- Bitcoin often dips during sudden oil price spikes, but historically rebounds by 16–24% within a week.

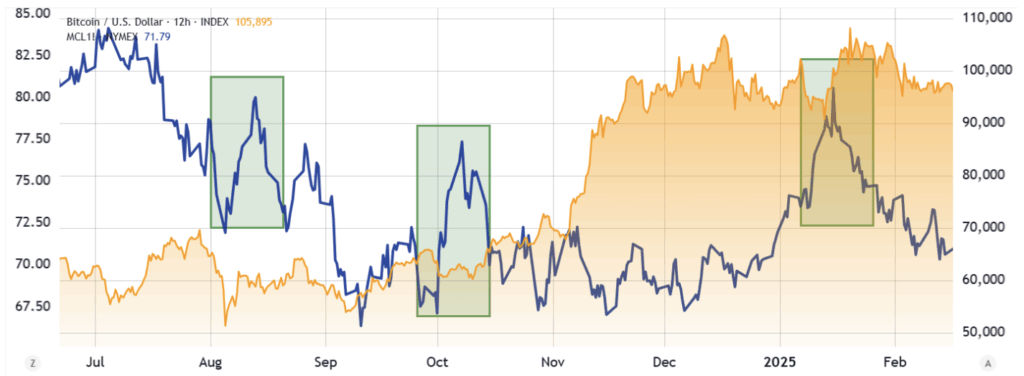

- Past examples from Jan, Oct, and Aug 2024 show BTC rallying after geopolitical oil disruptions.

- With oil again hitting multi-month highs, BTC’s current drop may set up a bounce to $119K by late June.

Bitcoin’s been catching some heat lately, especially as geopolitical jitters rattle global markets and push oil prices higher. At face value, BTC isn’t usually the go-to safe haven in these kinds of scenarios. Investors tend to duck for cover in things like cash or government bonds. But here’s the twist—some traders see these oil-driven drops as golden buy-the-dip moments, and history might just back that up.

This past week, for example, crude oil jumped nearly 19%, hitting $77 a barrel between Wednesday and Friday. At the same time, Bitcoin slumped from about $110K to just under $103K. On the 15-minute chart, it’s a clear inverse move. That lines up with the idea that Bitcoin behaves more like a risky growth asset than a defensive one. But zoom out, and the story changes a bit.

Past Oil Spikes Led to Sharp BTC Rebounds

If you look at bigger timeframes—like over 10 days—the correlation between oil and BTC gets weirdly inconsistent. But what has been consistent is what happens after big oil spikes. Three times over the past year, Bitcoin took a hit when oil jumped, then bounced hard not long after. We’re talking rebounds of 16% to 24%, usually within a week.

Take mid-January this year: oil jumped to over $80, BTC sank to $89K, and then roared back to $109K just days later. Same kind of setup happened in October 2024 after tensions flared in the Middle East. Bitcoin fell, shook off the panic, then popped 16% in eight days. And in August, it was Libya’s oil disruption that shook BTC temporarily—before it rallied back from $56K to $65K.

Could This Be Another Entry Opportunity?

Right now, BTC’s trading around $102,800, which—if these past patterns hold—could be another low before a snapback. Oil’s at a five-month high again, and while no one can guarantee what’s next, the data does hint that a move back up to $119K isn’t out of the question. Timing’s tight though—if it plays out like previous cases, that kind of move could happen by June 21.

So yeah, Bitcoin might not be the safe-haven asset during times of global chaos… but it could be the rebound play right after. Sometimes, the market just needs a little fear before it finds its footing.