- Bitcoin is down over 25% in a month, reviving fears of a deeper reset

- The current crash is macro-driven, not caused by an exchange implosion like 2022

- Some analysts see sub-$40K risk, but a full $15K repeat looks unlikely

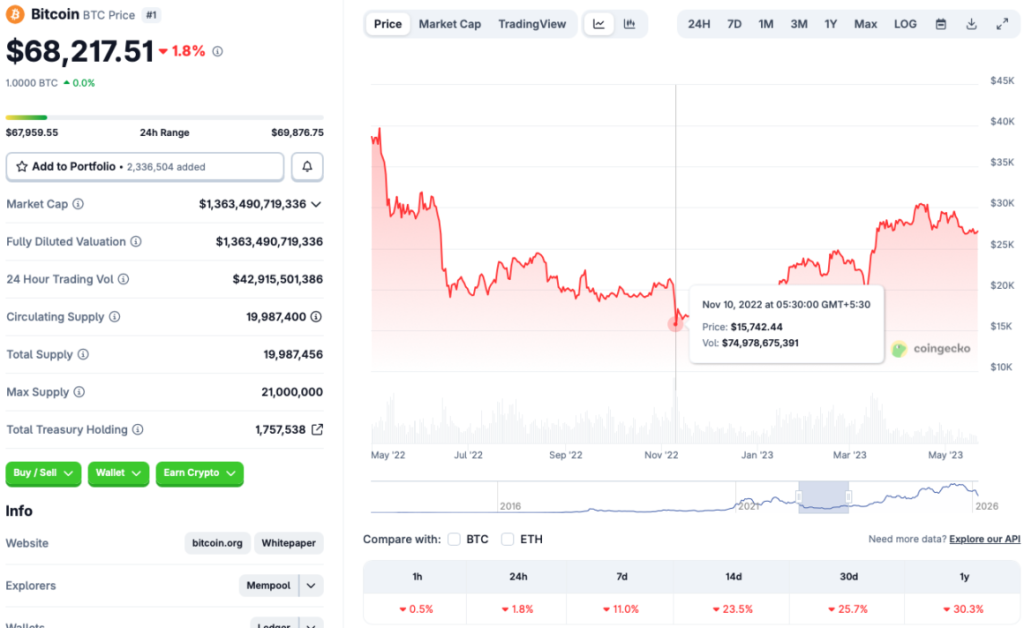

Bitcoin has slid back toward its 2021 all-time high range, a level that feels psychologically heavy even if it’s not technically “new.” The asset recently dipped to around $62,000 before bouncing slightly, but the broader trend still looks fragile. According to CoinGecko data, Bitcoin remains down roughly 11% over the last week, 23.5% over the past 14 days, and about 25.7% across the last month.

That kind of drawdown is enough to revive the worst-case conversations. When BTC loses momentum this fast, the market stops thinking in terms of “healthy pullbacks” and starts thinking in terms of old trauma. For many investors, the fear is simple. If Bitcoin once hit $15,000, could it happen again.

Why $15K Happened in 2022

The November 2022 crash wasn’t just a price correction. It was a systemic collapse tied directly to the FTX failure. Once the exchange suffered a bank-run style unraveling, confidence evaporated across the entire industry. Bitcoin fell to the $15,000 level, and the rest of the market imploded alongside it. Solana dropping to around $9 became one of the defining symbols of that phase.

The important point is that 2022 wasn’t just about macro. It was about crypto infrastructure breaking in real time. That kind of event forces liquidation and contagion in a way normal risk-off cycles don’t.

This Crash Is Macro and Liquidity, Not a Single Crypto Blowup

This time, the drivers look different. The current drawdown is being blamed on macroeconomic uncertainty, geopolitical tension, and a tightening liquidity environment. Those are serious forces, but they don’t have the same “instant death spiral” quality as a major exchange defaulting.

That’s why a straight-line repeat of $15K is unlikely under the current setup. Not impossible, but less probable. To get that kind of downside, Bitcoin would likely need a second shock layered on top, something like a major credit event, a large institution failing, or a hidden blowup inside crypto markets.

Some Analysts Still See Sub-$40K as Realistic

Even if $15K is a stretch, deeper downside is still on the table. Some experts believe Bitcoin could fall below $40,000 this cycle. Stifel, for example, has suggested BTC could dip to around $38,000 this year. That’s the more realistic bearish target range traders keep circling, because it matches how Bitcoin typically behaves when liquidity gets tight but the system itself doesn’t break.

A drop into the $30Ks would still feel brutal. It would also likely trigger widespread capitulation in altcoins and memecoins. But it would be a different kind of crash than 2022, more “macro washout” than “industry collapse.”

The Long-Term Thesis Still Has Institutional Support

Despite the ugly short-term action, many institutions remain optimistic about Bitcoin’s longer-term trajectory. Firms like Grayscale and Bernstein still expect BTC to reach a new all-time high in 2026, arguing that Bitcoin may be following a five-year cycle rather than the classic four-year rhythm.

That view is basically saying this isn’t the end of the story. It’s the uncomfortable middle. Bitcoin may look weak now, but the broader thesis hasn’t been invalidated, at least not yet. For now, the market is still in the phase where fear gets louder than math.