- Bitcoin is trading more like a tech stock than a hedge, with volatility even lower than Tesla in some years.

- Standard Chartered’s “Mag 7B” index shows BTC would’ve outperformed the traditional Magnificent 7 since 2017.

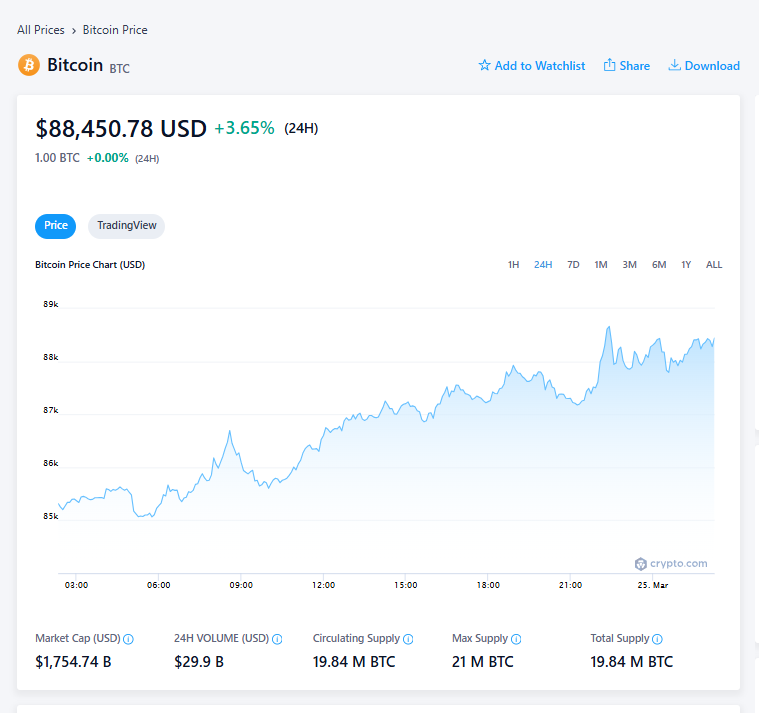

- Futures open interest is rising again as traders shake off macro jitters, with BTC holding strong near $88K.

So here’s the deal: Bitcoin’s been moving a lot like tech stocks lately. Standard Chartered analyst Geoff Kendrick says if you’re still thinking of BTC as some wild hedge against market chaos, you might wanna rethink that. These days? It’s acting more like a high-flying tech name—think Apple, Nvidia, that whole crew.

To test the idea, Kendrick made up a “Mag 7B” index. It’s basically the famous Magnificent 7—Apple, Microsoft, Meta, Amazon, Alphabet, Nvidia, and Tesla—but he swapped out Tesla and dropped Bitcoin in instead. If you’d run with that idea since 2017? You’d actually be up 5% more than the OG lineup. Not bad.

Right now, Bitcoin’s market cap sits around $1.7 trillion, which technically makes it the sixth biggest “stock” in that group. And yeah, BTC just pulled back a bit after flirting with $88K, but it’s still holding strong with a 3.7% gain in the past day, per CoinGecko.

Futures Are Heating Up Again

Traders seem to be shaking off the jitters. Open interest in Bitcoin futures jumped over 10% in the past 24 hours—$57 billion in outstanding contracts, up from just $45B earlier this month when Trump’s tariff drama spooked the markets. So yeah, folks are piling back in.

Kendrick’s data also shows BTC is acting like the big names. When he looked at price dips and how much volume was traded, Bitcoin came off looking a lot like Nvidia. Tesla? That’s more comparable to ETH these days. Wild.

And here’s another nugget—volatility. Turns out, this “Mag 7B” with BTC is actually less volatile than the regular Mag 7 in every single year since 2017. That’s surprising, right? Kendrick says average annual volatility was about 2% lower with BTC in the mix. Go figure.

Wait… Didn’t BTC Just Ditch Its Correlations?

Sorta. In late 2024, Bitcoin kinda did its own thing. NYDIG dropped a report that said BTC outperformed every major asset class in Q4—stocks, gold, even the dollar. That was right after Trump won the election in November, so maybe that had something to do with the surge.

But Kendrick’s latest point is clear: when the dust settles, Bitcoin still moves like tech. So if you’re trying to predict what it’s gonna do next, maybe stop thinking of it as “digital gold” and start thinking of it like Microsoft with a little more chaos.