- Bitcoin dropped 2.6% to $111,773, seen as a healthy post-rally correction.

- Solana held steady above $197, maintaining a bullish trendline and strong structure.

- Analysts expect BTC to rebound toward $130K and SOL to test $240–$250 if momentum continues.

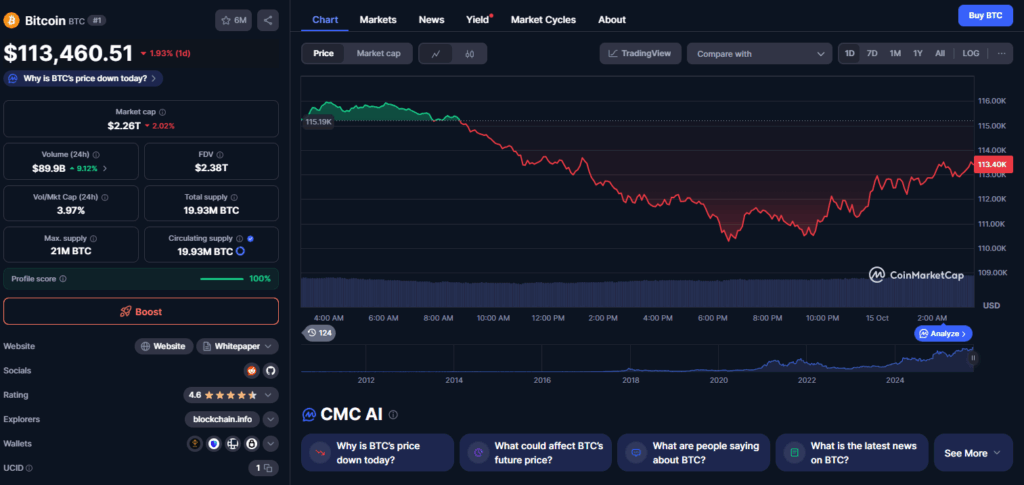

The crypto market saw a divergence on Tuesday as Bitcoin (BTC) cooled off from its recent highs while Solana (SOL) continued to show strength. According to CoinMarketCap, Bitcoin slipped 2.6% to $111,773, while Solana climbed 1.36% to $197, signaling that traders may be rotating capital into high-performing altcoins. Despite Bitcoin’s pullback, analysts say the move reflects a healthy correction rather than the start of a deeper downturn.

Bitcoin’s Correction Viewed as a Market Reset

Bitcoin’s recent dip followed an early-week surge that briefly tested the $126,000 level before heavy selling pressure set in. The correction, which pushed BTC below $112,000, appears driven by profit-taking and the unwinding of leveraged positions. Data from Glassnode shows that many traders accumulated Bitcoin in the $117,000–$119,000 range, suggesting that buyers are stepping in on the dip.

Market analysts, including Stockmoney Lizards and Ted Pillows, note that such retracements are common after strong rallies. Futures data reveals a $4.1 billion decline in open interest, often a precursor to more stable price movement. If Bitcoin holds above $118,000, analysts expect a rebound toward the $125,000–$130,000 zone. On-chain indicators show investor sentiment remains steady, reinforcing the idea that this is a cooldown phase before the next advance.

Solana’s Bullish Structure Holds Firm

While Bitcoin corrected, Solana maintained resilience, trading near $197 with a clear bullish structure on higher timeframes. Analyst Batman highlighted a bullish Fair Value Gap (FVG) around the $210 area, which could act as a strong accumulation zone before Solana’s next leg higher. The chart shows a consistent upward trendline that has held since early August, suggesting firm structural support.

Batman noted that Solana could “dip slightly deeper into its FVG” before continuing upward — a move that may offer strategic entry points for traders. If momentum persists, SOL could rally toward $240–$250, aligning with prior resistance levels. Increasing trading volume and strong on-chain activity further underscore Solana’s position as one of the most technically sound altcoins in the current market.

Outlook: Divergence Could Signal Rotation Into Altcoins

Bitcoin’s short-term weakness contrasts sharply with Solana’s steady climb, reflecting a possible capital rotation within the crypto market. Analysts believe this divergence may continue as traders rebalance positions following weeks of volatility. Bitcoin’s consolidation phase could lay the groundwork for its next breakout, while Solana’s relative strength highlights growing investor confidence in its ecosystem.

For now, traders are watching Bitcoin’s $118,000 support and Solana’s $197–$210 zone as key decision levels. If both assets hold firm, the broader crypto market could soon regain its bullish footing heading into late October.