- Bitcoin volatility has triggered rising fear among retail investors.

- Santiment data shows bearish narratives dominating social platforms.

- Historically, extreme retail panic often precedes market stabilization or rebounds.

Bitcoin has been moving with unusual violence lately, sliding back toward the $86,000 zone after sharp intraday swings. The speed of the moves has rattled retail investors, many of whom are questioning whether BTC is heading down another painful rabbit hole. Panic, uncertainty, and second-guessing are spreading fast. Still, history suggests these moments of fear often mark turning points rather than breakdowns.

Retail Fear Is Spiking Across Social Platforms

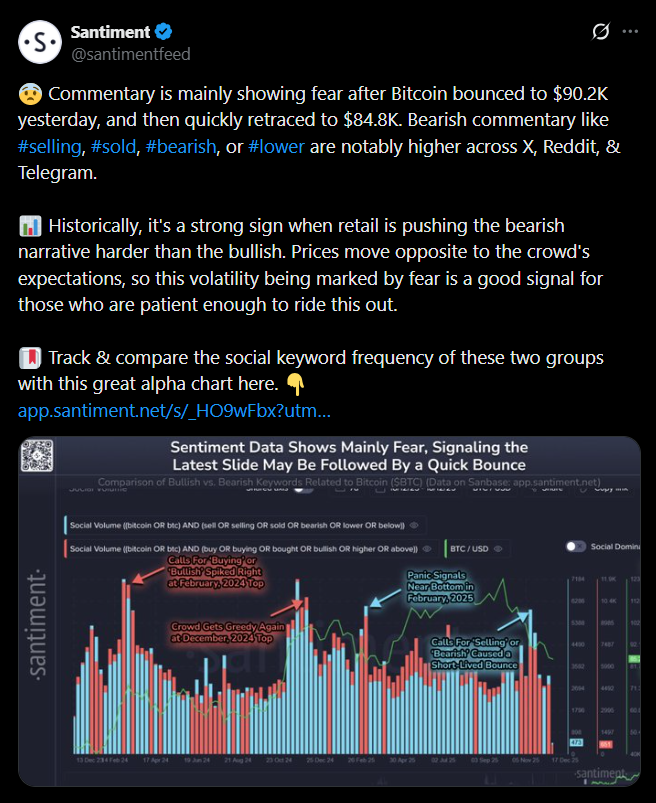

According to a recent Santiment report, market sentiment has slipped into a visibly anxious state. Bitcoin’s failure to hold above $90,000, followed by a quick retrace toward the mid-$80,000 range, has amplified bearish chatter online. Words like “selling,” “sold,” “bearish,” and “lower” are trending heavily across X, Reddit, and Telegram, reflecting a crowd leaning toward worst-case scenarios.

This type of emotional reaction isn’t new. Retail investors tend to react late, especially during volatile periods, often extrapolating short-term price action into long-term fear. Santiment notes that this clustering of bearish commentary is one of the clearest signs that sentiment, not fundamentals, is driving behavior right now.

Why Panic Can Be a Bullish Signal

Markets have a long track record of moving against the majority’s expectations. Santiment points out that when bearish narratives dominate social discussion, price often does the opposite of what most traders anticipate. In simple terms, when fear peaks, selling pressure tends to exhaust itself.

Historically, periods where retail sentiment turns sharply negative have preceded stabilization or even strong rebounds. This doesn’t mean price instantly reverses, but it does suggest downside momentum may be weaker than it appears on the surface.

Volatility Tests Patience, Not Conviction

Bitcoin’s recent swings are uncomfortable, especially for short-term holders. Yet Santiment argues that fear-driven volatility often rewards those willing to stay patient rather than react emotionally. When panic dominates the conversation, it usually means much of the selling has already happened.

While uncertainty remains high, the broader takeaway is that fear itself can become fuel for the next move higher. For Bitcoin, retail panic may be less a warning sign and more a signal that sentiment has reached an extreme.