- Newer Bitcoin whales are panic selling, causing heavy volatility and resistance near $111K.

- Exchange Whale Ratio suggests whales are prepping to offload during price surges.

- Geopolitical tensions and whale anxiety are keeping Bitcoin from making a clean breakout.

Bitcoin clawed its way back to around $105,900 after the Israel-Iran ceasefire on Tuesday, offering a little relief in a tense market. But—let’s not get too comfy. Behind the scenes, some newer Bitcoin whales are flipping out, and their panic is rattling the charts more than you’d think.

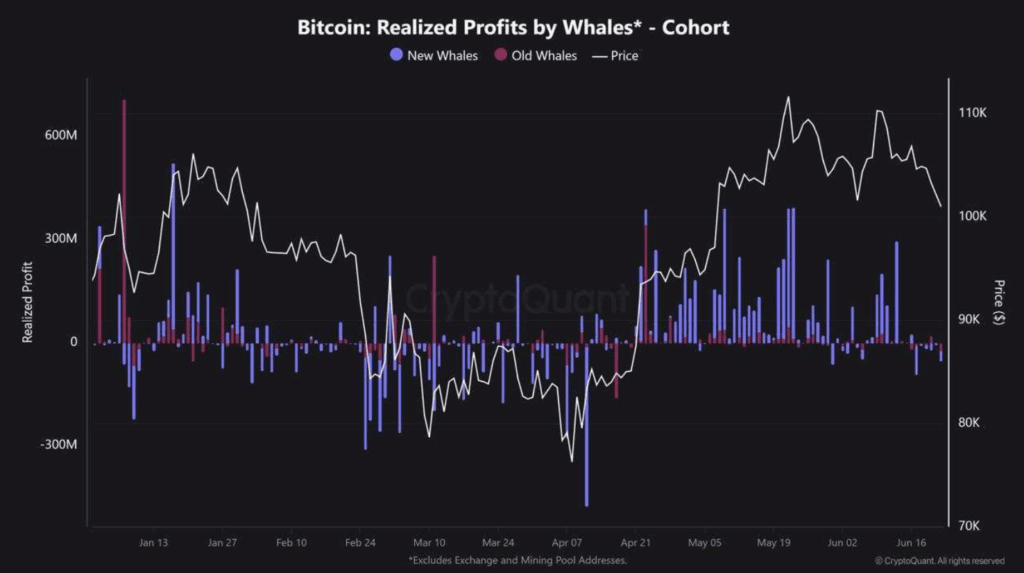

According to CryptoQuant, it’s not just random noise. We’re talking about whales realizing big losses and dumping their bags—hard. These new players, who probably jumped in near the highs, are selling under pressure. And when whales flinch, the whole market shakes.

Whale Drama: Who’s Selling, and Why It’s Hurting

Since mid-June, Bitcoin’s been on a bit of a rollercoaster. Started the month near $107K, bounced above $110K, and then—wham—dropped under $100K in a flash. From June 14 to June 22, whales cashed out with nearly $228 million in realized losses. That’s a big dent.

The wildest part? Most of that pain—about $85 million—came from newer whales. Just $8.2 million was from older, more seasoned holders. On June 17 alone, they dumped $95 million worth of losses into the market. Ouch.

It’s not just random sell-offs either. These folks are reacting to headlines, global tension, and good ol’ fear. And because they’re newer, they don’t have the stomach to ride it out. When Bitcoin nears that sticky $111K level, these whales seem to panic—and prices stumble.

Exchange Activity Adds to the Mess

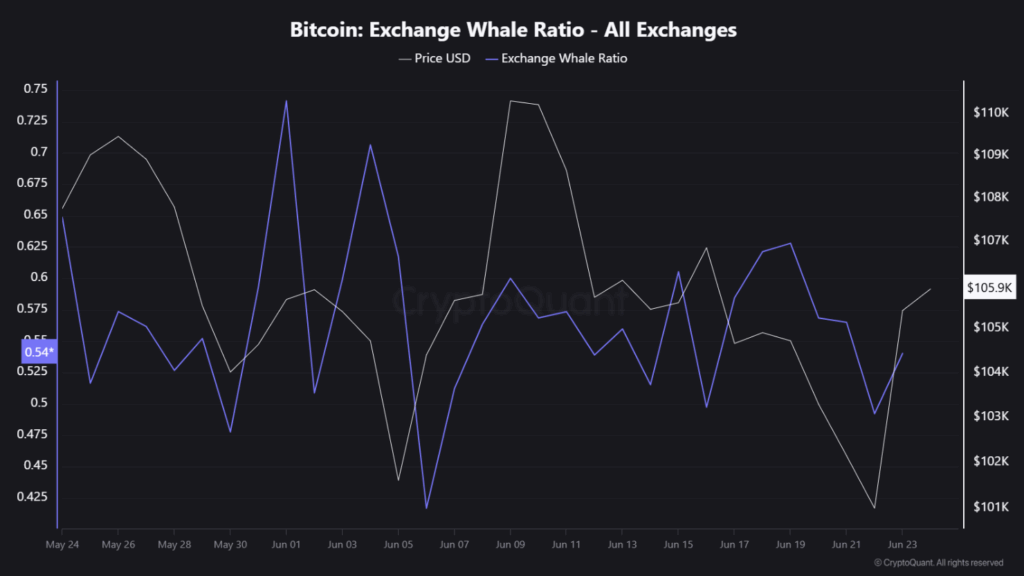

Now, if you’re wondering where these whales are making their moves, look no further than the exchanges. CryptoQuant’s Exchange Whale Ratio—a metric tracking large whale deposits—has been sitting pretty high all through June.

Basically, when this number’s up, whales are sending Bitcoin to exchanges. And why would they do that? Yeah, to sell.

The ratio usually spikes when Bitcoin’s pushing $110K, hinting that big wallets are prepping to take profits. It dipped when Bitcoin slid under $102K but jumped again as the price bounced back to $105,900. It’s like they’re baiting the market, setting traps near resistance zones.

Geopolitical Jitters Are Fueling the Chaos

This whale anxiety isn’t happening in a vacuum. With the Israel-Iran conflict, market nerves are already on edge. And newer whales? They’re extra twitchy. Every major headline has them reaching for the sell button.

Their quick-trigger behavior ramps up the volatility. And once those sell-offs start, leveraged traders get caught in the crossfire—margin calls, forced liquidations, the whole domino effect.

So what’s it gonna take to break above $111K? Analysts say we need whales to chill. If selling slows and inflows onto exchanges drop, confidence might just creep back in. But until then, expect the swings to keep coming.