- Bitcoin surged past $100,000 after softer US inflation boosted demand for risk assets.

- Inflation relief and hopes for Fed rate cuts lifted stocks and crypto markets.

- Investors brace for volatility as Trump’s inauguration nears, spurring hedging activity.

Bitcoin has once again crossed the $100,000 threshold, with a softer-than-expected US inflation report fueling renewed interest in riskier assets, from tech stocks to cryptocurrencies.

Over the past month, Bitcoin has been bouncing between $90,000 and $100,000, carving out a relatively steady trading range. On Wednesday, the cryptocurrency jumped 3.9% to hit $100,222. This marks the first time Bitcoin has reached six figures since Jan. 7, just shy of its all-time high of $108,000 set on Dec. 17.

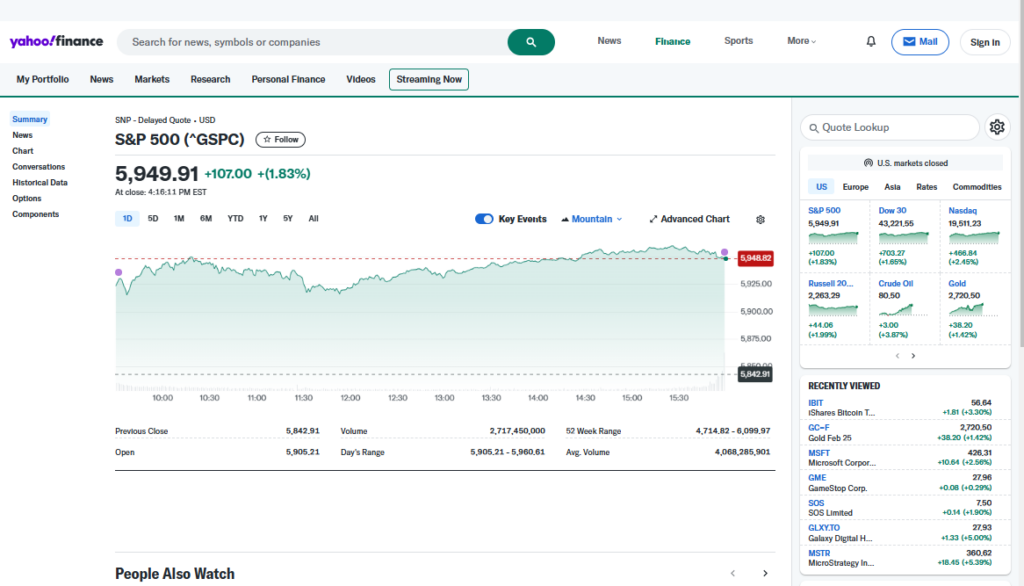

Interestingly, Bitcoin’s price movements have been increasingly tied to US tech stocks. A correlation gauge between the digital asset and the Nasdaq 100 index hit its highest level in two years. Currently, the 30-day correlation coefficient stands at 0.70. To put that into perspective, a coefficient of 1 means the two move in perfect sync, while -1 indicates they move in completely opposite directions.

Inflation Relief Fuels Rally

The latest inflation report offered some relief to jittery markets. Year-over-year inflation clocked in at 2.9%, aligning with expectations, while month-over-month core inflation came in slightly softer at 0.2%. Analysts had feared a higher print might constrain the Federal Reserve’s room to cut interest rates further.

The report gave a noticeable boost to equities and crypto alike. The S&P 500 and Nasdaq 100 both climbed over 1% after the data dropped, signaling investor optimism about a less hawkish Fed.

Trump Inauguration Looms Large

Meanwhile, the markets are also bracing for potential policy fireworks as President-elect Donald Trump’s inauguration approaches on Jan. 20. Speculators are weighing the risks of inflationary tariffs and tough immigration policies against Trump’s ambitious goal of making the US a leader in the crypto space.

“The sensitivity to interest rates over the past month underscores the significance of Wednesday’s CPI release,” analysts Vetle Lunde and David Zimmerman of K33 Research noted in a report. They added that Trump’s policy momentum could shape market sentiment further in the days leading up to the inauguration.

Volatility on the Horizon

In the options market, hedging activity is heating up. Investors appear to be gearing up for turbulence, with bearish bets on the rise. This suggests traders are protecting themselves against potential downsides as the inauguration nears.

“There’s a noticeable uptick in hedging against risks tied to upcoming political events,” said Sean Dawson, Head of Research at trading platform Derive.xyz.

Bitcoin’s recent rally underscores its growing ties to macroeconomic forces and investor sentiment. As inflation data and political developments unfold, the cryptocurrency market appears poised for more twists and turns.