The cryptocurrency market reacted to the Consumer Price Index (CPI) data released on Thursday, October 13, 2022, with Bitcoin leading by making a sudden pump and dump on Thursday and Friday.

The U.S. September inflation rate increased by 8.2%, missing the 8.1% scores that industry pundits had predicted by a meager 0.1%. However, it has remained at the highest level since 1982. With the CPI report recording the inflation rate at 8.2% in the U.S., the crypto markets turned green as several cryptocurrencies saw remarkable spikes.

For Michaël van de Poppe on CPI report-related volatility, it was a question of whether and when crypto would resume its unpredictability characteristic. He told his Twitter followers:

“Matter of time until massive volatility will kick back into the markets after four months of consolidation. The majority is still assuming we’ll continue to go downhill with the markets, but I think that odds of upwards momentum have increased.”

CoinMarketCap shows that leading cryptocurrency exchanges saw a surge in trading volume to record triple digits in percentages, with Bitcoin (BTC) and Ether (ETH) spiking by 5%. In the same way, decentralized exchanges (DEX) also recorded a similar surge in trading volume fueled by millions of inflows within 24 hours. Uniswap, for instance, recorded up to $264 million, Kine Protocol recorded $274 million, and dYdX recorded a striking $770 million in transactions.

BTC reacts to CPI data

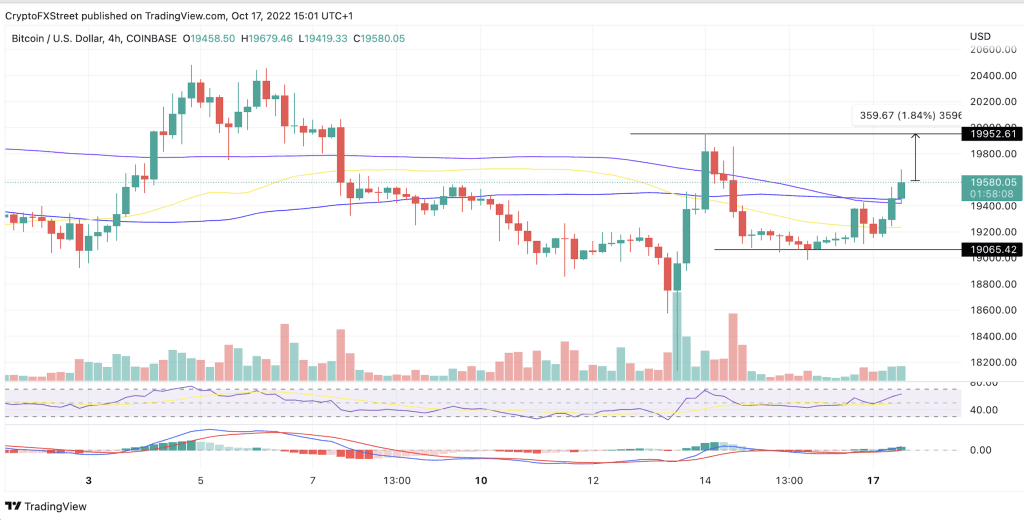

Bitcoin reacted to the CPI report with extreme volatility, recording volatile prices within the time around the release. For instance, data from CoinMarketCap showed a BTC market cap of $367.23 billion on October 12 before shedding $14.29.48 billion shortly after the CPI report publication.

CNBC reported that just a few moments following the release of the CPI report, Bitcoin, as had been predicted, dipped to hit $17,985, marking the lowest score this October. However, the flagship crypto was able to ward off the fully-fledged CPI incursion and recover above the $19,000 level.

Analysts cautioned that volatility was long overdue, as Bitcoin (BTC) remained firmly tied to $19,000 into the October 16 weekly close. The situation has changed, however, as BTC is teetering around the $19,600 level, according to data from CoinGecko. This comes after signs of rejection during the weekend every time it tried to breach the $20,000 mark.

Based on the CPI report, the current surge is attributed to institutional investors primarily pumping and dumping the big crypto as exchanges record massive capital outflows. Capital outflow refers to an increasing number of investors withdrawing their crypto assets from talks and storing them in wallets. When this happens, an asset such as BTC becomes scarce, thereby causing increased prices.

The four-hour chart data indicates that investors are chasing the short-term pumps to salvage their previous losses. Nonetheless, the market may not remain green, as seen in the weekend charts where BTC was in the red. As such, the pump may be short-lived as BTC has been unable to break the resistance barrier defined by the $19,550 and $21,000 supply zone.

It appears that bears still have the market within their tight grip, and BTC may face further price corrections. Temporary pumps like the one witnessed around the CPI report publishing have been expected this year. Multiple financial analysts speculate that 2023 could see a recession, dragging the markets further south.