- Bitcoin hits a fresh all-time high at $125,580, powered by $3.2B in ETF inflows last week.

- Coinbase Premium Index stays positive for 30 straight days, signaling steady U.S. institutional accumulation.

- Technicals suggest $130K next, with $150K possible by year-end despite short-term overbought risks.

Bitcoin just printed another all-time high, blowing past $125,500 and landing at $125,580 on October 5. The surge has been fueled by a wild run of institutional demand, with spot Bitcoin ETFs scooping up more than $3.2 billion in fresh inflows over the past week alone. It’s the kind of buying frenzy that has traders whispering about the next big milestone: $150,000.

Under the hood, the story gets even more interesting. On-chain data reveals that the Coinbase Premium Index has been positive for a straight 30 days, something we haven’t seen in a long while. Basically, it means U.S. institutions—those regulated players on Coinbase—are consistently paying above-market prices compared to overseas exchanges. That’s a pretty clear signal of aggressive accumulation, even through the late September wobble where Bitcoin dipped from $124,500 down to $108,600 before snapping right back.

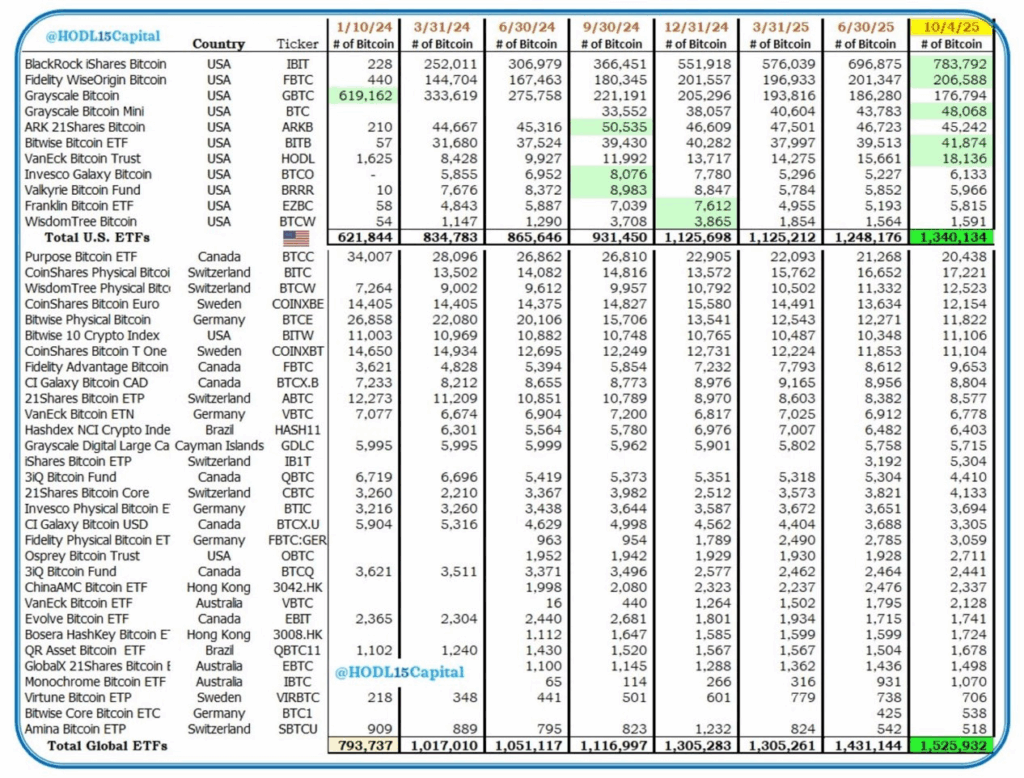

Institutional Appetite Keeps Growing

The ETF scene has been on fire. According to Farside Investors, Bitcoin ETFs closed last week with nearly a billion dollars in inflows just on Friday, and a total of $3.24 billion across the week—second-highest since these products launched in January 2024. That resilience is notable because even during corrections, institutions kept piling in rather than backing away.

This combination of ETF demand and premium pricing suggests that the big money crowd sees these dips as opportunities, not warnings. While retail traders took profits around mid-September, the data shows institutions used that moment to quietly load their bags. If anything, it’s a reminder that the market’s heartbeat is now being set by professional capital, not just day traders chasing quick gains.

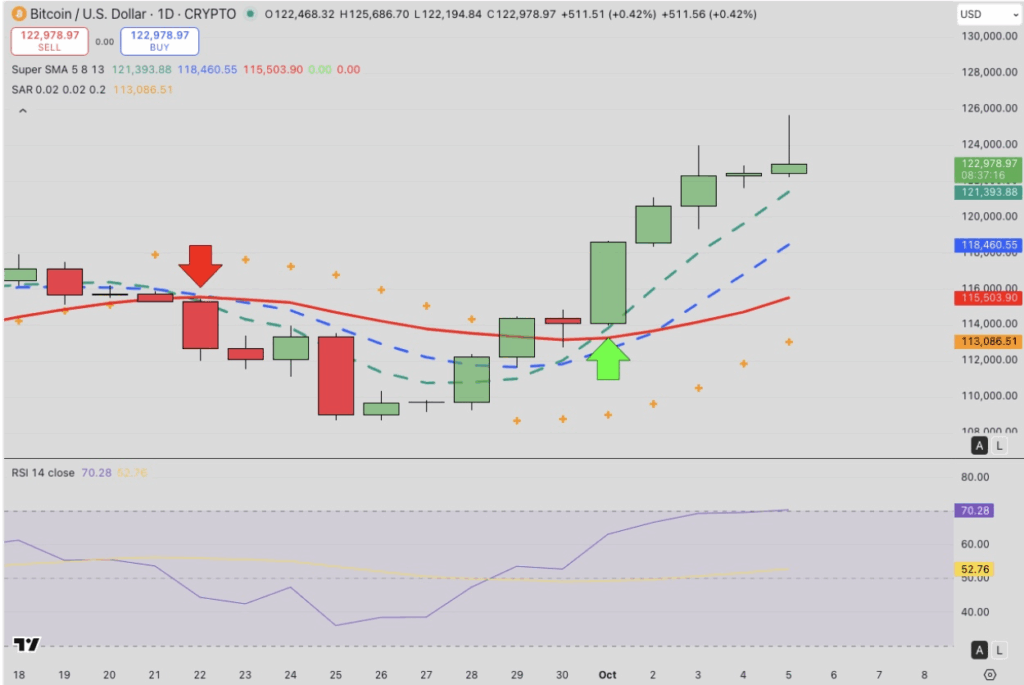

Technical Picture Points Higher

From a chart perspective, things look sturdy. Bitcoin has now closed green in nine of the last ten sessions, breaking through every near-term resistance level with surprising ease. After clearing the death cross at $118,461 during the September slump, BTC has entered fresh price discovery—hovering comfortably above its 5-, 8-, and 13-day moving averages.

The Parabolic SAR still sits below $113,000, hinting that if a correction does come, buyers will likely step in quickly. On the flip side, RSI is brushing up against 70, which suggests we might see a little cooling off before another leg higher. Traders are already setting sights on $130,000 as the next logical checkpoint, with $150,000 sitting out there as the big psychological prize before year-end.

Outlook: Strong Hands vs. Overheated Markets

All told, Bitcoin’s structure looks bullish, with ETF demand and institutional flows providing a sturdy backbone. But the market’s still delicate—momentum this strong can lead to overbought conditions, and the slightest pause might trigger fast pullbacks. Still, if the inflow machine keeps humming and the Coinbase premium holds steady, BTC could be staring down $150,000 sooner than most expect.

For now, the path seems clear: institutions are buying, ETFs are stacking, and Bitcoin continues carving fresh highs into the chart. The question hanging in the air is simple—how much higher can this wave carry before gravity finally kicks in?