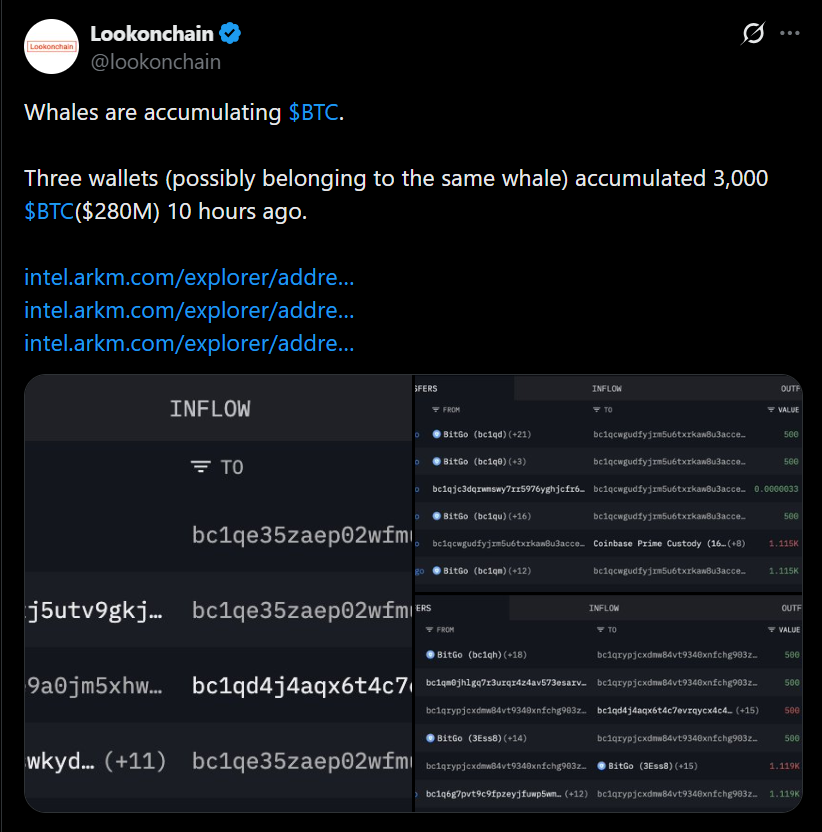

- Three wallets accumulated roughly $280 million worth of Bitcoin during a short pullback.

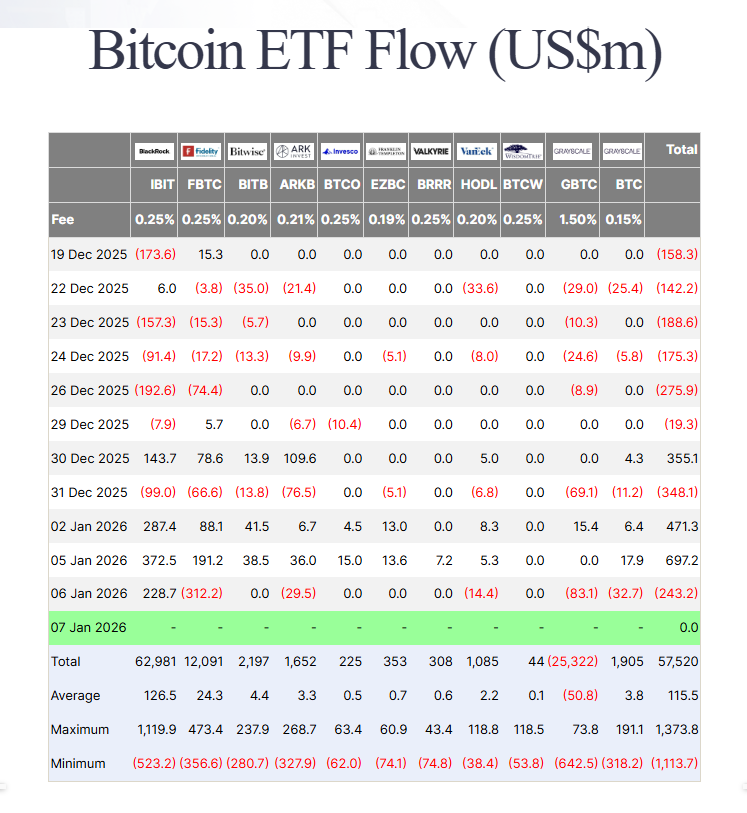

- Spot Bitcoin ETFs saw strong early inflows, with BlackRock continuing to add exposure.

- The current dip appears to be consolidation, not a breakdown, as demand remains active.

Large buyers are stepping back into Bitcoin as three wallets, believed to be linked to a single entity, accumulated roughly 3,000 BTC worth about $280 million over the past 15 hours. The purchases were flagged by Lookonchain and come as Bitcoin digests its strong start to the year. After reclaiming levels above $94,000 on Monday, BTC has eased back toward the $92,000 area, a move that so far looks more like consolidation than rejection.

Big Buyers Are Moving Quietly

What stands out isn’t just the size of the purchase, but the timing. Accumulation during a pullback often signals confidence rather than urgency. These wallets didn’t chase the local highs above $94,000. Instead, they stepped in as momentum cooled, suggesting a longer-term view rather than short-term speculation. In thin liquidity environments, that kind of behavior usually belongs to entities with patience and scale.

ETF Flows Still Support the Bigger Trend

Bitcoin’s early-January rally was backed by strong institutional participation. US spot Bitcoin ETFs pulled in roughly $1.2 billion in net inflows across the first two trading days of the year, according to Farside Investors. While momentum softened on Tuesday, resulting in about $243 million in net outflows across the group, BlackRock’s IBIT stood out by adding $229 million. That divergence matters. When one fund continues absorbing supply while others pause, it often signals selective conviction rather than broad risk-off behavior.

Consolidation After Strength Isn’t a Warning

Bitcoin cooling off near $92,000 after a sharp push higher doesn’t undermine the broader setup. Price is still holding well above key psychological levels, and accumulation during pullbacks reinforces the idea that demand hasn’t disappeared — it’s just more deliberate. If ETF inflows stabilize again and spot demand continues to surface on dips, Bitcoin’s recent highs may prove to be a base rather than a ceiling.