- Key risk metrics like Bitcoin’s Sharpe Ratio and Normalized Risk Metric are trending lower, showing weaker risk–reward and cooling institutional appetite, even as the cycle matures.

- Newer whale cohorts are sitting on heavy losses, realizing over $1 billion in just days, while long-term whales have quietly added more than 36,000 BTC between late October and early November.

- This mix of fading hype, pressured new money, and aggressive long-term accumulation mirrors past pre-recovery phases, hinting that Bitcoin’s strongest hands are still betting on the long game.

Bitcoin is in a weird spot right now. On paper, the risk–reward profile is getting weaker, institutional demand looks like it’s cooling off, and some of the newer big wallets are sitting on brutal, billion-dollar losses. But underneath that mess, the veterans – the real long-term whales – are quietly loading up like nothing’s wrong.

So, is BTC actually “cooling off”… or just resetting before the next rude surprise?

Risk–reward is slipping, and the metrics are calling it

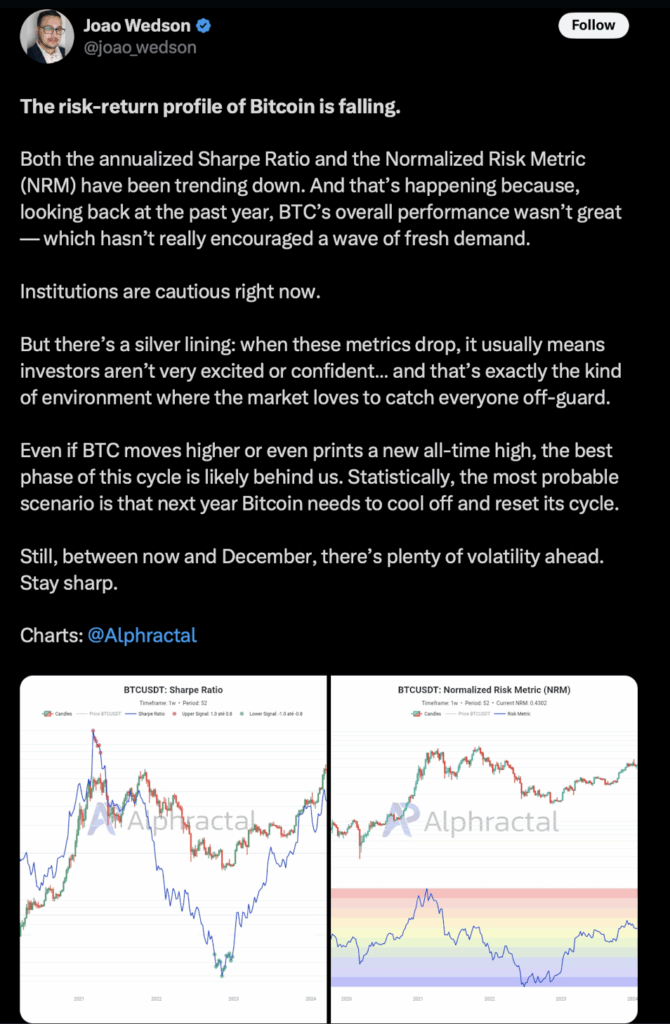

If you look at the numbers instead of just the price candles, Bitcoin doesn’t look as attractive as it did earlier in the cycle. Two key performance metrics – the annualized Sharpe Ratio and the Normalized Risk Metric (NRM) – have been trending down.

Both of these, in their own way, basically answer the question: “Am I being fairly rewarded for the risk I’m taking?” And lately the answer has been leaning more toward “eh, not really.” Lower Sharpe and weaker NRM point to underwhelming performance and fading enthusiasm, especially from the more conservative side of the market.

Joao Wedson, CEO of Alphractal, summed it up nicely in a post on X: when these metrics drop, it usually means investors aren’t excited or confident. And that’s precisely the kind of environment where markets love to flip the script and catch everyone sleeping.

Even if Bitcoin does go on to put in new highs, there’s a real argument that the most explosive part of this cycle might already be behind us. From here, the moves could be choppier, meaner, and more selective about who actually makes money.

New whales are getting cooked

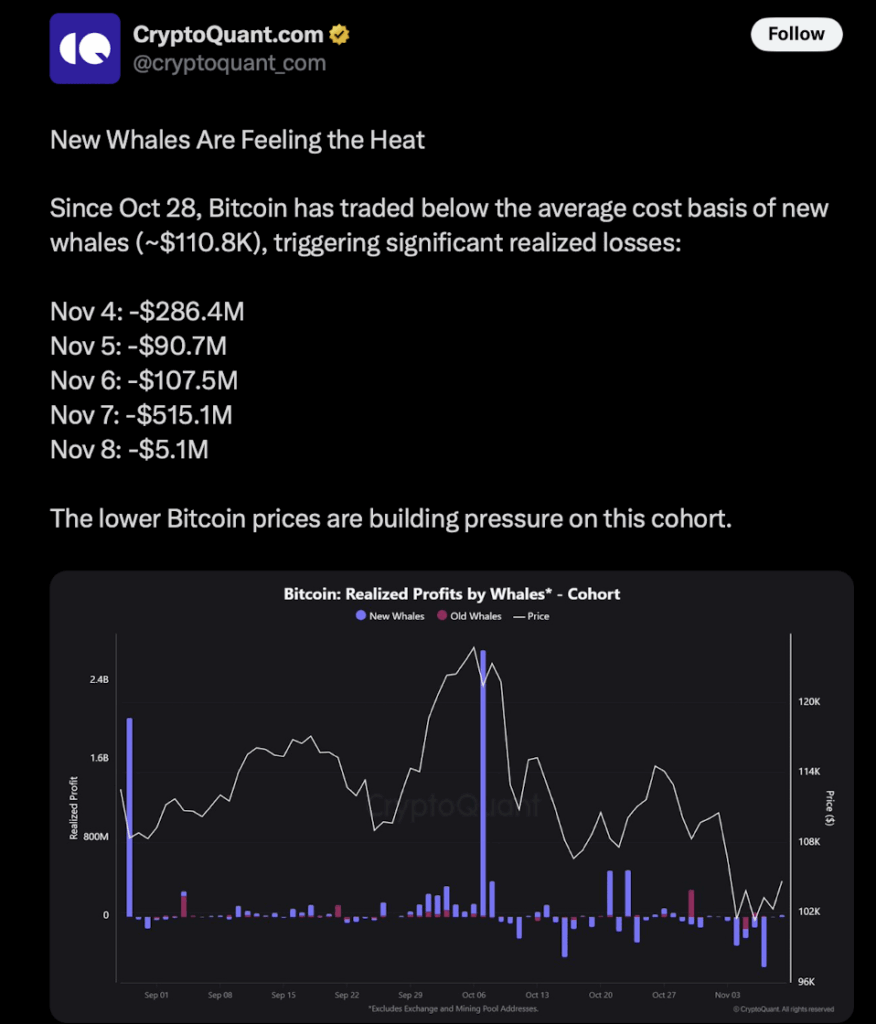

Then there’s the “new money” – the newer whale cohorts that came in closer to the top, probably feeling pretty smart at the time.

According to data from CryptoQuant, this fresh group of big holders is under serious pressure. Since late October, Bitcoin has traded below their Average Cost Basis, which sits somewhere around $110.8K in this dataset. That means a lot of these newer whales are deep in the red, not just slightly underwater.

The numbers are rough. This cohort has realized more than $1 billion in losses over just a few days, with around $515 million flushed out on the 7th of November alone. That kind of pain doesn’t go unnoticed – and it puts their conviction to the test.

Right now, there’s a kind of quiet tug-of-war between old and new money. The key question is simple: do these newer whales grit their teeth and hold, or do they capitulate and dump into weakness? Whichever way that balance tilts could heavily influence how BTC moves next – whether we see a cold, grinding drawdown or a sharp, reflexive rebound fueled by short covering and forced re-entries.

The old guard whales are doing the opposite

While newer whales are bleeding, the older, more entrenched players are doing something very different: they’re buying. And not small amounts either.

Between the 24th of October and the 7th of November, wallets holding more than 10,000 BTC more than doubled their stack. In that short window, they added over 36,000 BTC. That’s not a casual DCA; that’s a statement.

This kind of aggressive accumulation is eerily similar to patterns seen before major recoveries in previous cycles, like back in 2020. When everyone else was nervous, the biggest and slowest hands were quietly hoovering up supply, preparing for what came next while the rest of the market argued about tops and crashes..

Right now, it looks like the same playbook: retail and new whales feel squeezed, institutions cool down, risk–reward metrics fade… and the deepest pockets treat it all as a discount rack.

Under the noise, the strongest hands are still all-in on the long game

If you just look at price volatility and social sentiment, it’s easy to think Bitcoin is stuck in some tiring mid-cycle stall. Metrics are soft, institutional appetite isn’t as loud, and some of the biggest newer wallets are nursing massive realized losses. It doesn’t exactly scream “all-time-highs tomorrow.”

But the story under the surface is different. Long-term holders are not just staying put; they’re actively increasing their exposure. They’re treating this phase as an accumulation window, not a danger zone. Historically, that kind of behavior from LTHs has rarely been noise.