- Retail investors are capitulating as short-term holders lock in losses below cost

- Whales continue to accumulate, pushing large-wallet supply to a four-month high

- Ongoing loss realization is keeping Bitcoin range-bound between key support and resistance zones

Bitcoin’s on-chain data is starting to tell a very uneven story. As volatility picked up, retail behavior shifted fast, with panic selling accelerating as drawdown fears crept back in. Short-term holders began exiting positions below their cost basis, locking in losses and reflecting a clear slide in sentiment. During this stretch, the supply held by short-term holders in loss expanded sharply, a classic sign of capitulation rather than calm repositioning.

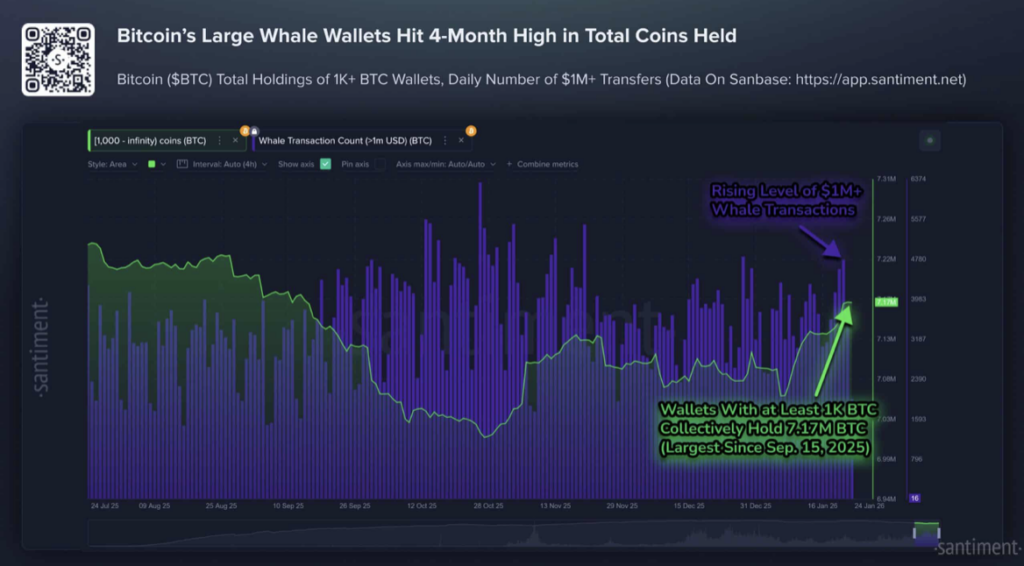

While smaller players rushed for the exit, larger wallets quietly moved the other way. Whales, defined as holders with at least 1,000 BTC, have been accumulating steadily for weeks. Combined balances across these wallets increased by roughly 104,340 BTC, a 1.5% rise, pushing total whale-held supply to about 7.17 million BTC. That figure now sits at a four-month high, which is hard to ignore.

At the same time, daily transfers exceeding $1 million climbed to a two-month peak. That activity points to active accumulation rather than distribution, suggesting smart money is absorbing supply as retail selling begins to thin out. It’s the kind of dynamic that tends to appear late in corrective phases, once weaker hands are mostly flushed.

Short-Term Holders Lock in Losses as Pressure Lingers

Bitcoin’s Net Realized Profit and Loss data shows that the roughly $4.5 billion in realized losses didn’t hit all at once. Instead, they built up through repeated downside spikes, indicating prolonged stress rather than a single panic event. As price stalled near recent highs, distribution intensified, and short-term holders continued selling into drawdowns.

Macro uncertainty played a role here, alongside ETF outflows and fading upside momentum. These factors combined to keep pressure on recent buyers, who were already positioned poorly after failed breakouts above $90,000. Historically, similar NRPL flushes appeared in 2018, 2020, and late 2022. The last comparable case saw Bitcoin hovering near $28,000 before entering a long basing phase, not an immediate rebound.

Looking at the 30-day realized net profit and loss in BTC terms adds another layer of clarity. This metric slipped below zero in late 2025, marking the first sustained negative reading since September 2023. Importantly, the selling appears gradual, not abrupt, which points to pressure-driven exits rather than full-blown panic. Most of these losses are coming from short-term holders, as recent entrants give up after momentum failed to follow through.

Range-Bound Price Action Takes Shape

This steady realization of losses has shaped Bitcoin’s current structure. Price remains stuck inside a wide consolidation range, with selling below cost adding supply during every rebound. That behavior has repeatedly capped upside attempts near the $95,000 to $100,000 resistance zone, making breakouts difficult to sustain.

On the downside, pressure has eased around the $85,000 to $88,000 area. Buyers have consistently stepped in there, absorbing supply and preventing deeper pullbacks. The result is a choppy, sideways market rather than a clean trend in either direction. For a meaningful breakout to occur, realized losses likely need to decline while spot demand strengthens.

If loss realization ticks up again, though, support could weaken quickly and open the door to another retest of lower levels. For now, Bitcoin sits in a waiting phase, shaped by exhaustion on one side and quiet accumulation on the other.