- Over $1.16 billion in crypto positions were liquidated, mostly longs.

- Bitcoin dropped 4% to $105,700, while Ethereum fell 7% to $3,583.

- Analysts blame U.S. spot selling, ETH weakness, and rate concerns ahead of key jobs data.

Well, so much for “Uptober.” After a disappointing October where Bitcoin barely managed to hold its gains, November’s starting off on a rough note. The entire crypto market’s bleeding red, with Bitcoin slipping 4% in just 24 hours and altcoins seeing even steeper drops.

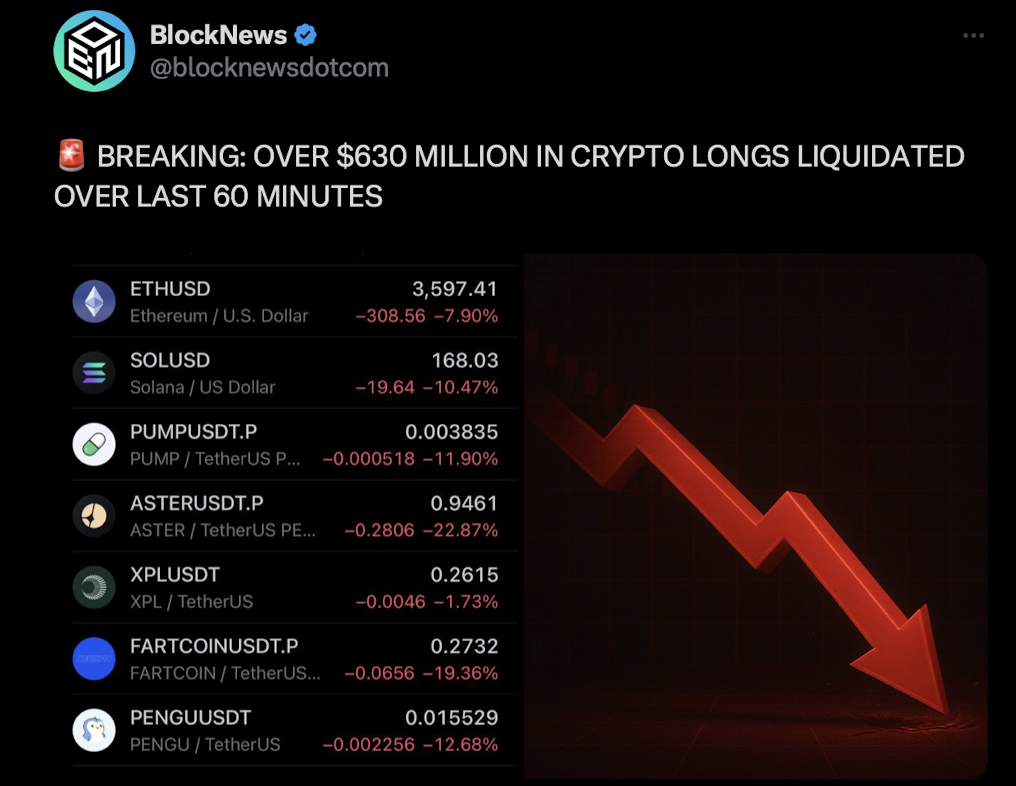

Data from CoinGlass paints a pretty grim picture — roughly $1.16 billion in leveraged positions got liquidated in a single day. Most of those were longs, meaning traders were betting prices would rise. Instead, the market flipped on them hard.

Bitcoin and Ethereum took the biggest hits, with $298 million and $273 million in liquidations respectively. It’s a reminder that even seasoned traders can get caught when the market turns fast.

Bitcoin Falls to Two-Week Low

Bitcoin’s price dropped to around $105,700, its lowest level since mid-October, according to CoinGecko. That’s about a 4% decline on the day — not catastrophic, but enough to shake sentiment after weeks of sideways movement.

Ethereum, though, took a much harder hit. The second-largest crypto by market cap plunged nearly 7%, landing at $3,583 — its lowest price in almost three months. Other big names followed the same path: XRP fell 7%, BNB, Solana, and Dogecoin all slid about 9%.

Interestingly, while crypto was tanking, U.S. stock markets — including the Nasdaq and S&P 500 — actually stayed in the green. No major macro event seemed to trigger the selloff, making it one of those mysterious crypto-only shakeouts that come without much warning.

Analysts Point to Sell Pressure and Weak Ethereum Setup

Pseudonymous analyst Maartunn from CryptoQuant offered a few theories on X (formerly Twitter). He noted that U.S. spot Bitcoin traders appeared to be offloading positions, possibly locking in profits before macro data hits later this week.

He also highlighted “signs of fragility” in Ethereum’s structure — weaker support levels and reduced buying pressure — that could be fueling the broader market drop. When ETH wobbles, altcoins usually follow, and that seems to be exactly what’s happening now.

Rate Jitters and Economic Concerns Add to the Pressure

The latest drop came just after comments from U.S. Treasury Secretary Scott Bessent, who warned that some parts of the U.S. economy may have already slipped “into recession” due to sustained high interest rates. That spooked some investors, especially with this week’s jobs report looming.

Higher rates usually make risk assets — like crypto — less appealing. So, traders might be taking a cautious stance ahead of any new data that could sway market sentiment.

The Bottom Line

Crypto’s November kickoff isn’t looking pretty. With over $1 billion in liquidations, falling altcoin prices, and growing uncertainty around macro trends, the market’s feeling tense. Still, Bitcoin’s long-term structure remains intact — but if selling continues through the week, that might change quickly.