- Bitcoin’s open interest plunged by $10 billion in two months, potentially setting up for a market reset.

- Analysts predict BTC could hit $126,000 by June, with a new price floor estimated at $69,000.

- A drop below $70,000 could signal a bearish shift, while holding above it keeps the bull cycle intact.

Bitcoin’s market just took a wild turn—over $10 billion in open interest wiped clean in only two months. Some analysts think this is the reset BTC needed before a big comeback.

The Leverage Unwind

CryptoQuant analyst Darkfost recently shared insights on X, noting that on Jan. 17, Bitcoin’s open interest skyrocketed to a record-breaking $33 billion—an indication of extreme leverage running through the market. But then, political uncertainty struck. Former U.S. President Donald Trump’s recent actions rattled traders, leading to a wave of liquidations.

Between Feb. 20 and Mar. 4, nearly $10 billion in open interest disappeared. That’s a steep drop, bringing Bitcoin’s 90-day futures open interest change down to -14%. Historically, such declines often act as market resets—shaking out excess speculation and setting the stage for a more stable, sustainable climb.

Bullish Sentiment Still Lingers

Despite the chaos, some experts remain confident in Bitcoin’s long-term trajectory. Economist Timothy Peterson points out that April and October tend to be Bitcoin’s strongest months for seasonal gains. His latest analysis suggests BTC could break new all-time highs before June, with a median target price of $126,000.

Adding to the optimism, Peterson’s “Lowest Price Forward” model estimates that Bitcoin’s new price floor is $69,000, with a 95% probability of holding above that level. Looking back, previous bull markets have seen corrections like Bitcoin’s recent 30% pullback—only to be followed by explosive rallies.

But Not Everyone’s Convinced

Not all analysts are fully on board with the bullish outlook. Benjamin Cowen, founder of Into The Cryptoverse, issued a cautionary take during a Mar. 15 YouTube stream. He warns that if Bitcoin dips below its 2024 highs—sitting in the lower $70,000 range—the bull cycle could be in serious trouble.

Cowen likens the current market setup to 2017, when BTC retested the previous year’s high before making its next big move. He suggests that if Bitcoin closes in the low $60,000s, it could signal the end of this bull run. On the flip side, holding above $70,000–$73,000 would keep market structure intact, preventing a shift toward a more bearish outlook in Q3.

A Critical Moment for Bitcoin

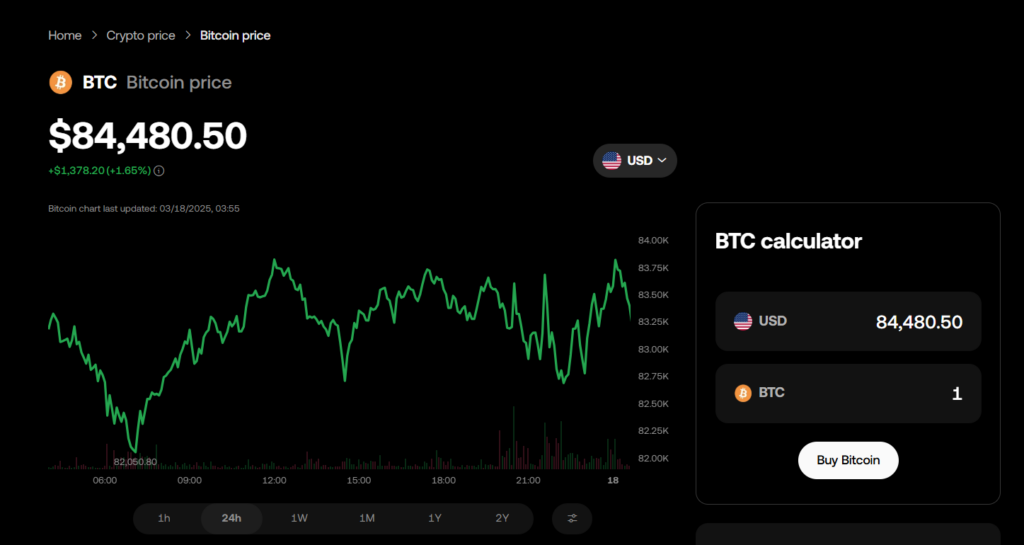

Right now, Bitcoin is in a consolidation phase, trading at $82,900 at the time of writing. If past trends repeat, this sharp reset could be exactly what BTC needs before its next major rally. Will the bulls take back control, or is a deeper pullback still on the horizon? The coming months will tell.