- Bitcoin surged past $104,000, driven by optimism around Trump’s pro-crypto policies and strong market sentiment.

- Analysts predict BTC could hit $130,000 by the end of January, fueled by FOMO and favorable regulatory outlooks.

- Altcoins like Ethereum, Solana, and Dogecoin also saw gains, reflecting broader crypto market momentum.

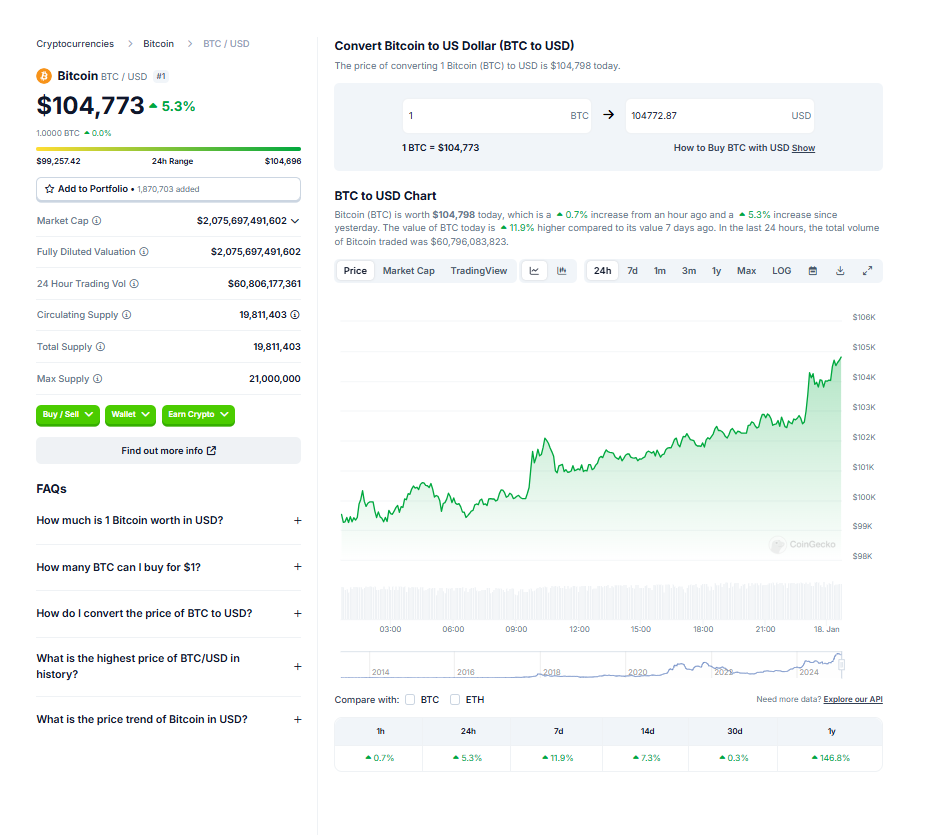

Bitcoin ($BTC) has surged past the $104,000 mark, fueled by strong market sentiment and speculation surrounding the pro-crypto stance of the incoming US administration. The cryptocurrency briefly hit $104,279 and is currently trading at $103,791, marking a 5.6% gain for the day, according to Coingecko.

Drivers Behind the Surge

Analysts point to heightened expectations regarding President-elect Donald Trump’s pro-crypto policies, bolstered by his public endorsements of Bitcoin’s transformative potential. Seamus Rocca, CEO of Xapo Bank, emphasized, “Trump’s acknowledgment of Bitcoin as a strategic asset and his calls for American leadership in crypto have injected renewed optimism into the market.”

Additionally, broader market sentiment remains strong, with Bitcoin’s price aligning with “Greed” levels on the Crypto Fear and Greed Index. Alex Kuptsikevich, Chief Market Analyst at FxPro, noted, “BTC has reclaimed its December highs and is poised to test the $108,000 to $110,000 range, with FOMO potentially pushing it to $130,000 by the end of January.”

Altcoin Momentum

The bullish trend isn’t limited to Bitcoin. Ethereum ($ETH) rose to $3,418, while altcoins like Solana ($SOL), Dogecoin ($DOGE), and Shiba Inu ($SHIB) saw gains of 4%, 8%, and 8%, respectively. Litecoin ($LTC) outperformed with a 12% spike.

Outlook for Bitcoin and the Market

Bitcoin’s current trajectory suggests further growth, particularly if equities maintain their risk appetite. Kuptsikevich stated, “If the momentum holds, we could see BTC testing new heights above $130,000 soon, especially with regulatory clarity on the horizon.”

The next 100 days under Trump’s administration will be critical, with market participants eagerly awaiting progress on crypto regulation and its potential impact on Bitcoin’s role in the financial system.