- BitMine added another 112 million dollars in ETH, continuing its push to own five percent of the supply.

- Tom Lee says Ethereum has bottomed and expects a seven to nine thousand dollar range by January.

- A hawkish Fed cut pressured crypto, but improving ISM data may signal a bullish setup for 2026.

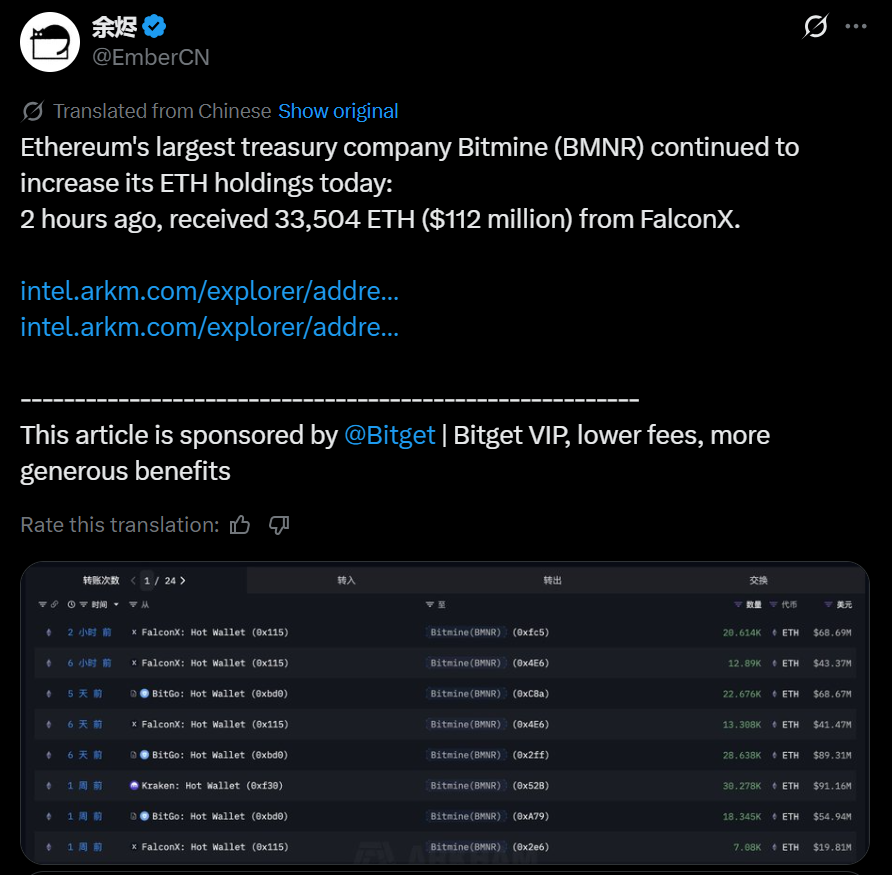

BitMine, the Ethereum-focused treasury firm led by Fundstrat co-founder Tom Lee, added more than one hundred million dollars worth of ETH this week. On-chain data from Arkham, relayed by EmberCN, shows the company acquiring 33,504 ether through FalconX, though the firm has not yet formally confirmed the purchase. The addition continues a steady pattern of accumulation across the entire year as BitMine moves toward its goal of controlling five percent of Ethereum’s total supply.

Inside BitMine’s Growing Balance Sheet and Strategy

According to its most recent 8-K filing, BitMine now holds 3.86 million ETH alongside modest BTC reserves, a billion dollars in cash, and a moonshot equity position tied to Worldcoin’s WLD ecosystem. The firm’s leadership has remained vocal about Ethereum’s long-term role in global finance and continues to scale its holdings aggressively. Tom Lee reiterated that the amount of ETH they are buying has doubled compared to two weeks ago, reinforcing his claim that Ethereum has already bottomed near the 2,500 dollar area.

Fed’s Hawkish Cut Pressures Crypto, but Tom Lee Sees a 2026 Reversal

The Federal Reserve delivered a twenty-five basis point rate cut on Wednesday, but Chair Jerome Powell signaled uncertainty around further easing. This hawkish tone pushed bitcoin and ether lower even as equities rallied, reflecting lingering caution across digital assets. Tom Lee, however, predicted crypto prices will reverse higher in early 2026 regardless of the Fed’s stance this month. He pointed to two key catalysts: the likelihood of a new and more dovish Fed Chair next year, and the ISM Index climbing back above fifty, which historically aligns with major crypto expansions.

Ethereum Market Outlook Strengthens Despite Short-Term Volatility

Ether currently trades near 3,186 dollars after a four-percent daily decline, while bitcoin sits close to 90,000 dollars. Despite short-term weakness tied to macro uncertainty, BitMine’s persistent accumulation and Tom Lee’s seven-to-nine thousand dollar ETH target for January reflect growing confidence among institutional buyers. With liquidity conditions evolving and Treasury signals shifting, Ethereum may be positioning itself for a broader upswing heading into 2026.