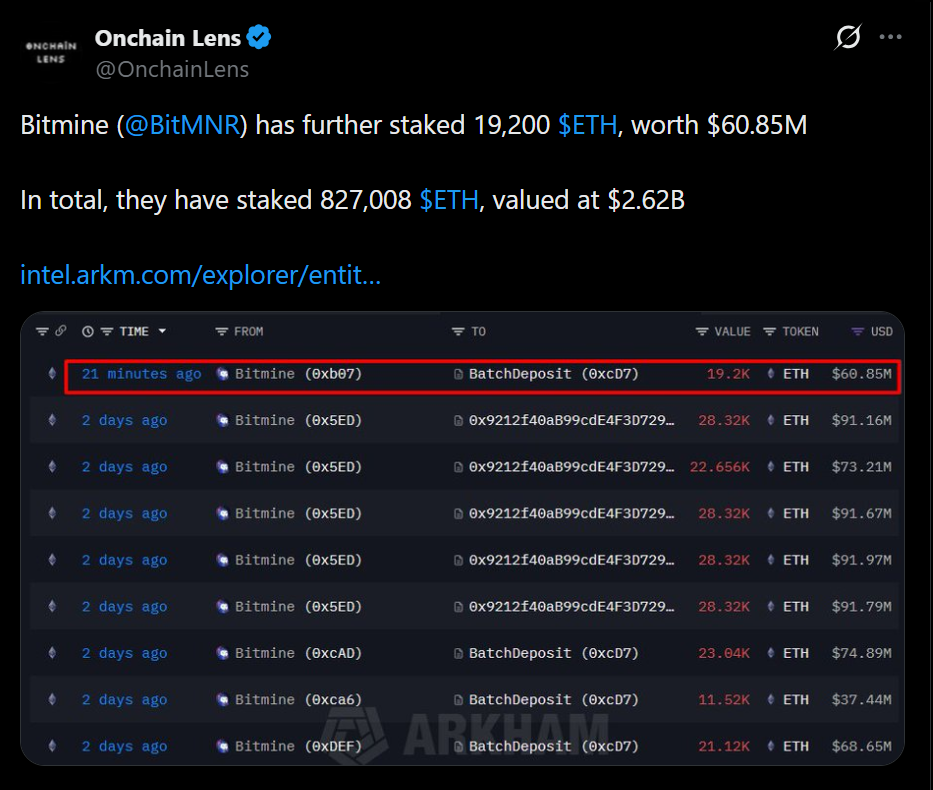

- Bitmine staked an additional 19,200 ETH, bringing total staked holdings above 827,000 ETH.

- The firm is launching its own U.S.-based validator network to internalize staking operations.

- Ethereum is being positioned as long-term, yield-generating infrastructure on the balance sheet.

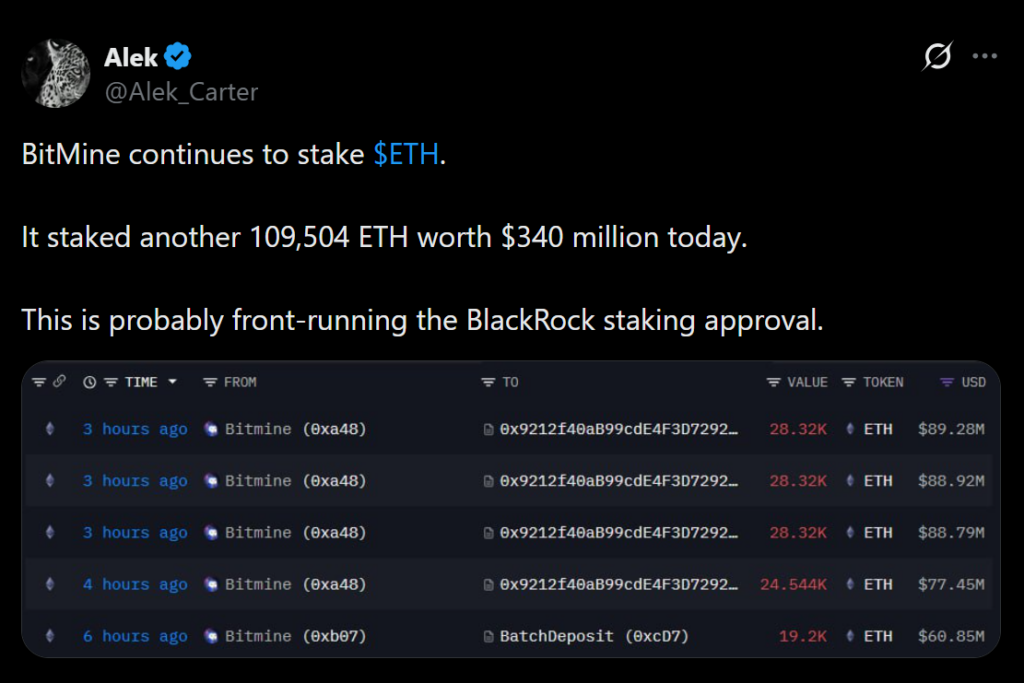

Bitmine is quietly turning Ethereum into a balance-sheet strategy, not a trade. The Nasdaq-listed firm staked an additional 19,200 ETH worth more than $60 million, pushing its total staked holdings past 827,000 ETH, now valued at over $2.5 billion. The pace matters. In just four days, Bitmine appears to have moved roughly 167,800 ETH into staking, signaling urgency, not experimentation.

Ethereum Is Being Treated Like Infrastructure

This isn’t passive holding. Bitmine is actively preparing to launch its own Made-in-America Validator Network, known as MAVAN, designed to internalize staking operations rather than outsource them indefinitely. Pilot programs with institutional providers are already underway, suggesting this is about control, reliability, and scale. Staking ETH directly turns Ethereum from a volatile asset into productive infrastructure on the balance sheet.

The Balance Sheet Tells the Real Story

As of January 4, Bitmine held more than 4 million ETH alongside smaller Bitcoin positions and roughly $915 million in cash, all wrapped inside a $14.2 billion balance sheet focused on long-term crypto accumulation. That composition isn’t accidental. It reflects a conviction that Ethereum’s role as settlement and yield-bearing infrastructure justifies deep, patient exposure rather than tactical positioning.

Why This Matters for Ethereum

Large-scale staking like this removes liquid supply while reinforcing network security. When institutions choose to lock capital instead of keeping it liquid, they’re signaling comfort with price, protocol, and policy risk. That combination is rare. Bitmine isn’t chasing short-term upside. It’s embedding Ethereum into its core financial architecture, yield and all.

What This Signals Going Forward

This move fits a broader pattern. Ethereum is increasingly being treated less like a speculative token and more like programmable financial infrastructure. Firms willing to stake hundreds of thousands of ETH aren’t waiting for hype cycles. They’re positioning for durability. And that kind of positioning tends to matter long after the headlines fade.