- Bitcoin price analysis sees a potential move toward $94,000 as the launch of options on BlackRock’s Bitcoin ETF approaches

- The impending release of Nvidia’s corporate earnings on November 20 is seen as a potential catalyst for market volatility

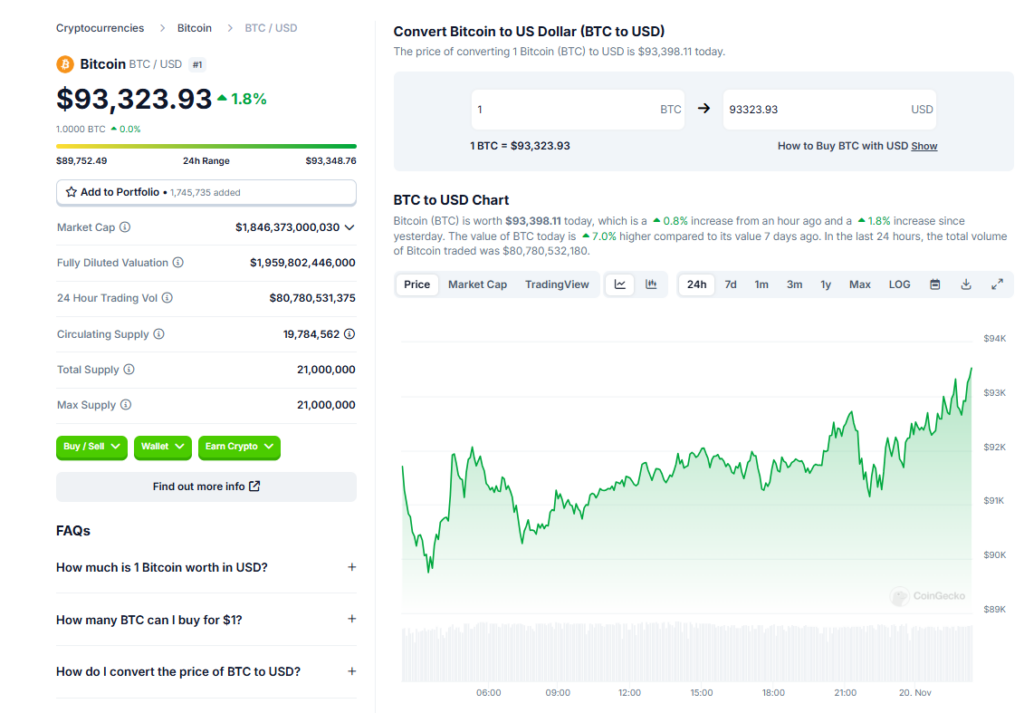

- Bitcoin’s price action has been fluctuating near its all-time highs, rebounding after a brief dip and consolidating within a narrow range

The bitcoin price saw volatile swings near its all-time highs on November 19th as geopolitical tensions sparked volatility across risk assets. However, the bulls quickly regained control and pushed the price back toward $94,000, with the launch of options on BlackRock’s bitcoin ETF helping keep the price rangebound.

Bitcoin Price Action and Liquidity Dynamics

Data from Cointelegraph Markets Pro and TradingView showed the bitcoin price staging a rebound after a brief dip at the Wall Street open. The price rose back to $92,700, coming within $1,000 of its record highs from November 13th.

Popular trader Skew suggested the impending launch of options on BlackRock’s iShares Bitcoin Trust (IBIT) ETF was keeping the price stuck in a narrow range. However, he noted a key detail was the limit bids moving higher within exchange order books. This indicates strengthening bid liquidity heading higher up the books.

Data from monitoring resource CoinGlass confirmed the bulk of sell-side interest lies around the existing highs, extending to $94,000. Fellow trader Daan Crypto Trades added that the longer price consolidates around this region, the more likely a breakout above the highs becomes.

Trader Justin Bennett anticipates a bullish short-term outcome, seeing a liquidity hunt taking the bulls for a shot at $100,000.

Market-Wide Impact of Nvidia Earnings

Crypto traders are also eyeing the release of Nvidia’s corporate earnings, scheduled for November 20th. Although not directly related to crypto, the event could spark market-wide volatility if the numbers surprise expectations.

The options market is implying a 12% move after the earnings release, according to trading resource The Kobeissi Letter. As Nvidia recently retook its spot as the world’s most valuable company, its earnings are being closely watched across global markets.

Conclusion

With strengthening buy-side liquidity, the launch of ETF options, and a major earnings event on the horizon, bitcoin is gearing up for increased volatility near its all-time highs. The bulls remain in control and appear poised to take another shot at $100,000 in the coming days.