- BTC futures premium fell below 4%, signaling trader anxiety despite strong prices.

- Options skew hit 5%, indicating a shift toward bearish sentiment.

- Institutional buyers remain strong, but confidence in the $100K support is clearly shaky.

So, Bitcoin’s hovering just 8% below its all-time high, sitting at about $103,450. Sounds good, right? Well, maybe not. Derivatives metrics—those deeper, behind-the-scenes signals—are showing signs of weakness. Like, weirdly bearish. And it’s not just the usual futures jitters either. Something else feels off.

Yeah, crypto traders can be twitchy, especially with leverage in the mix. But this—this feels different. The optimism just isn’t there. And with BTC dropping briefly to $102,400, people are asking: is this about Bitcoin itself… or the broader economy falling apart at the seams?

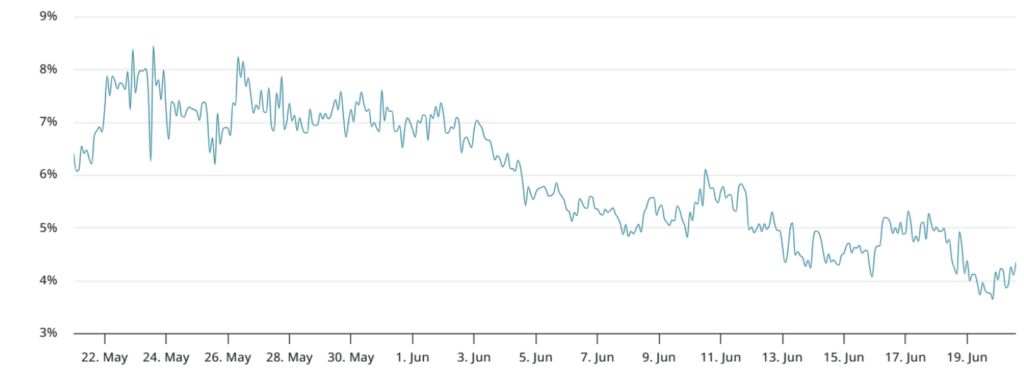

Futures Premiums Signal Caution

Let’s talk about those monthly futures. Normally, BTC futures trade a few points above spot—between 5% to 15%—to account for time until settlement. Basic stuff. But since June 12, that gap has dipped below 5%, following a rejection at $110K. That’s not a great sign. Actually, it’s the lowest premium we’ve seen in like, three months.

What’s even more bizarre? The metric was stronger back on June 5, even though BTC was trading at just $100,450 then. On Thursday, the premium dropped below 4%. That’s lower than April’s levels—remember that day Bitcoin nose-dived to $74,440? This current number’s lower than that.

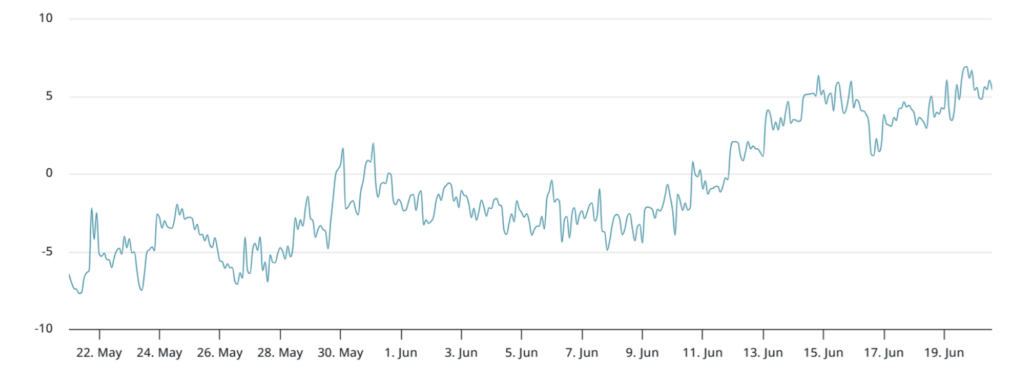

Options Market Echoes the Sentiment

To check if it’s just a futures thing, we peek into options. Specifically, put-call skew. When traders start sweating, they pile into puts, which pushes the skew above 5%. If everyone’s feeling bullish, the skew usually slides under -5%.

Right now? We’re sitting at 5% on the dot. Right on the border of “ehh” and “yikes.” Not terrible, but not encouraging either. Back on June 9, that skew was a comfy -5% after BTC surged past $110K. But that optimism? It’s gone. Fast.

Macro Mess and Market Malaise

Zooming out, macro stuff isn’t helping. The Russell 2000 index—U.S. small-caps—held support at 2,100, which is… something. But war tensions, sticky inflation, and interest rates hanging above 4.25%? Yeah, not great. Recession talks are back. And crypto traders—like most traders—don’t love uncertainty.

Funny enough, institutional players don’t seem scared. Over the past 30 days ending June 18, U.S.-listed BTC ETFs raked in over $5.1 billion. That’s huge. Firms like Strategy, H100 Group, and even Metaplanet went shopping—buying tons of Bitcoin.

Where’s the Confidence Gone?

The big question: why does the market feel bearish, even when price action seems stable? Confidence is just… thin. Traders aren’t sure the $100K support will stick. And that nervous energy is showing across derivatives. Puts are up, premiums are down, and volatility’s not exactly fading.

So, what’s it gonna take to flip the vibe? Honestly—who knows. Maybe a Fed rate cut, or some positive ETF-related surprise. But until then, the longer BTC chills around the $100K level, the more it starts to feel like bears are sharpening their claws again.